Key Takeaways

- Transition to as-a-service model and cloud solutions is expected to boost revenue stability, growth, and recurring income.

- Growing demand for Sectra's secure communication and IT solutions is anticipated to drive revenue through increased adoption and customer satisfaction.

- Transition to SaaS model and reliance on large orders may cause financial volatility and strain margins, while facing challenges in cybersecurity and geopolitical tensions.

Catalysts

About Sectra- Provides solutions for medical IT and cybersecurity sectors in Sweden, the United Kingdom, the Netherlands, and rest of Europe.

- Transition to an as-a-service model is expected to enhance future revenue stability and growth, with a significant increase in recurring cloud revenue anticipated as products move from hardware-based to cloud solutions. This transition is likely to impact revenue positively in the long term.

- The company’s extensive patent portfolio, which has already resulted in a significant one-time profitability boost, is positioned to continue contributing positively to earnings as new opportunities for licensing and settlements arise.

- High customer satisfaction, evidenced by awards and low churn rates, is anticipated to drive revenue growth through repeat business and the expansion of services within existing customer accounts.

- Growing demand for Secure Communications likely to drive revenue growth as increasing geopolitical tensions and defense spending in Europe bolster demand for secure communication solutions.

- Strategic focus on consolidating IT systems in healthcare facilities with Sectra’s comprehensive imaging IT solutions is expected to lower costs and enhance efficiency, potentially increasing adoption and impacting revenue growth.

Sectra Future Earnings and Revenue Growth

Assumptions

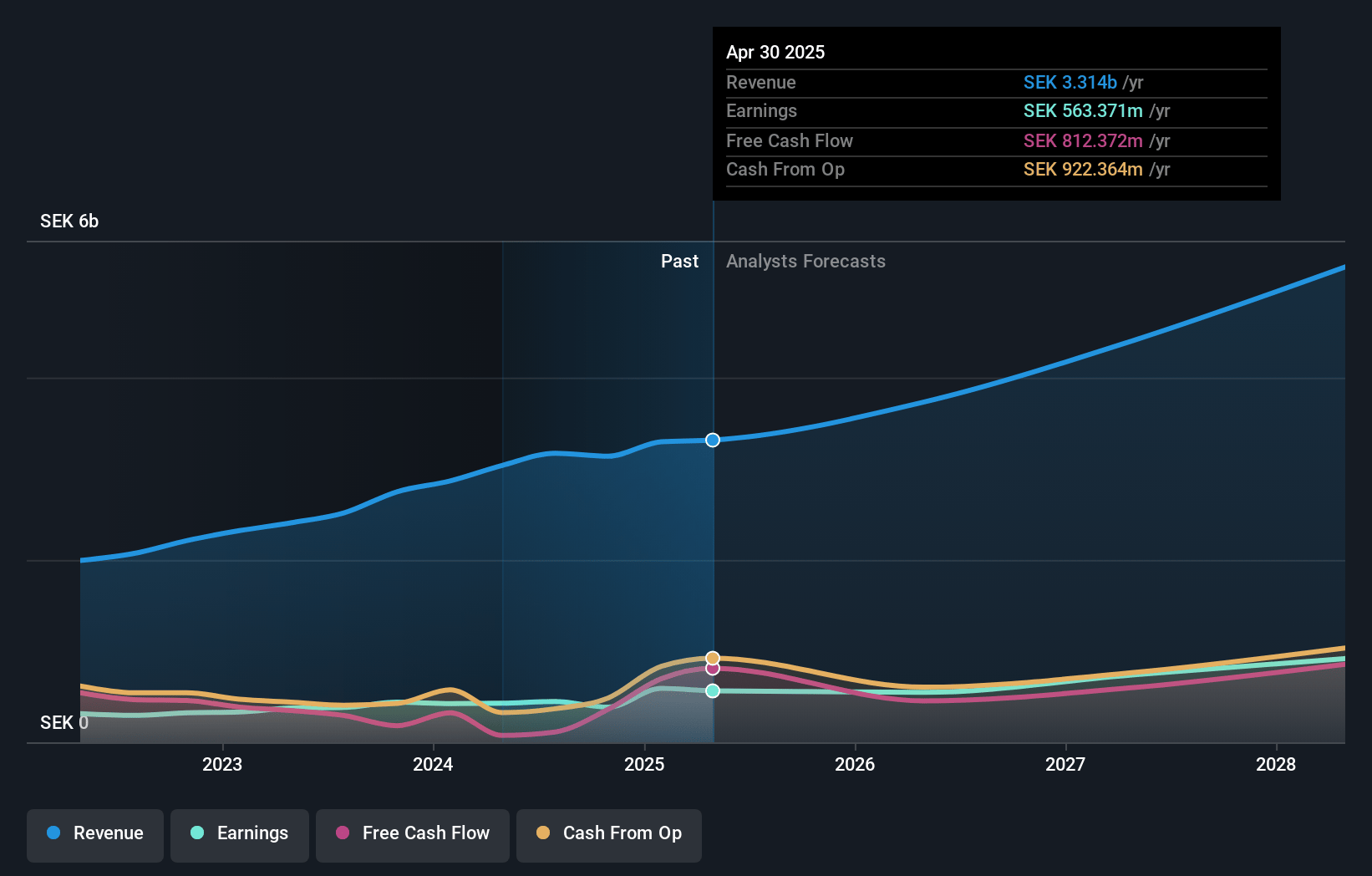

How have these above catalysts been quantified?- Analysts are assuming Sectra's revenue will grow by 16.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 17.0% today to 17.6% in 3 years time.

