Key Takeaways

- The Warsaw Unit acquisition and strategic location capitalize on low initial rental rates, boosting future profits through increased rental income and property valuations.

- Commitment to sustainability and high occupancy rates drive improved margins and potential revenue growth across rapidly developing Eastern European markets.

- High interest rates, lease terms, and expenses constrain flexibility and growth, impacting margins, revenue, and portfolio expansion in the real estate market.

Catalysts

About Eastnine- A real estate investment firm.

- The acquisition of the Warsaw Unit, a transformative move for Eastnine, is expected to drive future profit growth due to its prime location and low initial rental rates compared to the market, which will eventually increase. This is likely to positively impact rental income and property valuations.

- The high occupancy rate at 96.1%, projected to increase to 97% or more, suggests strong demand and efficient property management, which should lead to higher net operating income and improved net margins.

- Eastnine's strategic position in the fast-growing economies of Latvia, Lithuania, and Poland, characterized by rapid GDP growth and low leverage, indicates potential for significant top-line revenue and earnings growth.

- The commitment to sustainability and improvements in property certifications (BREEAM and LEED at the highest levels) may attract high-quality tenants at premium rents, supporting revenue growth and improving net margins through higher occupancy and rental rates.

- With planned enhancements in the surplus ratio and strong potential for rental growth in key markets such as Warsaw and Vilnius, Eastnine's profit from property management is expected to grow by 21% in the near term, enhancing earnings and shareholder value.

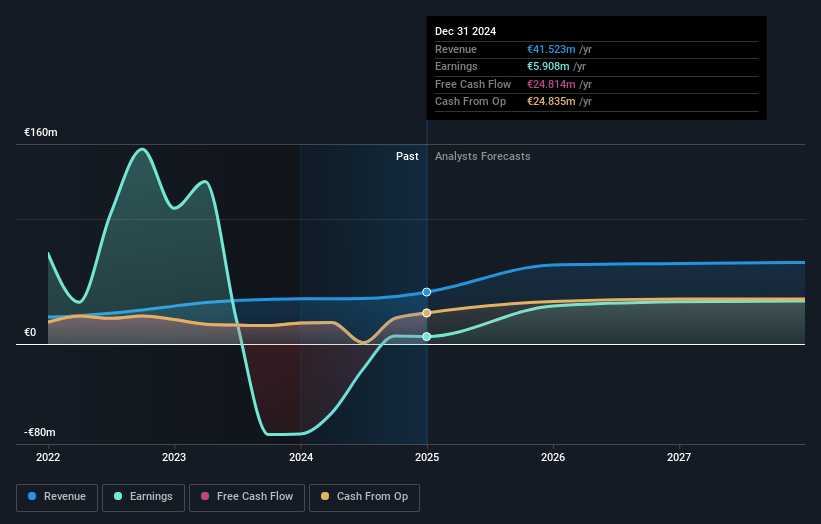

Eastnine Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Eastnine's revenue will grow by 16.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 14.2% today to 53.1% in 3 years time.

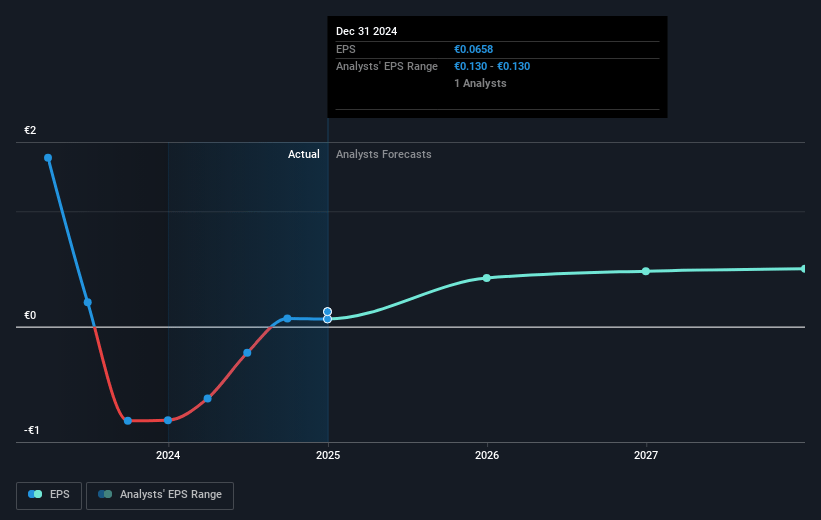

- Analysts expect earnings to reach €34.7 million (and earnings per share of €0.5) by about March 2028, up from €5.9 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €49.6 million in earnings, and the most bearish expecting €19.9 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.0x on those 2028 earnings, down from 62.7x today. This future PE is greater than the current PE for the GB Real Estate industry at 20.5x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.96%, as per the Simply Wall St company report.

Eastnine Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The high average interest rate of 4.5% on debt compared to peers, coupled with a significant proportion of fixed-rate loans, limits flexibility in benefiting from potential future decreases, impacting net margins through higher interest expenses.

- While rents at the Warsaw Unit are currently below market rates, the long average lease term (WAULT) of around 5 years means rental income may not immediately reflect higher market rents, impacting revenue potential.

- The real estate market's liquidity challenges in the Baltics and low transaction volumes could hinder Eastnine's ability to optimize and expand its portfolio effectively, potentially affecting future earnings.

- Leveraging at 50% LTV, while deemed comfortable, may constrain financial flexibility for future acquisitions without further equity issuance, impacting growth and net earnings.

- Rising legal and sustainability costs and central administration expenses, which include one-off costs and ongoing commitments, could pressure operating expenses and reduce net profit margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK58.0 for Eastnine based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €65.5 million, earnings will come to €34.7 million, and it would be trading on a PE ratio of 24.0x, assuming you use a discount rate of 10.0%.

- Given the current share price of SEK41.8, the analyst price target of SEK58.0 is 27.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.