Key Takeaways

- Expansion into emerging markets and focus on advanced, energy-efficient products position Systemair for sustained growth and access to higher-margin opportunities.

- Increasing demand for specialized ventilation solutions and a stable project mix enhance earnings quality, recurring revenue, and support further investment for future growth.

- Revenue and profit growth are challenged by project volatility, sluggish core markets, currency headwinds, expansion risks, and global trade uncertainties.

Catalysts

About Systemair- Manufactures and sells of ventilation, heating and cooling products, and systems in Europe, North America, the Middle East, Asia, Australia, and Africa.

- Systemair is expanding its manufacturing capacity in fast-growing regions like India and Saudi Arabia-both through acquisitions (NADI Airtechnics in India) and new factories-effectively positioning itself to capitalize on accelerating urbanization and infrastructure investments in emerging markets, which should support sustained revenue growth and greater exposure to higher-margin opportunities.

- Product innovation continues to be a focus with new advanced solutions (e.g., energy-efficient Menerga units, fire dampers, heat pump-based energy recovery) being launched and tailored for major infrastructure and sustainability-focused projects (e.g., metro expansion, public pool retrofits), enabling Systemair to capture structurally higher-margin, specialized market segments and benefit from increasing global demand for energy-efficient, sustainable building systems.

- Demand for advanced ventilation and air quality solutions is underpinned by stricter building codes, greater climate and indoor health awareness, and regulatory pressure on energy efficiency, providing a robust multi-year demand outlook that could translate to above-trend sales and margin expansion as the legislative environment becomes even more favorable.

- The growing share of industrial and infrastructure projects (often with longer lead times, recurring service, and specialized requirements) in Systemair's business mix supports more stable, higher-quality earnings and can increase recurring revenue from aftermarket and long-term service contracts, improving earnings visibility and smoothing cyclical fluctuations in the traditional construction sector.

- Improved balance sheet strength, with low net debt and rising free cash flow, provides ample capacity for further strategic M&A and organic investments, which can accelerate both top-line growth and long-term earnings if deployed to capture new verticals or deepen penetration in high-growth geographies.

Systemair Future Earnings and Revenue Growth

Assumptions

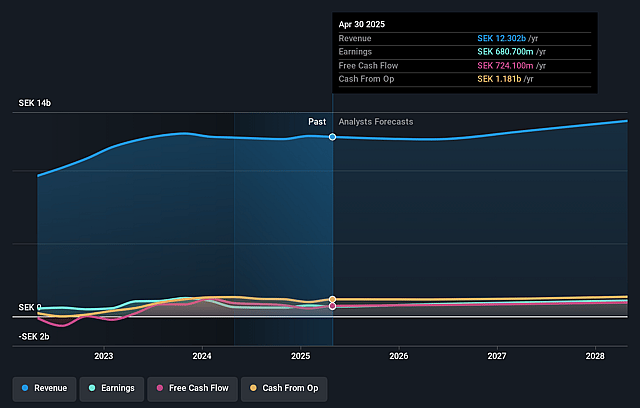

How have these above catalysts been quantified?- Analysts are assuming Systemair's revenue will grow by 4.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.4% today to 8.5% in 3 years time.

- Analysts expect earnings to reach SEK 1.2 billion (and earnings per share of SEK 5.15) by about September 2028, up from SEK 663.2 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as SEK1.1 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.0x on those 2028 earnings, down from 25.9x today. This future PE is lower than the current PE for the GB Building industry at 25.9x.

- Analysts expect the number of shares outstanding to decline by 0.15% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.2%, as per the Simply Wall St company report.

Systemair Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Exposure to volatile project-driven sales, especially in regions like Eastern Europe, increases revenue unpredictability and can pressure margins due to the lower profitability of large infrastructure projects, as highlighted by mixed project and regional effects on margins.

- Slow recovery and ongoing stagnation in large mature markets such as Germany and the broader Western European commercial sector may constrain top-line growth and limit Systemair's ability to accelerate revenue, particularly if economic or political incentives for building activity remain muted.

- Currency risks remain significant given the company's global footprint, with recent negative effects from a strengthening Swedish krona against the euro and other major currencies, reducing reported revenues and squeezing net profits due to adverse conversion impacts.

- Execution and integration risks tied to international expansion-including recent acquisitions like NADI in India and new facilities in Saudi Arabia-could lead to inefficiencies, increased capital expenditure, and potential declines in net margins if ramp-ups or integrations underperform expectations.

- Rising global trade tensions and tariff uncertainties, highlighted by ongoing volatility in North America, could disrupt supply chains, increase input costs, and impact earnings, especially if Systemair cannot fully offset these with local production or pricing adjustments.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK95.333 for Systemair based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK103.0, and the most bearish reporting a price target of just SEK83.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK13.9 billion, earnings will come to SEK1.2 billion, and it would be trading on a PE ratio of 20.0x, assuming you use a discount rate of 6.2%.

- Given the current share price of SEK82.5, the analyst price target of SEK95.33 is 13.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.