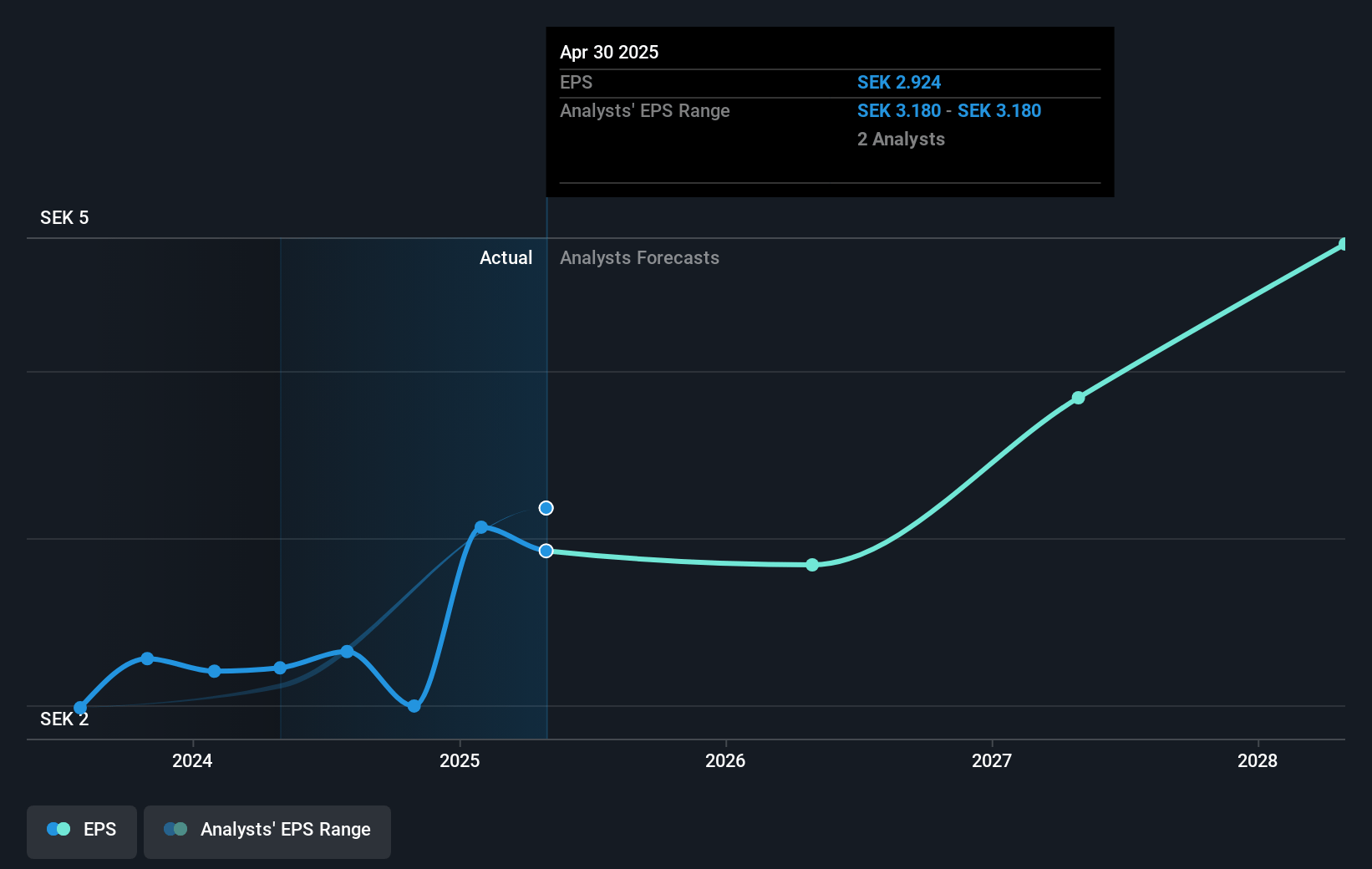

- Analysts expect earnings to reach SEK 918.0 million (and earnings per share of SEK 4.76) by about July 2028, up from SEK 563.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 74.6x on those 2028 earnings, down from 123.1x today. This future PE is lower than the current PE for the GB Healthcare Services industry at 88.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.92%, as per the Simply Wall St company report.

Sectra Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The transition to a software-as-a-service (SaaS) model, while ultimately beneficial, may currently impact revenue and profit margins negatively due to the loss of initial license sales. This can cause fluctuations in short-term financial performance.

- There is a notable decrease in the nonrecurring hardware business for medical education, which could impact revenue streams from this division as recurring revenue is not yet compensating for the decline in hardware sales.

- High dependencies on single large orders (like the SEK 3.1 billion order from Québec) suggest potential volatility in quarterly revenue figures. Such dependency can lead to fluctuating financial performance and unpredictability in revenue and order bookings.

- Ongoing large deployments and implementations, like those in the imaging IT sector, are resource-intensive and could negatively influence operating costs and margins. These implementations need not only internal adjustments but also depend on external factors like network readiness, which can delay revenue recognition.

- Potential risks in cybersecurity and geopolitical tensions may affect Secure Communications, despite being a rapidly growing sector. Changes in defense budgets or shifts in geopolitical climate could impact the demand and earnings from this business division.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK300.0 for Sectra based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK5.2 billion, earnings will come to SEK918.0 million, and it would be trading on a PE ratio of 74.6x, assuming you use a discount rate of 5.9%.

- Given the current share price of SEK359.8, the analyst price target of SEK300.0 is 19.9% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.