Key Takeaways

- Acquiring Paragonix and the phaseout of underperforming portfolios are set to enhance growth and profitability through market expansion and resource optimization.

- Strong order intake, productivity measures, and strategic integration aim to boost margins and sustain revenue growth in high-demand sectors.

- Restructuring and quality-related costs, along with regulatory scrutiny, pose significant challenges to Getinge's profitability and growth in key markets.

Catalysts

About Getinge- Provides products and solutions for operating rooms, intensive-care units, and sterilization departments.

- The acquisition of Paragonix Technologies brings innovative products like the KidneyVault system to Getinge, supporting future growth in organ transportation solutions, likely boosting revenue through market expansion in the transplant sector.

- The phaseout of the underperforming Surgical Perfusion portfolio will allow reallocation of resources to more profitable areas like ECLS and Transplant Care, potentially improving net margins and overall earnings from 2025 onwards due to a more focused business strategy.

- Strong order intake and sales growth across the portfolio, with particular strength in ventilators and ECLS, suggest sustained revenue growth potential as these areas continue to experience demand and as capacity issues are addressed.

- Ongoing productivity measures and structural cost efficiencies are expected to enhance margins by leveraging higher sales volumes and optimizing operational efficiency, positively impacting earnings over the coming years.

- The successful integration and profitability improvement of acquired businesses like Paragonix, along with targeted price adjustments and a recovery in impacted segments like Life Science, suggest further margin expansion and earnings growth capability.

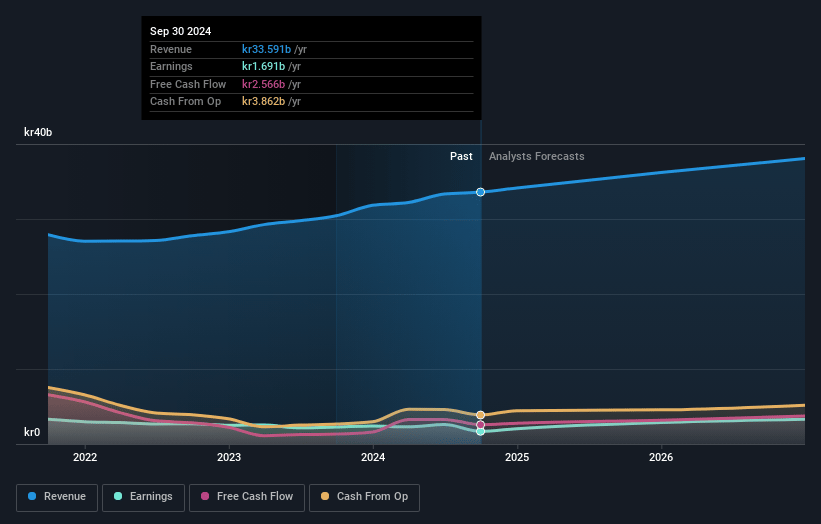

Getinge Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Getinge's revenue will grow by 5.0% annually over the next 3 years.

