Key Takeaways

- Expectations for sustained demand and premium pricing may prove optimistic if consumer trends shift toward plant-based proteins or regulatory pressures increase costs.

- Anticipated volume growth from capacity expansions relies on flawless execution, with operational delays or integration issues posing risks to earnings and efficiency.

- Strong market position, efficiency gains, and product innovation drive resilient revenue growth, margin improvement, and enhanced profitability amid favorable industry and consumer trends.

Catalysts

About Scandi Standard- Produces and sells chilled, frozen, and ready-to-eat chicken products in Sweden, Norway, Ireland, Denmark, Finland, Germany, the United Kingdom, rest of Europe, and internationally.

- The current valuation may be pricing in an overly optimistic continuation of the shift from red meats to poultry, assuming sustained robust consumer demand for chicken amid global health and wellness priorities; this could lead to disappointment if consumer trends toward plant-based alternatives accelerate, resulting in slower revenue growth than expected.

- The share price appears to factor in continued success in passing through higher production costs via price increases, despite ongoing volatility in input costs (notably feed), and assumes minimal margin pressure-even though there is increasing regulatory focus and potential public pressure on carbon emissions and animal welfare, which could drive up costs and compress profit margins.

- Investors seem to expect Scandi Standard's recent and planned capacity expansions (such as the Lithuanian and Dutch plants) will drive significant volume growth and enhanced efficiency, yet this relies on flawless execution of ramp-ups and integration-any delays or cost overruns could result in below-forecast earnings and ROCE.

- The market appears to be extrapolating strong export price growth and retail demand, potentially overlooking cyclical risks or downside from increased substitution by alternative proteins, which could lead to lower-than-anticipated top-line growth if global consumer preferences change or export markets slow.

- The valuation likely reflects the belief that Scandi Standard's leadership in sustainability and animal welfare will maintain premium pricing and market share; however, if regulatory standards tighten further or new entrants with disruptive plant-based or low-carbon alternatives gain traction, this could compress net margins and erode competitive advantage.

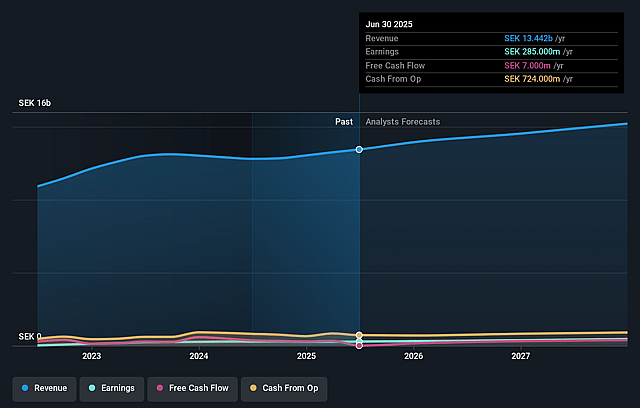

Scandi Standard Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Scandi Standard's revenue will grow by 5.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.1% today to 3.2% in 3 years time.

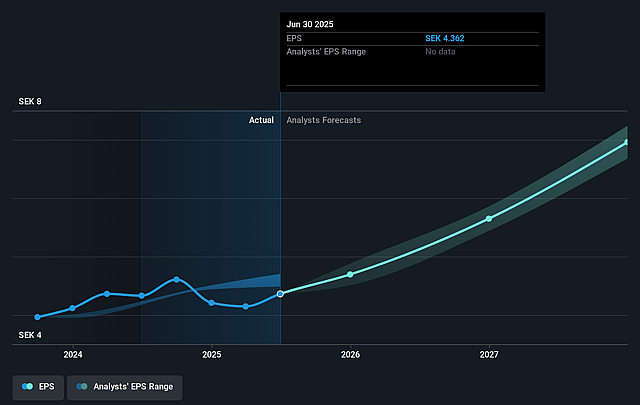

- Analysts expect earnings to reach SEK 499.1 million (and earnings per share of SEK 6.96) by about August 2028, up from SEK 285.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.2x on those 2028 earnings, down from 22.7x today. This future PE is lower than the current PE for the GB Food industry at 21.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.92%, as per the Simply Wall St company report.

Scandi Standard Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Strong ongoing and growing demand for chicken, supported by long-term trends of consumers switching from red meat (beef and pork) to poultry for reasons of affordability, sustainability, and health, helps insulate Scandi Standard's revenues from secular volume declines.

- Significant investments in new production capacity (Lithuania, Netherlands/Oosterwolde) position Scandi Standard for substantial volume growth and improved cost efficiency, which are likely to support higher future net sales and margin expansion.

- The company's established market leadership and consolidation in its core markets create high barriers to entry for new competitors, helping Scandi Standard maintain pricing power and stable or improving EBIT margins.

- Ongoing improvements in operational efficiency and automation, as well as strong management of feed and input costs (including hedging), enhance resilience and may positively impact long-term profitability and earnings growth.

- Expansion into value-added and ready-to-eat poultry products is leading to higher returns on capital, diversified revenue streams, and greater pricing power, which together support improved revenue growth and net margins over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK81.0 for Scandi Standard based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK15.6 billion, earnings will come to SEK499.1 million, and it would be trading on a PE ratio of 12.2x, assuming you use a discount rate of 4.9%.

- Given the current share price of SEK99.2, the analyst price target of SEK81.0 is 22.5% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.