Key Takeaways

- Growth in 5G, AI, and digital transformation is driving demand for Ericsson's advanced network solutions, supporting strong revenue and margin prospects.

- Enhanced operational efficiency and technology leadership are improving profitability, enabling long-term market share gains and diversified revenue streams.

- Geopolitical risks, emerging market instability, fierce competition, inconsistent software performance, and persistent regulatory burdens threaten Ericsson's margins, revenue reliability, and long-term profitability.

Catalysts

About Telefonaktiebolaget LM Ericsson- Provides mobile connectivity solutions to communications service providers, enterprises, and the public sector.

- Accelerating adoption of 5G stand-alone networks, network slicing, and differentiated enterprise connectivity is creating new monetization opportunities for operators-driving demand for Ericsson's advanced network equipment and software, which should support above-market revenue growth in the medium to long term.

- Expansion of AI-powered applications and edge compute is expected to significantly boost network data traffic, requiring further buildout and modernization of telecom infrastructure where Ericsson has strong product and R&D positioning-providing a long-term tailwind to both revenues and gross margins.

- Ongoing digital transformation across multiple sectors (including defense, mission-critical services, and industrial automation) is opening high-margin enterprise and private network opportunities for Ericsson, which should improve revenue diversification and margin profiles over time.

- Increased operational efficiency from structural cost actions, supply chain optimization, and the application of AI across processes is reducing OpEx and improving EBITA margins, creating meaningful headroom for future earnings growth even in a flat market environment.

- Ericsson's technology leadership and entrenched positions in key home markets (North America, India, Japan), along with an expanding IPR portfolio, positions the company to capture incremental market share and recurring licensing revenue, resulting in sustainable long-term improvements in top-line growth and profitability.

