Key Takeaways

- Strategic focus on defense sector may drive growth but poses risks of revenue volatility if defense spending fluctuates.

- Acquisition of German firm roda expands European market access, but integration risks could affect net margins and operational stability.

- Strong performance with record order intake and strategic focus on defense sector aligns with market trends, boosting revenue potential and profitability.

Catalysts

About MilDef Group- Through its subsidiaries, develops, manufactures, and sells rugged IT solutions in Sweden, Norway, Finland, Denmark, the United Kingdom, Germany, Switzerland, the United States, Australia, and internationally.

- The company has made a strategic decision to focus fully on the defense sector, anticipating strong demand in this area. While this could drive future revenue growth, investors might fear over-exposure to a single sector could lead to volatility if defense spending fluctuates. This could impact future revenue stability.

- MilDef’s acquisition of the German company, roda, is designed to expand their market access in Central Europe. While this expands their geographic footprint, integration risks and failure to realize synergies could negatively impact net margins if costs rise unexpectedly.

- The transformation into a leading pan-European player within tactical and rugged IT through the roda acquisition contains execution risks that could strain operational margins if the integration is not handled efficiently and synergies aren’t realized quickly.

- Their reliance on continued strong order intake, especially from the Nordic and European defense sectors, may expose them to risks if defense budgets are reallocated. Investors might anticipate future order fluctuations to impact earnings consistency.

- A direct share issue raised significant capital (SEK 500 million) for the roda acquisition, potentially leading to shareholder dilution which might weigh down future EPS if growth does not exceed expectations.

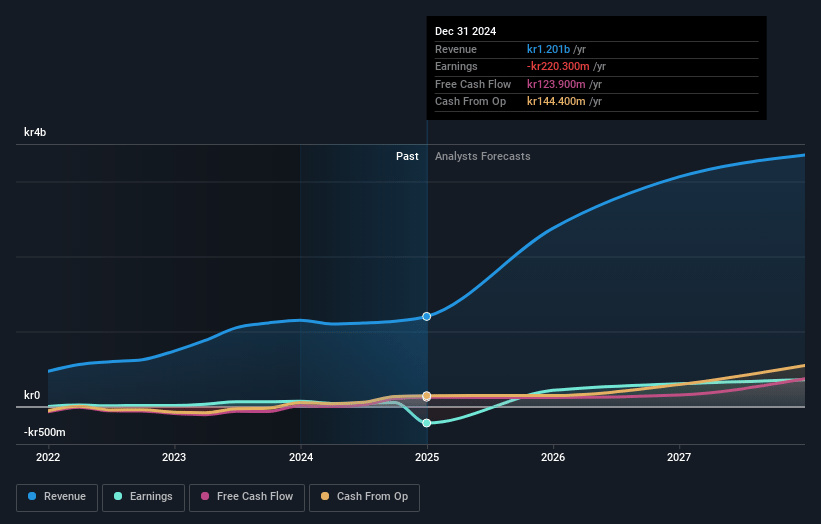

MilDef Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming MilDef Group's revenue will grow by 40.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from -18.3% today to 10.6% in 3 years time.

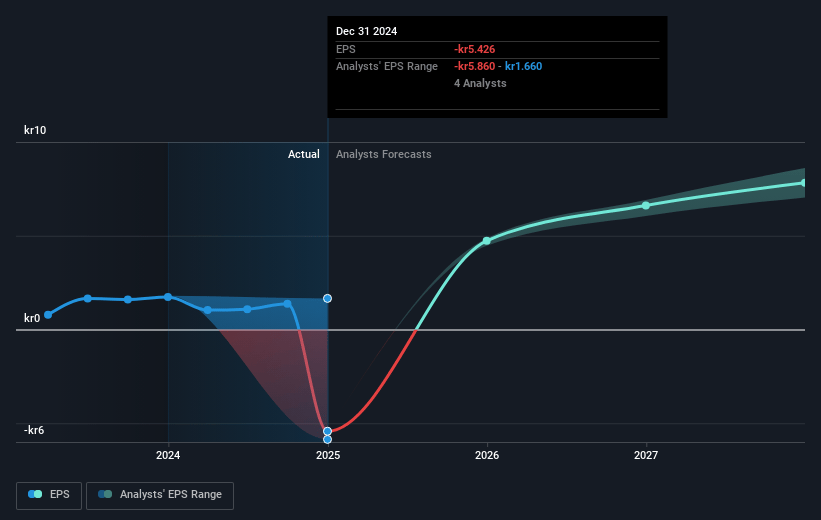

- Analysts expect earnings to reach SEK 357.0 million (and earnings per share of SEK 7.7) by about March 2028, up from SEK -220.3 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting SEK393 million in earnings, and the most bearish expecting SEK321.0 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 30.5x on those 2028 earnings, up from -43.1x today. This future PE is lower than the current PE for the SE Aerospace & Defense industry at 43.7x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.98%, as per the Simply Wall St company report.

MilDef Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- MilDef has achieved a record-high order intake exceeding SEK 700 million and record-high net sales, suggesting strong demand and potential for revenue growth.

- The company reported a stable development of operating expenses (OpEx) with only a 5% increase compared to the prior year, indicating potential for improved net margins through operational efficiency.

- MilDef's book-to-bill ratio is 1.5 on a rolling 12-month basis, indicating a robust pipeline and the potential for sustained revenue growth in the future.

- The acquisition of the German company, roda, opens up Central Europe for future growth and provides synergy potential, which could positively impact revenue and profitability.

- The strategic decision to focus fully on the defense sector aligns with increased defense spending in MilDef's core markets, potentially driving revenue and supporting long-term growth prospects.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK170.833 for MilDef Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK217.5, and the most bearish reporting a price target of just SEK125.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK3.4 billion, earnings will come to SEK357.0 million, and it would be trading on a PE ratio of 30.5x, assuming you use a discount rate of 5.0%.

- Given the current share price of SEK208.5, the analyst price target of SEK170.83 is 22.0% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.