Key Takeaways

- Enea's AI adoption and term-based revenue model are set to enhance growth, efficiency, and net margins by increasing revenue stability and differentiation.

- Strategic focus on security, network solutions, and potential acquisitions positions Enea for expansion, driven by cross-selling and substantial upsell opportunities.

- Diversified revenue model and reliance on recurring income provide stability but may limit growth, with operational cost pressures impacting profitability and no dividend for investors.

Catalysts

About Enea- Provides software products for telecom and cybersecurity industries worldwide.

- Enea's adoption of AI technologies in their offerings and internal processes is expected to drive efficiency and innovation, enhancing revenue growth and potentially improving net margins through cost savings and increased product differentiation.

- The shift to a term-based revenue model and an increase in recurring revenues, which now account for 69% of total revenue, should provide earnings stability and predictability, positively impacting net margins and reducing revenue volatility.

- Enea's strategic focus on double-digit growth areas, such as security and network solutions, with notable deals like the USD 27 million contract expected to contribute to future revenues over three years, can help improve annual revenues and earnings.

- With significant upsell opportunities worth more than SEK 0.5 billion identified in existing customer accounts, Enea's potential for revenue expansion through cross-selling could drive future incremental earnings.

- The consolidation and improvement of Enea's balance sheet, coupled with discussions of potential acquisitions, may strategically position the company for expansion and growth, enhancing future revenues and overall financial performance.

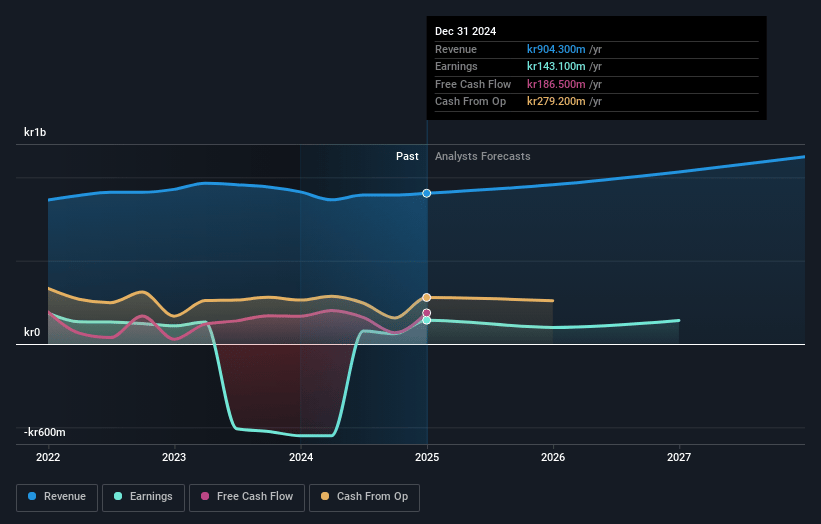

Enea Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Enea's revenue will grow by 7.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 15.8% today to 12.5% in 3 years time.

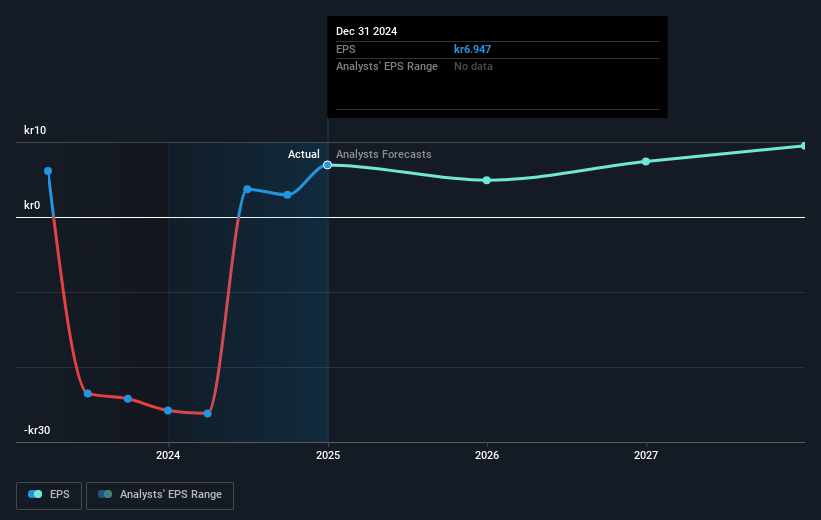

- Analysts expect earnings to reach SEK 140.5 million (and earnings per share of SEK 9.5) by about March 2028, down from SEK 143.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.5x on those 2028 earnings, up from 11.6x today. This future PE is greater than the current PE for the GB IT industry at 15.3x.

- Analysts expect the number of shares outstanding to decline by 2.53% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.83%, as per the Simply Wall St company report.

Enea Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Enea's growth is closely tied to the telecom operator market, which is only experiencing single-digit growth, potentially limiting revenue expansion for Enea.

- The company's transition to a term-based revenue model and reliance on smaller deals, while diversifying income streams, can lead to revenue volatility and may not immediately reflect increased earnings in quarter-to-quarter comparisons.

- Enea's significant reliance on recurring revenues creates stability, yet it may mask lukewarm overall growth in net sales, which could impact investor perception and revenue visibility.

- Operational expenses have increased due to inflation adjustments and one-off items, potentially impacting net margins and profit if costs are not managed efficiently going forward.

- The absence of a dividend could be a concern for income-focused investors and suggests a focus on retaining cash, which may be needed to address potential vulnerabilities in cash flow and capital utilization.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK125.0 for Enea based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK1.1 billion, earnings will come to SEK140.5 million, and it would be trading on a PE ratio of 19.5x, assuming you use a discount rate of 6.8%.

- Given the current share price of SEK83.3, the analyst price target of SEK125.0 is 33.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.