Key Takeaways

- Regulatory tightening, customer churn, and economic headwinds threaten Kambi's addressable market, revenue growth, and earnings stability.

- Technological disruption and intensified competition are compressing margins and threatening Kambi's share in key regions.

- Kambi is positioned for sustainable growth and improved profitability through global market expansion, product innovation, client diversification, operational efficiency, and industry-wide B2B shifts.

Catalysts

About Kambi Group- Provides sports betting technology and services to the betting and gaming industry in Europe, the Americas, and internationally.

- The increasing pace of global regulatory tightening-in the form of new taxes, stricter deposit limits, and more rigorous requirements as seen in the Netherlands, Sweden, Illinois, and Colombia-raises the risk that further legislation will constrain Kambi's addressable market and reduce transaction-based revenue growth over the long term.

- The sports betting industry continues to face accelerating technological disruption, especially through advanced AI and automation that may enable new or existing competitors to offer lower-cost, more customized platforms. If Kambi cannot keep up with the speed of innovation, its market share and top-line revenue are likely to be eroded over time.

- Rising competitive intensity, particularly in key growth regions such as Latin America and Europe, is driving a sustained decline in revenue-share commercial terms. Current contract rates have already fallen by half compared to a decade ago, and further price pressure will challenge Kambi's ability to maintain net margins and earnings growth as contracts renew or support for new deals is won mainly on pricing.

- Customer concentration risk remains elevated, with major clients such as LeoVegas and Kindred either in-sourcing their sportsbook requirements or moving portions of their business off the Kambi platform. These trends, amplified by the churn in key U.S. and European customers, create persistent topline revenue volatility and undermine the company's earnings resilience.

- Macro headwinds such as rising interest rates and ongoing economic uncertainty can weigh on consumer discretionary spending on betting activities, which will suppress betting turnover on Kambi's platform. This dynamic is likely to limit both near-term and structural earnings growth, especially if the global economic backdrop remains weak.

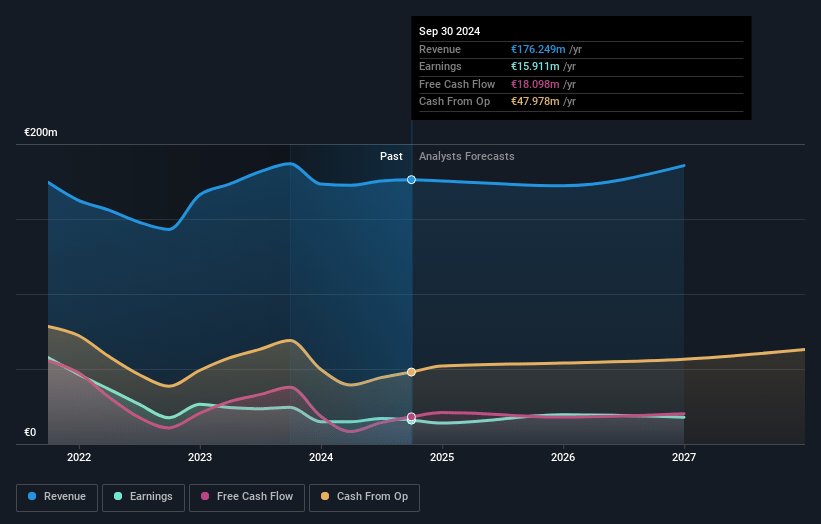

Kambi Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Kambi Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Kambi Group's revenue will grow by 3.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 7.4% today to 11.7% in 3 years time.

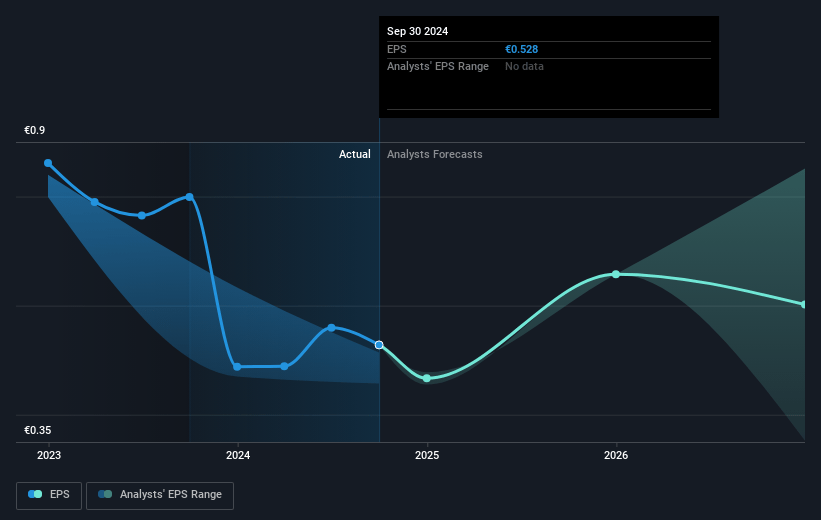

- The bearish analysts expect earnings to reach €22.8 million (and earnings per share of €0.79) by about July 2028, up from €13.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 13.8x on those 2028 earnings, down from 24.3x today. This future PE is greater than the current PE for the SE Hospitality industry at 12.7x.

- Analysts expect the number of shares outstanding to decline by 3.56% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.71%, as per the Simply Wall St company report.

Kambi Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing regulation and legalization of sports betting in new global markets-including successful entry into Latin America and the U.S., as well as prospective launches in Asia-may increase Kambi's total addressable market and drive higher long-term revenues and earnings growth.

- Kambi's expansion of modular offerings, such as Odds Feed+ and Bet Builder products, alongside a growing pipeline of Tier 1 operator interest, could lead to higher average contract values and recurring SaaS-like revenues, supporting sustainable margin expansion over the long term.

- Diversification of Kambi's customer base, highlighted by new partnerships like RedCap in Latin America, the OLG lottery in Ontario, and ongoing relationships with Bally's and LeoVegas (with deal renewals extending through 2027), may reduce revenue volatility and improve earnings resilience even as legacy clients exit or switch providers.

- Continued advancements in internal efficiency initiatives, including automation and AI-driven trading, are contributing to meaningful cost reductions across personnel and infrastructure, positioning the company for higher net margins and profitability as these investments scale through 2026 and beyond.

- Structural industry trends toward B2B infrastructure models, product outsourcing for regulatory compliance, and the increasing importance of sophisticated, customizable technology solutions are likely to expand Kambi's addressable market and support stickier, long-term contracts with operators, underpinning stable or growing performance on both revenues and net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Kambi Group is SEK112.45, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Kambi Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK194.1, and the most bearish reporting a price target of just SEK112.45.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €194.6 million, earnings will come to €22.8 million, and it would be trading on a PE ratio of 13.8x, assuming you use a discount rate of 7.7%.

- Given the current share price of SEK124.1, the bearish analyst price target of SEK112.45 is 10.4% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.