Key Takeaways

- Investments in infrastructure and accommodations aim to enhance customer experience and boost revenue through increased occupancy and ski pass sales.

- Expansion in retail and strategic partnerships could diversify and increase income streams, while sustainability efforts may enhance operational efficiency and brand value.

- Dependence on weather and high capital expenditures increase financial risk, while challenges in bookings and digital conversion may impact revenue growth.

Catalysts

About SkiStar- Owns and operates Alpine ski resorts in Sweden and Norway.

- The investment in new gondolas and ski lifts in Trysil and Are, along with anticipated developments in these ski areas, are expected to significantly enhance customer experience and capacity, potentially boosting future revenue from increased ski pass sales and accommodation.

- The expansion and development of the Vemdalen ski area and the addition of 500 new beds in Salen are likely to increase accommodation availability and attractiveness of these destinations, driving higher occupancy rates and associated revenue growth.

- The continued growth and focus on the retail segment, particularly through acquisitions and strengthening operations, indicate an effort to diversify income streams and capture higher margins through branded products, improving earnings.

- Strategic partnerships and collaborations, like the one with landowners in Trysil for more development, can create new revenue opportunities through real estate sales and joint ventures, positively impacting net income.

- SkiStar's initiatives in sustainability, such as investment in electric vehicles and participation in global alliances, may improve operational efficiency and reduce costs, supporting better net margins and brand value in the long term.

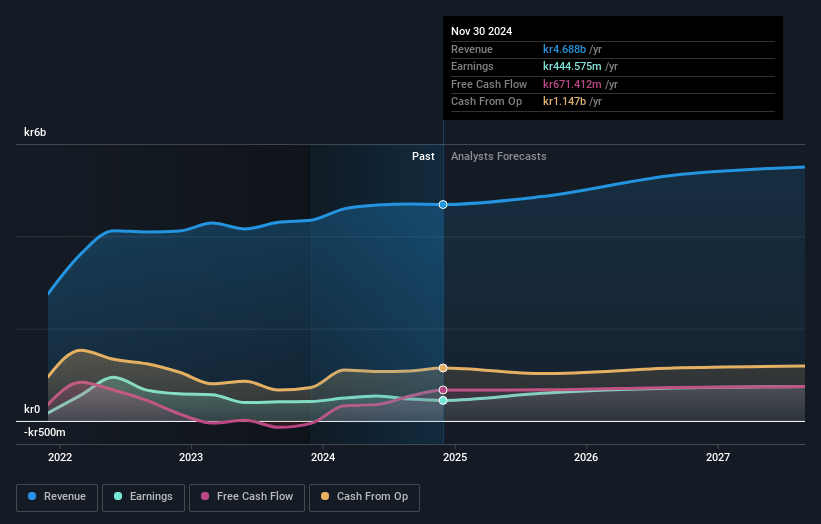

SkiStar Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming SkiStar's revenue will grow by 6.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 9.5% today to 14.9% in 3 years time.

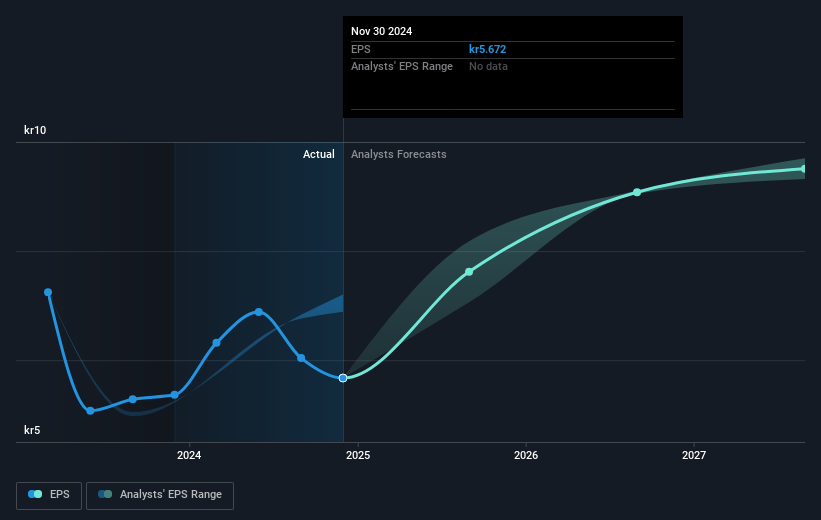

- Analysts expect earnings to reach SEK 853.6 million (and earnings per share of SEK 9.46) by about March 2028, up from SEK 444.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.8x on those 2028 earnings, down from 29.7x today. This future PE is greater than the current PE for the GB Hospitality industry at 12.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.94%, as per the Simply Wall St company report.

SkiStar Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- SkiStar's financial performance is highly dependent on weather conditions, as warmer weather has led to higher costs for snow preparation and staffing, impacting operating margins.

- The company's growth strategy involves significant capital expenditures for new facilities, such as the gondola in Trysil, which requires a substantial investment of approximately NOK 200 million, potentially affecting cash flow and increasing financial risk.

- The late Easter this year has created challenges in bookings for weeks 14 and 15, leading to potential revenue shortfalls in the third quarter compared to previous years.

- SkiStar has experienced a slowdown in conversion rates on digital platforms, which could impact future revenues if not addressed, despite the increase in digital engagement.

- The retail segment's growth has been affected by weather-related product demands, and while online sales are strong, physical store sales have stagnated, which could limit overall revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK186.5 for SkiStar based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK5.7 billion, earnings will come to SEK853.6 million, and it would be trading on a PE ratio of 20.8x, assuming you use a discount rate of 6.9%.

- Given the current share price of SEK168.7, the analyst price target of SEK186.5 is 9.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives