Key Takeaways

- Strategic expansion into Asia and implementing a subscription-based model for recurring revenue could drive significant growth in revenue and net margins.

- Acquisitions and enhanced R&D and sales capabilities could position the company as a market leader with opportunities for synergistic revenue growth.

- The company faces risks from reduced Americas market revenue, prolonged sales cycles, increased costs, reliance on partner success, and acquisition-related margin dilution.

Catalysts

About Surgical Science Sweden- Develops and markets virtual reality simulators for evidence-based medical training in Europe, North and South America, Asia, and internationally.

- The strategic expansion into new geographic regions, particularly Asia, where significant growth is already being observed, could drive increased revenue. Optimizing sales channels to leverage a broad product portfolio is expected to enhance this growth.

- The breakthrough SEK 52 million procurement contract in Southeast Asia for military medical personnel training could indicate potential new revenue streams, particularly in the emerging mixed reality solutions market, potentially enhancing earnings.

- The new subscription-based model with Intuitive, starting in January 2025, aims to supply the da Vinci 5 systems with simulation software. This recurring revenue model could stabilize and potentially increase revenue, contributing positively to net margins due to a steady income flow.

- The acquisition of Intelligent Ultrasound, positioning Surgical Science as a leader in ultrasound simulation, opens new market opportunities with a strong growth potential. This could lead to increased revenue streams and improved net margins due to the synergies from merging R&D and sales operations.

- The ongoing reorganization and expansion in R&D and sales capabilities are intended to increase operational efficiency, potentially leading to higher earnings. By scaling R&D projects and enhancing customer responsiveness, Surgical Science could improve its response to increased demand, thereby supporting revenue growth.

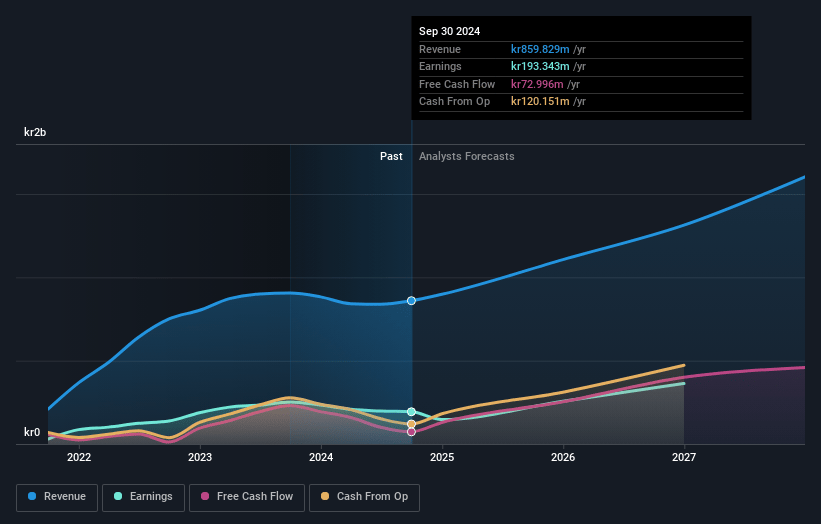

Surgical Science Sweden Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Surgical Science Sweden's revenue will grow by 23.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 14.9% today to 25.8% in 3 years time.

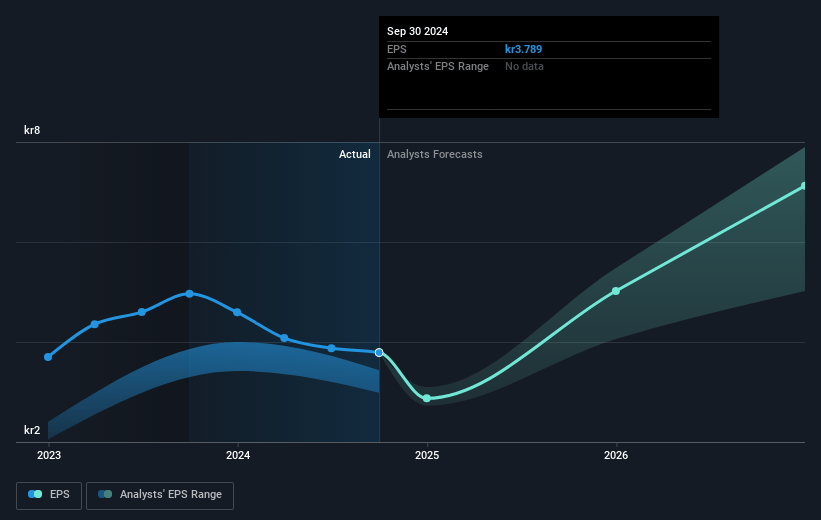

- Analysts expect earnings to reach SEK 426.5 million (and earnings per share of SEK 8.36) by about May 2028, up from SEK 131.6 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting SEK492.6 million in earnings, and the most bearish expecting SEK314 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 27.7x on those 2028 earnings, down from 53.4x today. This future PE is lower than the current PE for the SE Medical Equipment industry at 30.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.46%, as per the Simply Wall St company report.

Surgical Science Sweden Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The decrease of 20% in the Americas market poses a risk to meeting growth expectations in the Educational Products segment, potentially impacting revenue growth from this critical geographic area.

- The current strained global budgetary climate for hospitals and training centers prolongs the sales conversion cycle, which may negatively affect revenue realization and cash flow timing.

- Increased costs related to sales incentives and a higher share of sales from distributors are putting pressure on margins, potentially affecting net margins and overall profitability.

- The reliance on the success of robotic companies, which are in various stages of the regulatory approval process, represents a risk. If these companies do not succeed, it could negatively impact future license revenue growth.

- The acquisition of Intelligent Ultrasound, while strategic, initially dilutes group margins by three percentage points, posing a challenge to achieving targeted 2026 profitability goals, which could impact earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK197.167 for Surgical Science Sweden based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK1.7 billion, earnings will come to SEK426.5 million, and it would be trading on a PE ratio of 27.7x, assuming you use a discount rate of 5.5%.

- Given the current share price of SEK137.7, the analyst price target of SEK197.17 is 30.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.