Key Takeaways

- Strategic divestment and targeted acquisitions are enhancing operational efficiency, margin quality, and expanding Sdiptech's high-margin revenue streams.

- Strong positioning in infrastructure-related segments benefits from modernization trends and regulatory focus on sustainability, supporting sustained organic growth and resilient customer relationships.

- Heavy reliance on acquisitions and exposure to regional risks threaten organic growth, margin stability, and long-term earnings amid rising costs and uncertain portfolio streamlining.

Catalysts

About Sdiptech- Provides technical services for infrastructures in Sweden, the United Kingdom, Germany, Denmark, Italy, the Netherlands, Austria, Norway, Finland, the Unites States, and internationally.

- The ongoing divestment of low-margin, non-core businesses and increased strategic focus on product-based companies positions Sdiptech to improve margin quality and operational efficiency, which should enhance net margins and return on capital employed over the medium term.

- Sdiptech's core segments-especially Energy and Electrification, Water and Bioeconomy, and Safety and Security-are well positioned to benefit from accelerating demand driven by the modernization of aging infrastructure and increased investments in resilient public systems, supporting sustained organic revenue growth.

- The company's refined acquisition strategy, emphasizing strict margin and quality criteria, allows it to capitalize on industry fragmentation and growing demand for specialized infrastructure providers, expanding its high-margin revenue base over time and supporting long-term EBITDA growth.

- Heightened regulatory focus on sustainability and energy efficiency in key European markets aligns well with Sdiptech's technological offerings, likely increasing recurring demand for its solutions and supporting steady improvement in organic sales and stickier customer relationships.

- The strengthening of management teams and business area expertise, with particular reinforcement in the U.K. and core verticals, is expected to accelerate operational improvements, enable better integration of future acquisitions, and support compounding earnings growth over the next several years.

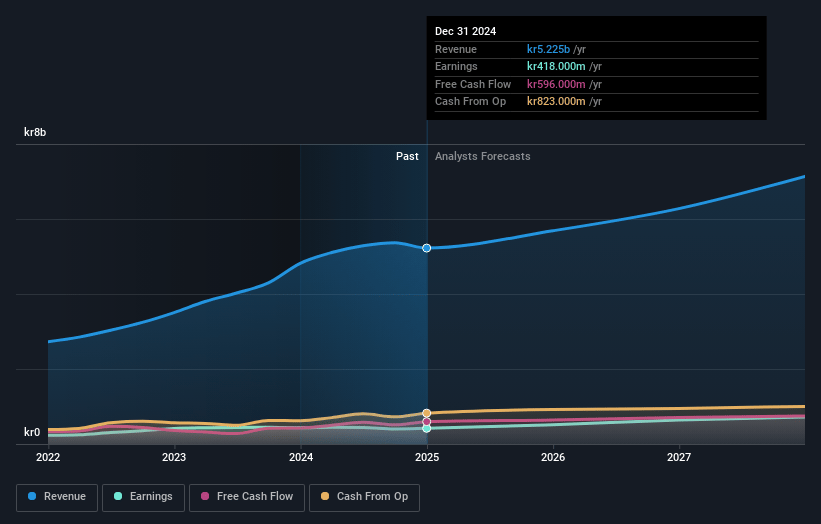

Sdiptech Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Sdiptech's revenue will grow by 5.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.3% today to 10.6% in 3 years time.

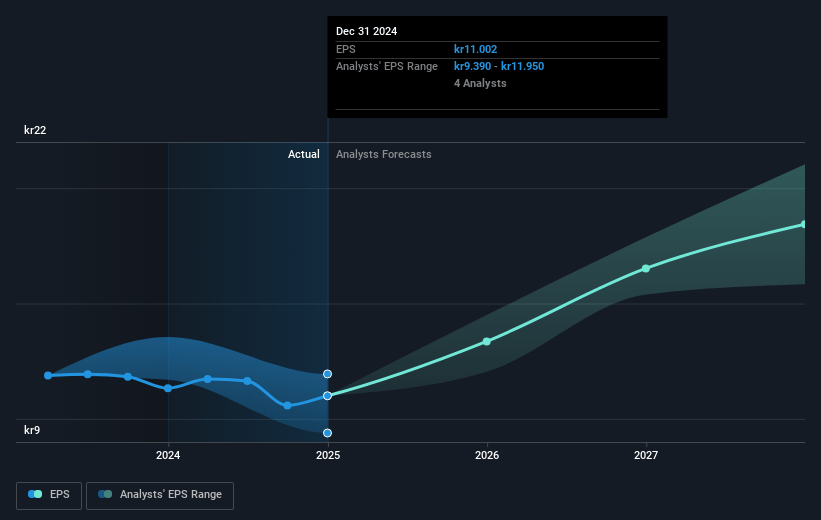

- Analysts expect earnings to reach SEK 645.1 million (and earnings per share of SEK 16.8) by about July 2028, up from SEK 381.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.3x on those 2028 earnings, up from 19.9x today. This future PE is greater than the current PE for the SE Commercial Services industry at 19.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.1%, as per the Simply Wall St company report.

Sdiptech Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sdiptech's recent negative organic sales growth (-4% for the quarter, -3% over the last 12 months) signals underlying challenges in achieving consistent organic expansion; persistent weakness here could weigh on revenue growth and, consequently, future earnings.

- The group's profitability is heavily supported by acquisitions rather than organic improvement, with acquisition-driven gains masking underlying margin declines (e.g., adjusted EBITDA margin fell from 20.1% to 18.8% YoY); overdependence on successful M&A integration increases risks of operational inefficiencies and potential future margin compression.

- Sdiptech's high geographic concentration (45% of revenue from the U.K.) exposes it to regional macroeconomic or regulatory shocks, which could result in revenue and earnings volatility if conditions worsen in key markets.

- Rising labor costs (particularly due to wage legislation and social fees in the U.K.) and persistent cost inflation are pressuring margins and may continue to offset operational improvements, directly impacting net margins over the long term.

- The ongoing divestment of underperforming companies, while intended to streamline the portfolio, will entail substantial non-cash goodwill write-downs (SEK 400–500 million) and may not immediately improve cash flow conversion or organic growth, posing risks to both net income and capital efficiency until the transition is complete.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK296.75 for Sdiptech based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK365.0, and the most bearish reporting a price target of just SEK230.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK6.1 billion, earnings will come to SEK645.1 million, and it would be trading on a PE ratio of 20.3x, assuming you use a discount rate of 6.1%.

- Given the current share price of SEK199.5, the analyst price target of SEK296.75 is 32.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.