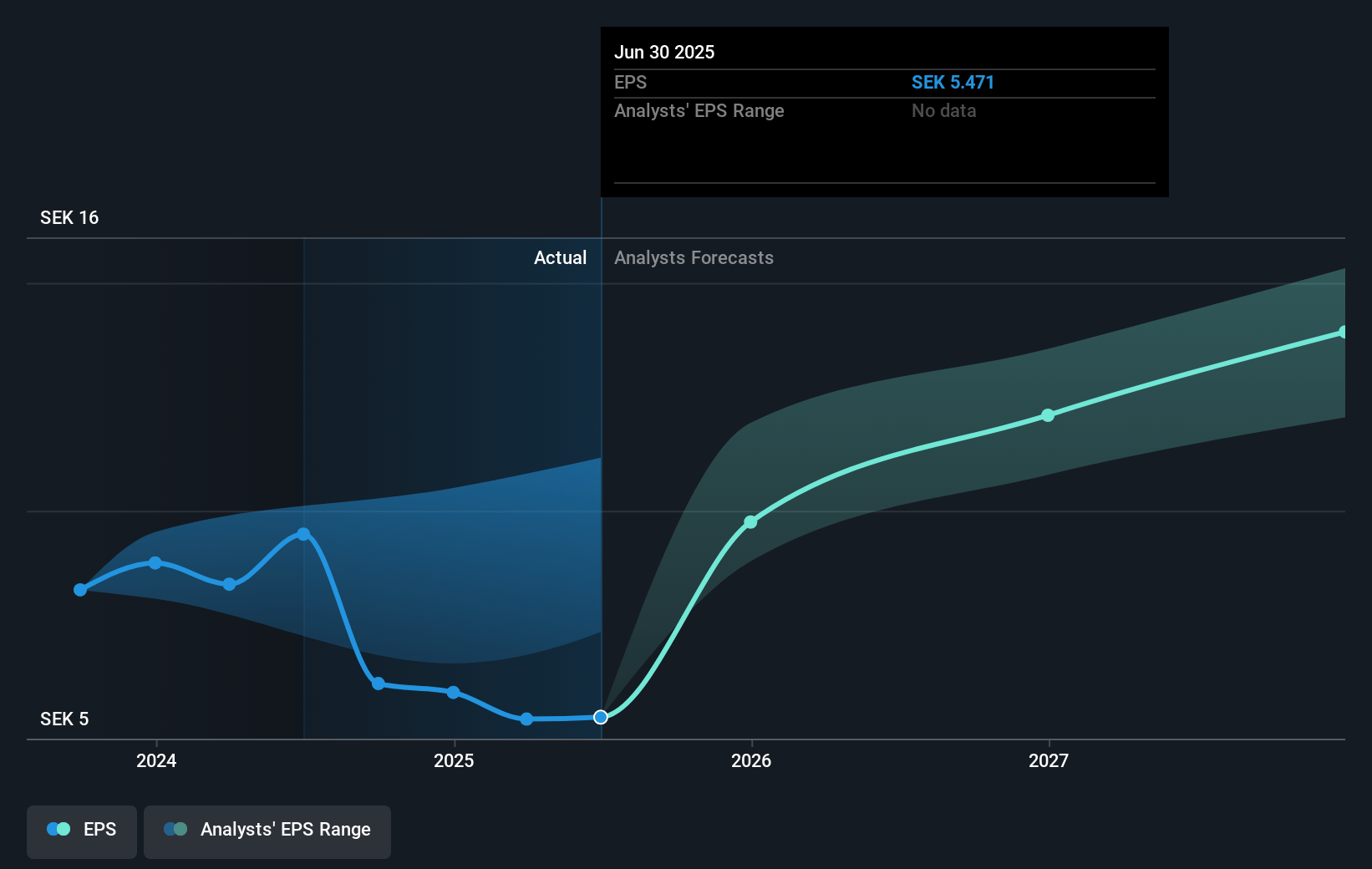

- Analysts assume that profit margins will increase from 4.7% today to 9.8% in 3 years time.

- Analysts expect earnings to reach SEK 3.9 billion (and earnings per share of SEK 14.46) by about April 2028, up from SEK 1.6 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as SEK4.6 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.0x on those 2028 earnings, down from 32.6x today. This future PE is lower than the current PE for the GB Medical Equipment industry at 28.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.86%, as per the Simply Wall St company report.

Getinge Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The phaseout of the Surgical Perfusion product portfolio, despite freeing up resources, involves significant restructuring costs estimated at approximately SEK 800 million, negatively impacting margins and potentially causing near-term financial strain.

- Getinge continues to face challenges with quality-related costs, which peaked in 2024 and exceeded SEK 800 million, impacting net margins and profitability.

- Continued FDA scrutiny and the associated restrictions on certain products like the Cardiosave intra-aortic balloon pump pose risks to order intake and sales in the U.S. market, affecting revenue and growth potential.

- The acquisition of Paragonix, while showing growth, initially dilutes group profitability and may take time to positively impact overall margin performance.

- Potential pricing challenges in 2025 due to market conditions may not replicate the favorable pricing impacts seen in 2024, potentially affecting revenue growth and margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK243.625 for Getinge based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK300.0, and the most bearish reporting a price target of just SEK191.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK40.2 billion, earnings will come to SEK3.9 billion, and it would be trading on a PE ratio of 20.0x, assuming you use a discount rate of 5.9%.

- Given the current share price of SEK195.9, the analyst price target of SEK243.62 is 19.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.