Key Takeaways

- Strategic focus on profitable markets and digitalization initiatives are set to enhance revenue by optimizing resources and eliminating unprofitable operations.

- Strong order backlog and emphasis on sustainability and talent development position Netel for growth in expanding markets and boost competitive advantage.

- Operational strain from Finnish divestment, declining telecom profitability, and competition may impact financial stability, revenue consistency, and cash flow, hindering growth opportunities.

Catalysts

About Netel Holding- Provides construction and maintenance services for communication infrastructure and power networks in Sweden, Norway, Finland, Germany, and the United Kingdom.

- The decision to sell loss-making operations in Finland allows Netel to focus on more profitable segments like Power, Telecom, and Infraservices in higher potential markets (Sweden, Norway, Germany, and the UK). This strategic realignment is expected to improve revenue by concentrating resources on growth markets and enhancing profitability through the elimination of operational losses in Finland.

- The enhancement of internal efficiencies and operational excellence, including digitalization initiatives and the deployment of new business systems, is projected to improve Netel's earnings by optimizing resource allocation and supporting better project management.

- Netel's strong order backlog, driven by new large contracts with clients like Telenor and UGG, signals a promising outlook for future revenue growth, particularly in the Power and Telecom divisions, which are positioned in fast-growing markets like Germany.

- The focus on sustainability and collaboration with clients to create a more sustainable and emission-free society strengthens Netel's competitive advantage, potentially attracting more business from environmentally-conscious clients, which could boost revenues and improve margins as sustainable projects often have favorable terms.

- Efforts to secure and develop talent to support growth across geographic areas and customer segments are crucial. This focus on talent development is expected to enhance operational efficiency and drive revenue growth by leveraging strong customer relationships and expanding into new market segments.

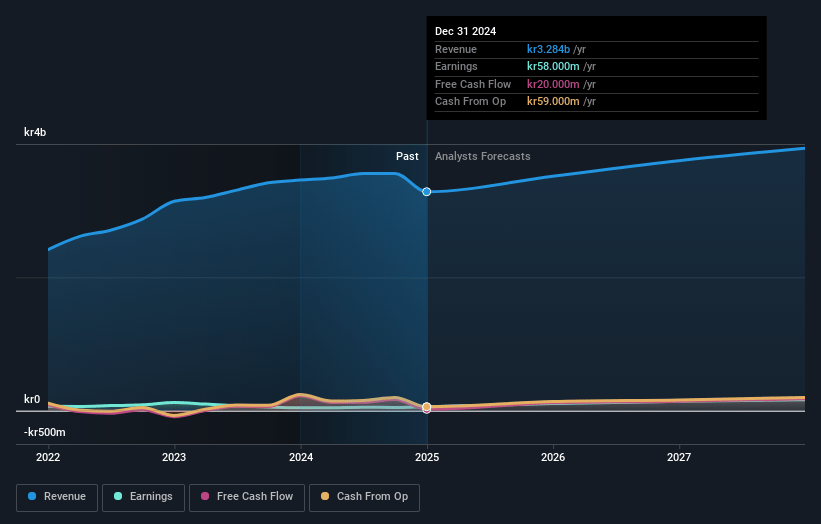

Netel Holding Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Netel Holding's revenue will grow by 6.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.8% today to 4.2% in 3 years time.

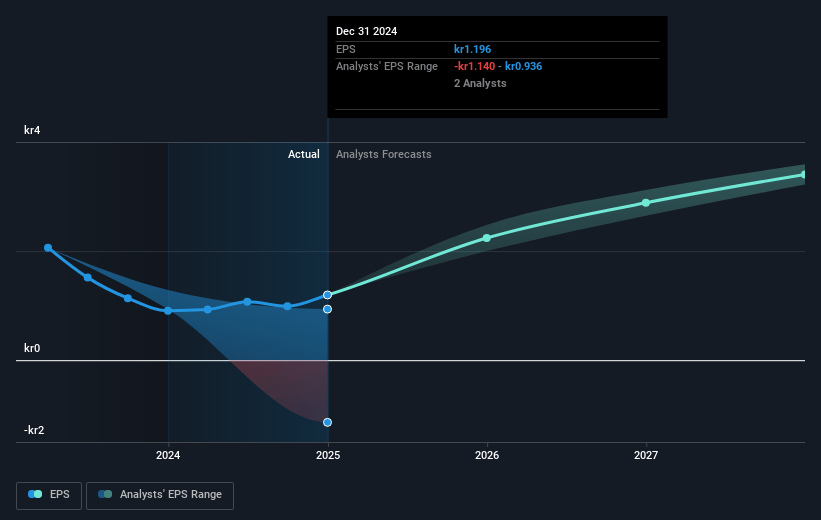

- Analysts expect earnings to reach SEK 165.0 million (and earnings per share of SEK 3.4) by about March 2028, up from SEK 58.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.5x on those 2028 earnings, down from 10.4x today. This future PE is lower than the current PE for the SE Construction industry at 20.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.78%, as per the Simply Wall St company report.

Netel Holding Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The divestment of Finnish operations is due to historically poor performance, resulting in a net loss and negative cash flow, which impacts the overall financial health and might strain resources until the sale is completed in 2025. This could impact earnings and financial stability.

- Telecom division profitability has declined, notably impacted by lower volumes in the U.K., and maintaining margin improvement amidst competitive service contracts remains challenging, which could affect long-term profit margins.

- The heavy reliance on large contracts, especially in Telecom and Power, means any fluctuations or delays in project completions can significantly impact revenue and profitability from quarter to quarter.

- The Infraservices division is facing heightened market competition, putting pressure on profit margins and possibly leading to lower-than-expected improvements in profitability, impacting overall net margins.

- Cash flow is a concern due to working capital needs and recent exit costs from Finland. Despite growth in the order backlog, operating cash flows are strained, which could impact the company's ability to invest in further growth or acquisitions.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK22.0 for Netel Holding based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK3.9 billion, earnings will come to SEK165.0 million, and it would be trading on a PE ratio of 8.5x, assuming you use a discount rate of 9.8%.

- Given the current share price of SEK12.38, the analyst price target of SEK22.0 is 43.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.