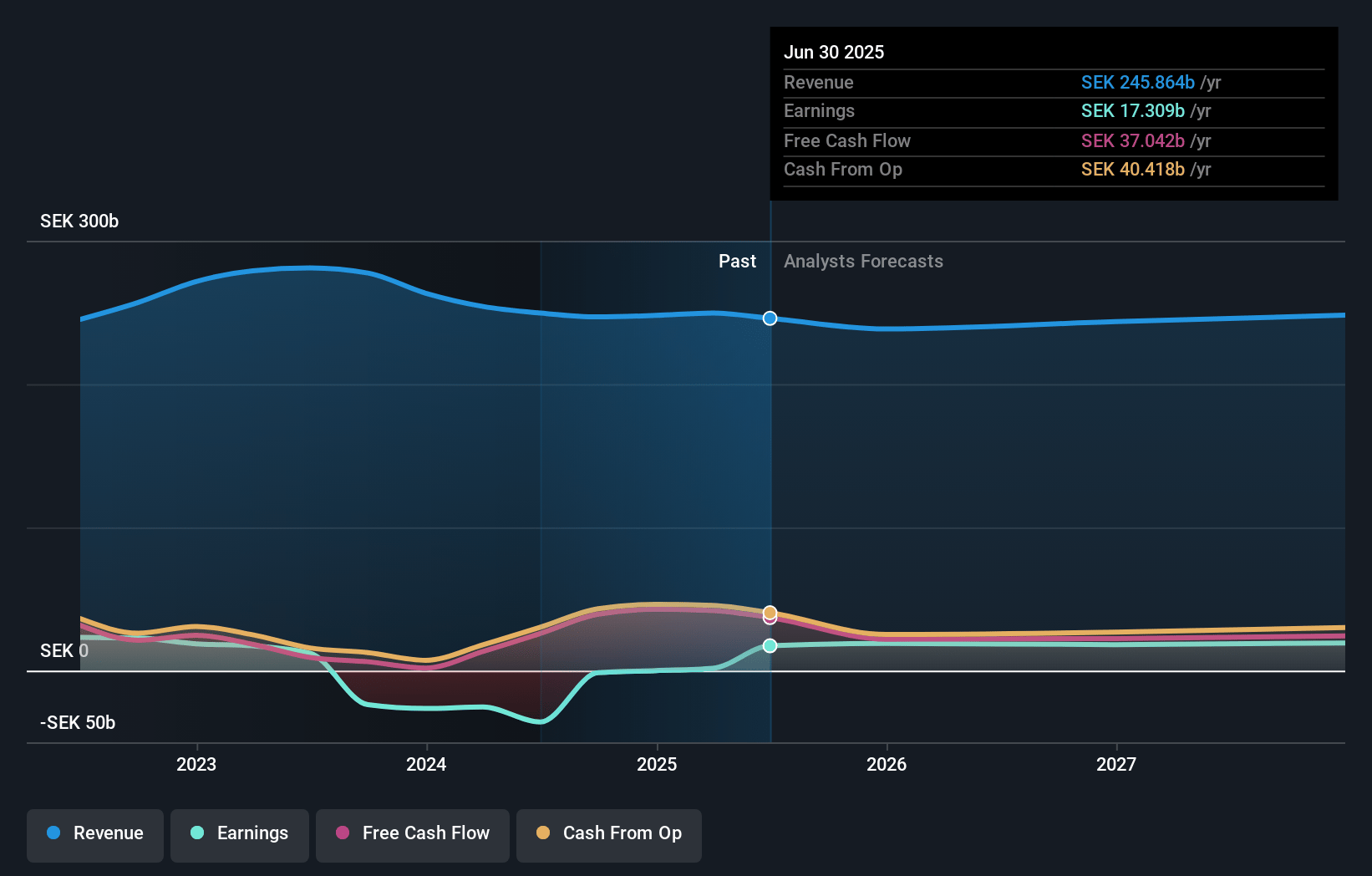

Telefonaktiebolaget LM Ericsson Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Telefonaktiebolaget LM Ericsson's revenue will decrease by 0.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.0% today to 7.7% in 3 years time.

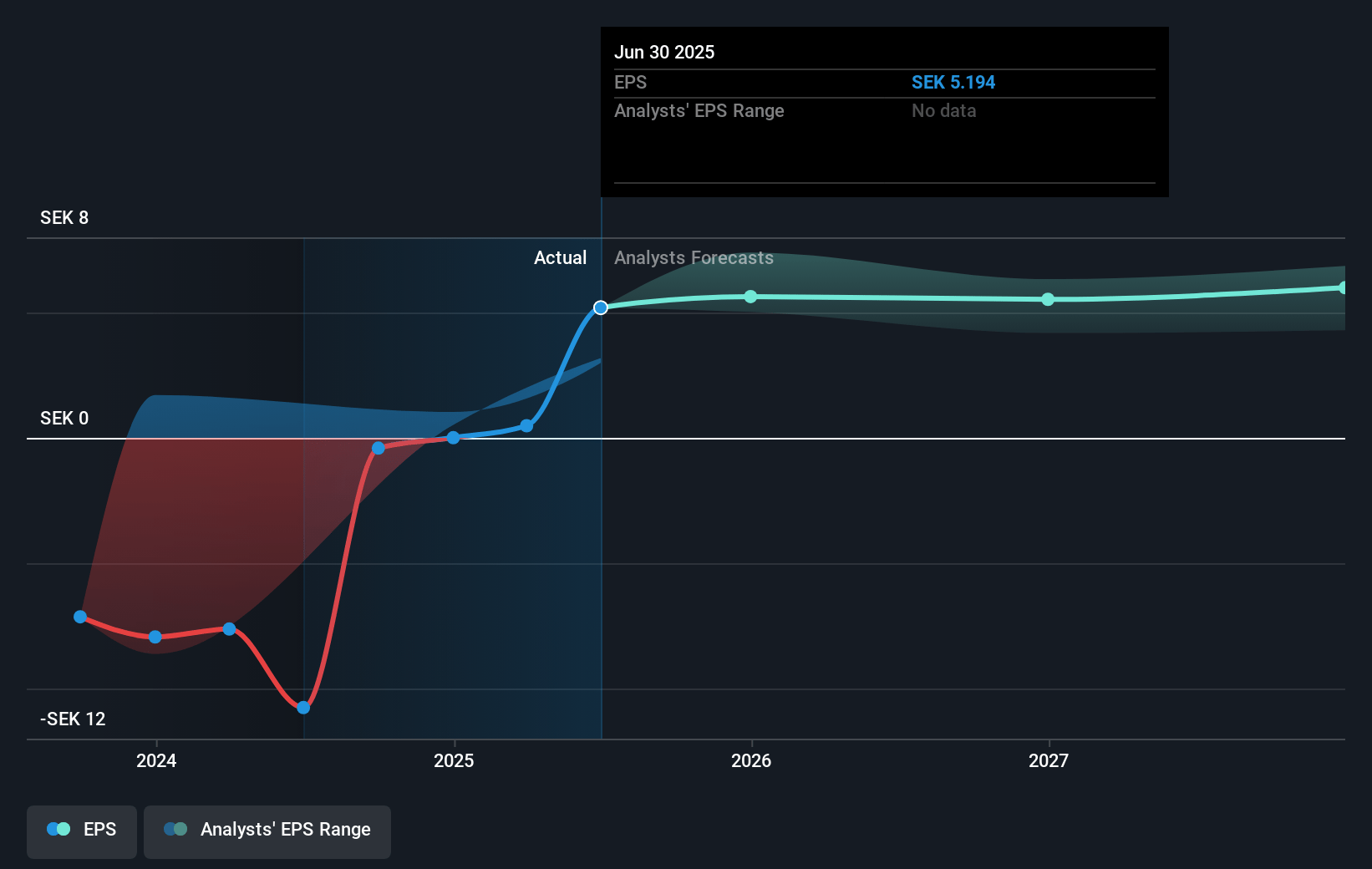

- Analysts expect earnings to reach SEK 19.2 billion (and earnings per share of SEK 6.11) by about July 2028, up from SEK 17.3 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting SEK23.0 billion in earnings, and the most bearish expecting SEK14.1 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.8x on those 2028 earnings, up from 13.9x today. This future PE is lower than the current PE for the GB Communications industry at 101.5x.

- Analysts expect the number of shares outstanding to grow by 0.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.27%, as per the Simply Wall St company report.

Telefonaktiebolaget LM Ericsson Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying geopolitical tensions and tariff uncertainties, especially between key markets such as the US, China, and Europe, may lead to further fragmentation of supply chains and unpredictable market access, potentially increasing Ericsson's operating costs and limiting revenue growth in key regions.

- Prolonged weakness or investment pauses in large emerging markets (such as India), as seen in Q2 and with uncertain recovery timing, expose Ericsson's revenue to regional demand swings, hindering sustainable top-line growth.

- Sustained competition from both Eastern and Western vendors, and margin pressure from potential industry consolidation among telecom operators (as hinted by intense pricing and market share battles), may erode Ericsson's pricing power, reducing gross margins and long-term profitability.

- Continued underperformance or volatility in software and services segments relative to peers-despite some recent margin gains-could jeopardize Ericsson's ambitions for recurring, high-margin revenues, increasing the risk of earnings inconsistency.

- Increasing legal, regulatory, and currency-related challenges, including ongoing cost burdens from restructuring and compliance (notably with persistent high restructuring costs and regulatory scrutiny around tariffs and data privacy), could compress net margins and constrain future earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK80.556 for Telefonaktiebolaget LM Ericsson based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK100.0, and the most bearish reporting a price target of just SEK56.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK247.5 billion, earnings will come to SEK19.2 billion, and it would be trading on a PE ratio of 16.8x, assuming you use a discount rate of 6.3%.

- Given the current share price of SEK72.1, the analyst price target of SEK80.56 is 10.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.