Last Update01 May 25Fair value Decreased 8.89%

Key Takeaways

- Strategic focus on U.S. market growth and marketing optimization is expected to boost revenue and improve net margins.

- Near-term revenue prioritization and leadership changes aim to enhance market adoption and drive shareholder value.

- Flat U.S. sales and reduced international revenue raise concerns about growth and diversification, while delayed R&D projects may affect future innovation and competitiveness.

Catalysts

About Integrum- Researches, develops, and sells various systems for bone-anchored prostheses.

- Integrum plans to focus on driving U.S. sales growth by concentrating on fewer centers of excellence, enhancing their marketing efforts, and focusing their SG&A dollars. This is expected to drive revenue growth in their U.S. operations.

- The company is strengthening its aftermarket business through increased engagement with certified prosthetists and enhanced Axor II sales. This focus is anticipated to boost recurring revenues and improve net margins.

- Integrum is strategically curtailing longer-term R&D projects to prioritize near-term revenue generation in the U.S., optimizing resource allocation to focus on projects that have a clearer path to market. This shift is expected to positively impact earnings by aligning R&D expenditure with market-driven goals.

- The commitment to enhancing transparency and disaggregating the revenue model aims to clearly communicate key performance indicators like the number of S1 surgeries, which are indicative of market penetration and future sales growth potential, ultimately forecasting an increase in overall revenue.

- Integrum is pursuing strategic commercial leadership, planning to appoint a CEO with market expertise to bolster market adoption and drive U.S. business growth, which should enhance earnings and shareholder value.

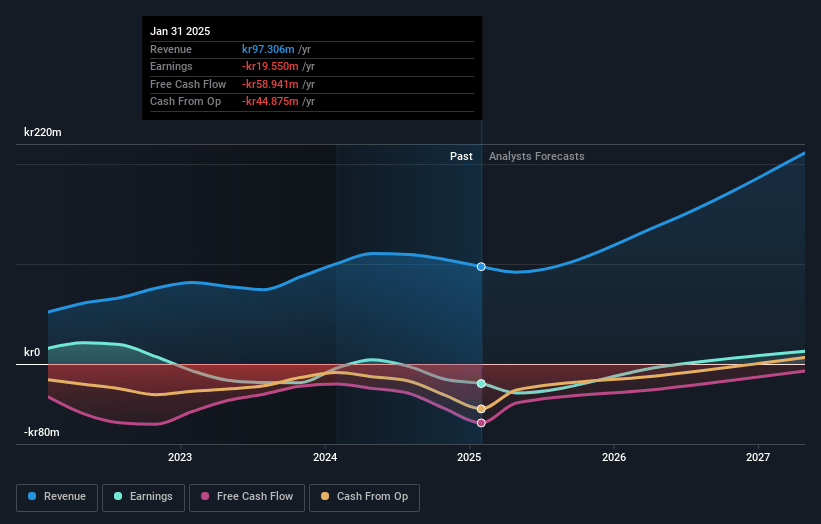

Integrum Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Integrum's revenue will grow by 35.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from -20.1% today to 7.6% in 3 years time.

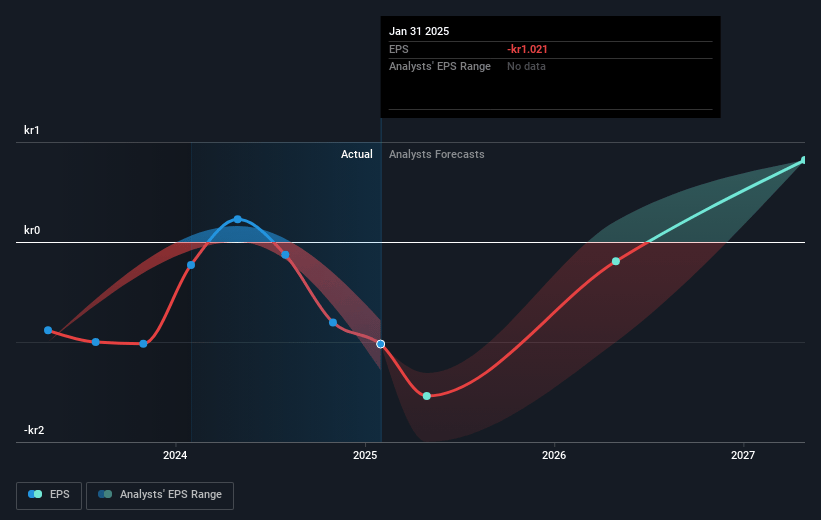

- Analysts expect earnings to reach SEK 18.7 million (and earnings per share of SEK 1.18) by about May 2028, up from SEK -19.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 54.0x on those 2028 earnings, up from -14.9x today. This future PE is greater than the current PE for the SE Medical Equipment industry at 30.9x.

- Analysts expect the number of shares outstanding to grow by 1.69% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.48%, as per the Simply Wall St company report.

Integrum Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Integrum's U.S. sales have remained flat compared to the previous year despite strategic changes, which could indicate challenges in penetrating the market and thus impact future revenue growth.

- The company's revenue was negatively impacted by a 21.2% decrease from the prior year's quarter, primarily due to reduced sales in EMEA and APAC, raising concerns about geographic revenue diversification.

- Operating losses were recorded with an EBIT of negative SEK 7.4 million compared to a slight profit previously, indicating challenges in achieving profitability.

- There is reliance on selective partnership strategies (e.g., Hanger and SPS) and focused market penetration efforts, which may limit scalability and potential earnings if these strategies do not yield anticipated results.

- Integrum has delayed or curtailed longer-term R&D projects to focus on immediate U.S. market growth, which could impact future innovation and competitiveness, thus influencing long-term revenue potential.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK39.0 for Integrum based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK244.4 million, earnings will come to SEK18.7 million, and it would be trading on a PE ratio of 54.0x, assuming you use a discount rate of 5.5%.

- Given the current share price of SEK13.66, the analyst price target of SEK39.0 is 65.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.