Narratives are currently in beta

Key Takeaways

- Expansion in the Americas and strategic releases in regulated markets could substantially drive revenue growth as these sectors mature.

- Investments in studio capacity and new technologies may enhance gaming experiences and improve operational efficiencies, bolstering net margins.

- Operational challenges and cybercrime risks pose significant threats to Evolution's revenue, growth, and financial performance, with increased costs impacting margins and requiring substantial investments.

Catalysts

About Evolution- Develops, produces, markets, and licenses online casino systems to gaming operators in Europe, Asia, North America, Latin America, and internationally.

- Expansion in Latin America and North America through new studios in Colombia and the U.S. could drive significant revenue growth, particularly as these markets mature and expand.

- Launch of innovative new games, like Lightning Storm and integration of Arcadia Gaming Solutions' technology, may enhance gaming experience and boost revenue through increased player engagement.

- Strategic product releases and expansion opportunities in regulated markets like Brazil and potentially France could significantly impact revenue growth.

- Strengthening presence in Asia-Pacific with planned studio expansion in the Philippines may bolster revenue by tapping into a high potential and rapidly growing market.

- Continued investments in expanding operational studio capacity and OS (运营商服务) enhancements could lead to improved net margins through operational efficiencies and increased game round volume.

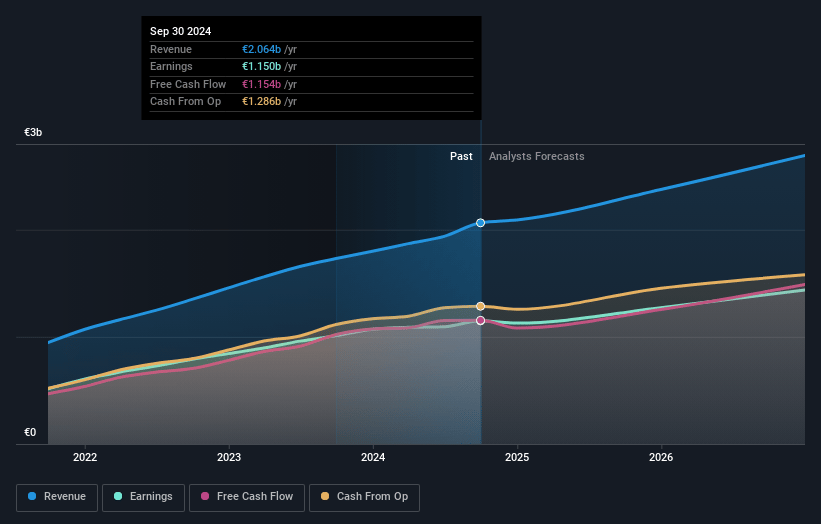

Evolution Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Evolution's revenue will grow by 12.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 55.7% today to 52.7% in 3 years time.

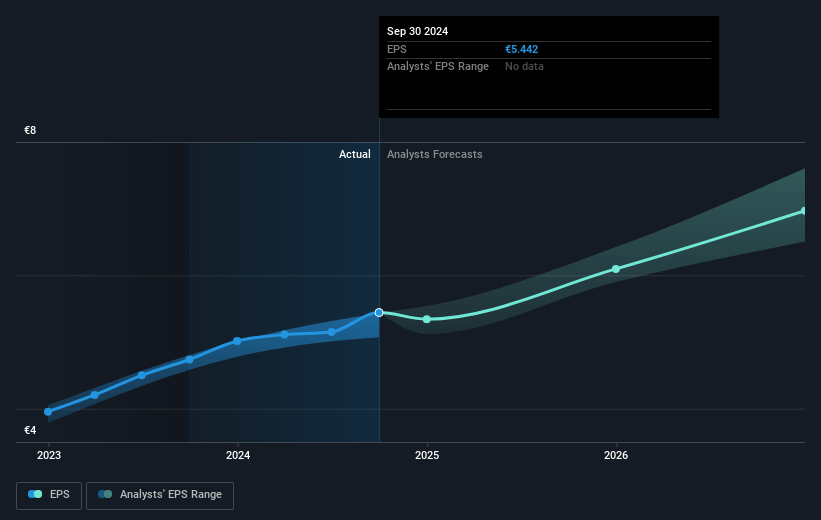

- Analysts expect earnings to reach €1.5 billion (and earnings per share of €7.57) by about November 2027, up from €1.1 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as €1.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 215.4x on those 2027 earnings, up from 15.4x today. This future PE is greater than the current PE for the GB Hospitality industry at 23.9x.

- Analysts expect the number of shares outstanding to decline by 0.35% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.81%, as per the Simply Wall St company report.

Evolution Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing operational challenges in Georgia, including union strikes and illegal activities, have forced Evolution to operate at reduced capacity. Prolonged instability could impact revenue generation and strain operational expenses due to increased costs and disruptions. This situation affects Evolution's ability to maintain and grow its current production levels, reducing future revenue potentials.

- The rise in cybercrime activities affecting Evolution's Asian operations is a notable risk. Sophisticated attacks on Evolution's video distribution could lead to unauthorized usage and redistribution of their products, potentially leading to significant revenue losses as legitimate earnings are siphoned away by criminal activities.

- The slower growth in Asia attributed to cyberattacks and potential geopolitical factors, as well as the adjustments made to counter them, may pressure Evolution's growth trajectories and reduce revenue inflows from one of its fastest-growing markets.

- The decrease in the expected contribution from the Georgia studio, where they are unable to return to full capacity, may strain their EBITDA margins. As one of their significant operations is undermined, maintaining previous margin levels could be challenging, impacting overall financial performance.

- The need for substantial investment in expansion and new studio setups in response to existing capacity issues highlights Evolution's capital expenditure pressures. Continual high CapEx for expansion may squeeze cash flow and profits, especially if operational issues remain unresolved and revenue growth does not compensate for higher investment costs.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €1379.3 for Evolution based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €1801.7, and the most bearish reporting a price target of just €898.83.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be €2.9 billion, earnings will come to €1.5 billion, and it would be trading on a PE ratio of 215.4x, assuming you use a discount rate of 5.8%.

- Given the current share price of €994.2, the analyst's price target of €1379.3 is 27.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives