Key Takeaways

- Structural separation of businesses aims to drive profitable growth and long-term revenue increases through focused competitive platforms.

- Electrification investments, especially in ceramic bearings for EVs, offer significant growth potential amid expanding market opportunities.

- Ongoing negative growth, automotive challenges, FX headwinds, and separation costs threaten AB SKF's revenue stability and profitability.

Catalysts

About AB SKF- Designs, manufactures, and sells bearings and units, seals, lubrication systems, condition monitoring, and services worldwide.

- The company is undertaking significant structural changes, including the upcoming separation of the industrial and automotive businesses, which is expected to create two competitive platforms focused on profitable growth, potentially driving long-term revenue and earnings growth.

- SKF's regionalization efforts, increasing local supply chain resilience and cost competitiveness in key markets such as the Americas (70% regionalization) and Asia (68% regionalization), are designed to enhance operational efficiencies, supporting long-term margin improvement.

- Increased investments in the burgeoning electrification trend, specifically in the development and sale of ceramic bearings for the EV market, present significant future growth opportunities, potentially impacting revenue positively as this sector expands.

- SKF's robust cash flow generation and focus on improving working capital efficiency, such as reducing inventories, demonstrate disciplined financial management which can help stabilize and improve net margins.

- The focus on portfolio management activities that enhance the product and customer mix is aimed at maintaining strong margins even in a negative growth environment, indicating potential for margin resilience and improvement going forward.

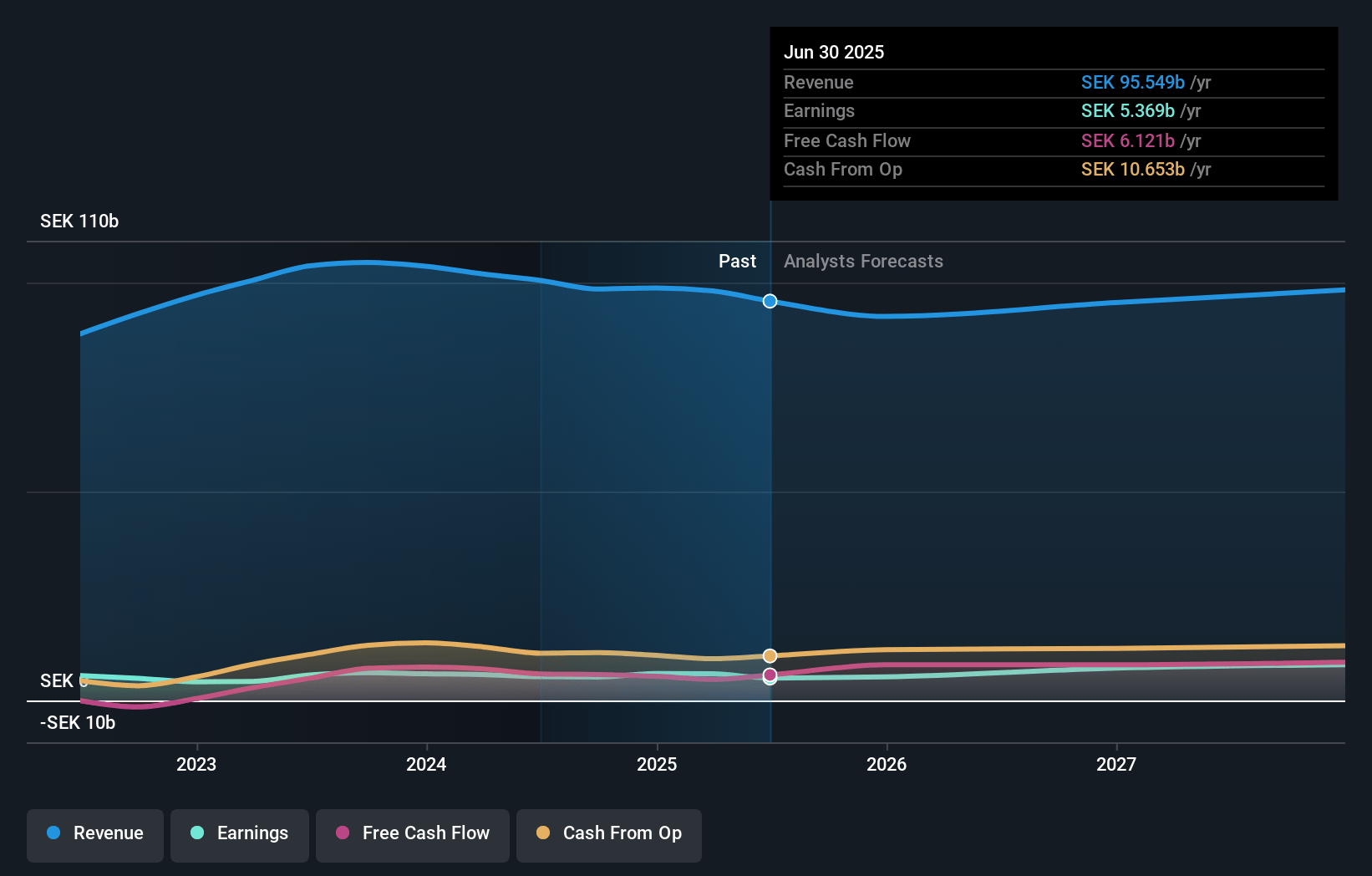

AB SKF Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming AB SKF's revenue will grow by 2.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.6% today to 8.4% in 3 years time.

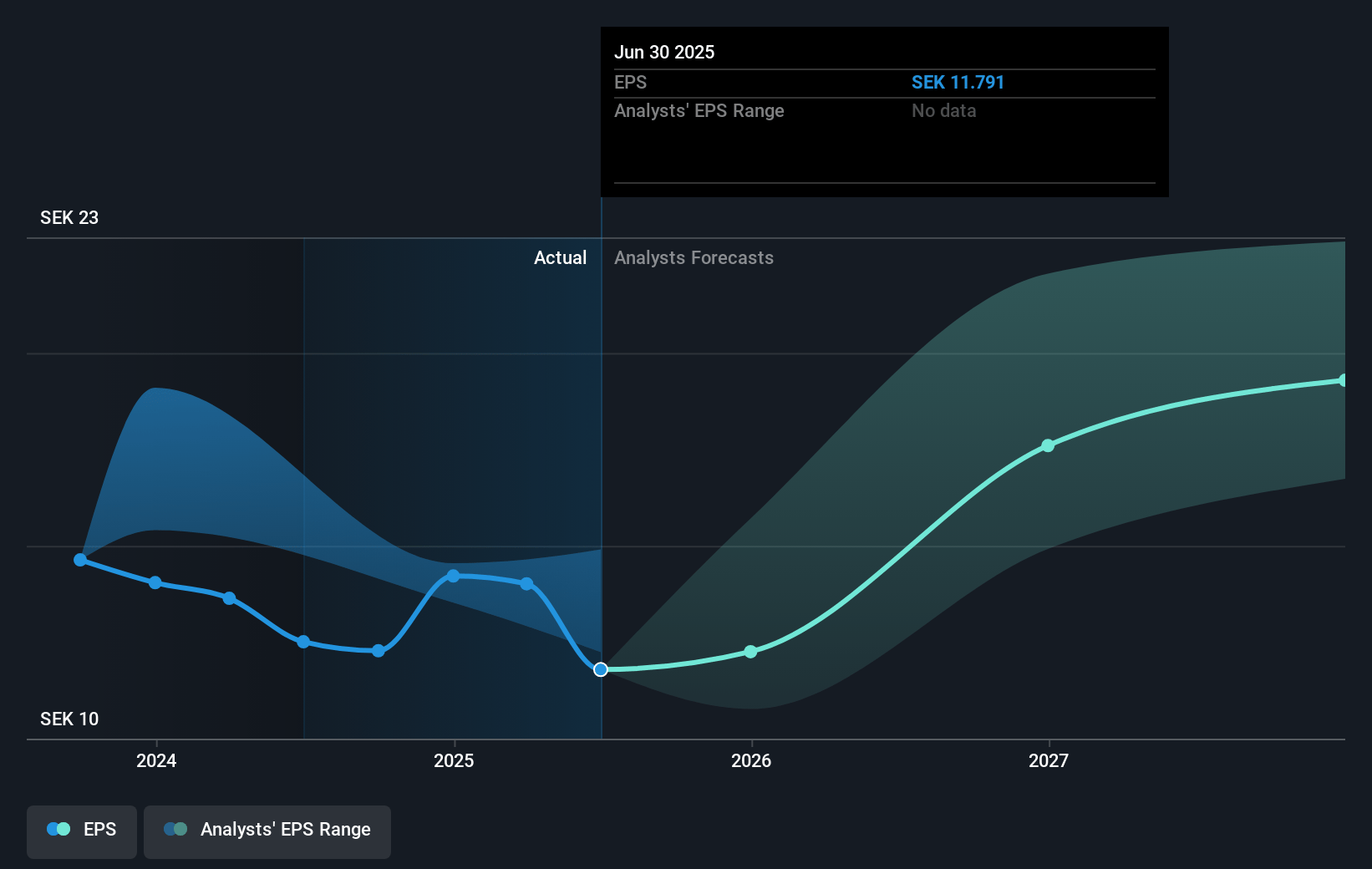

- Analysts expect earnings to reach SEK 8.8 billion (and earnings per share of SEK 19.45) by about April 2028, up from SEK 6.5 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting SEK10.4 billion in earnings, and the most bearish expecting SEK7.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.6x on those 2028 earnings, up from 12.7x today. This future PE is lower than the current PE for the GB Machinery industry at 21.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.16%, as per the Simply Wall St company report.

AB SKF Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing negative organic growth, with the company reporting declines for six consecutive quarters, poses risks to future revenue and profitability, particularly as they have not been able to fully mitigate these effects with volume declines impacting fixed cost absorption.

- The separation of the industrial and automotive businesses involves planning and preparations, which can incur significant costs and potential disruptions, possibly impacting net margins and earnings.

- Destocking in China and fluctuations in industrial distributions, as reported in several regions, introduce variability and risks to revenue stability and inventory management.

- The automotive sector is experiencing significant negative organic growth and reduced output from OEMs, especially in Europe, which challenges revenue and the ability to maintain net margins in this segment.

- FX headwinds, primarily from the Turkish lira and the euro, have had a negative impact on margins, further contributing to the unpredictability of earnings and profit levels.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK235.312 for AB SKF based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK280.0, and the most bearish reporting a price target of just SEK190.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK104.8 billion, earnings will come to SEK8.8 billion, and it would be trading on a PE ratio of 14.6x, assuming you use a discount rate of 6.2%.

- Given the current share price of SEK180.55, the analyst price target of SEK235.31 is 23.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.