Key Takeaways

- Strategic acquisitions and financial flexibility are key drivers of Lifco's growth, boosting both organic and inorganic expansion.

- Efficient cash flow and inventory management aid profitability, enhancing operational efficiencies and supporting future dividend growth.

- Lifco faces potential revenue and earnings challenges due to weak market conditions, slow growth in segments, extra costs, and risks with acquisition strategies.

Catalysts

About Lifco- Engages in the dental, demolition and tools, and systems solutions businesses in Sweden, Norway, Germany, rest of Europe, the United Kingdom, Asia, Australia, Italy, North America, and internationally.

- Lifco's commitment to pursuing strategic acquisitions, particularly in high-margin sectors, is expected to drive future revenue growth. These acquisitions are crucial catalysts for enhancing Lifco's organic and inorganic growth rates, positively impacting their earnings.

- The potential improvement in the Demolition & Tools segment, contingent on market recovery, could result in enhanced operational leverage and higher EBITA margins. When construction markets stabilize, Lifco could see significant margin improvements, boosting overall profitability.

- System Solutions' strong performance, partially driven by the contract manufacturing sub-segment, indicates potential for sustained revenue and earnings growth. As this business area benefits from niche strengths and favorable market conditions, Lifco's overall margins could improve.

- Lifco's focus on maintaining flexible financial management and cash flow efficiency allows the company to capitalize on strategic opportunities and potential buybacks, which could improve earnings per share (EPS) in the future.

- The company's strategy to reduce inventory levels in the face of fluctuating market conditions aids in improving free cash flow. This disciplined cash flow management can contribute positively to operational efficiencies and future dividend growth, impacting net margins favorably.

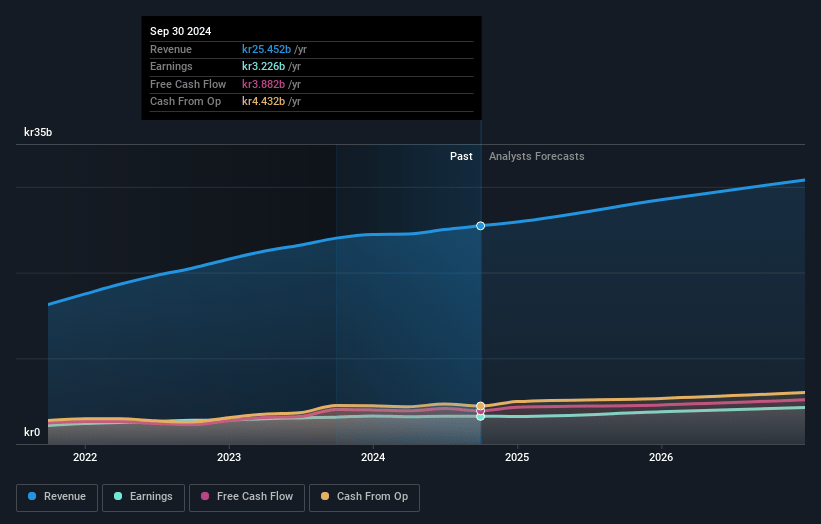

Lifco Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Lifco's revenue will grow by 11.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 12.6% today to 14.2% in 3 years time.

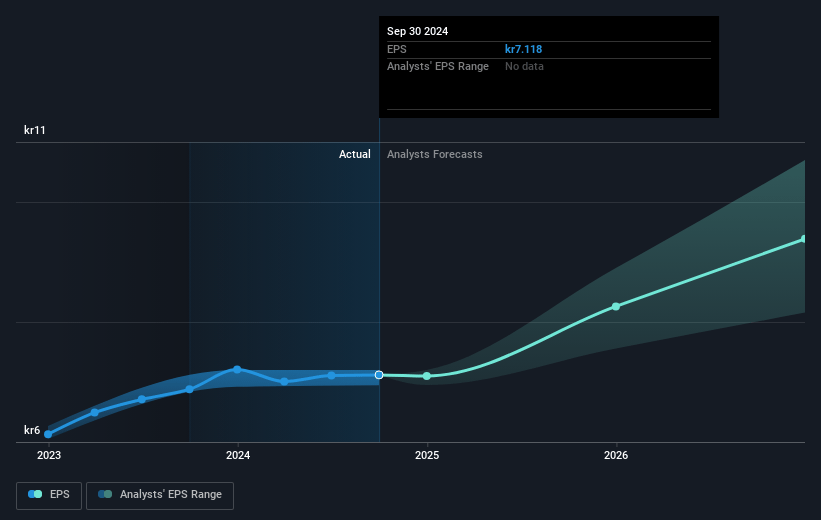

- Analysts expect earnings to reach SEK 5.1 billion (and earnings per share of SEK 10.82) by about March 2028, up from SEK 3.3 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as SEK4.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 39.6x on those 2028 earnings, down from 48.6x today. This future PE is greater than the current PE for the GB Industrials industry at 33.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.38%, as per the Simply Wall St company report.

Lifco Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Lifco's Demolition & Tools division is experiencing ongoing weak market conditions, leading to negative organic sales and presenting challenges in maintaining profit levels due to the high margin characteristics of the business. This could negatively impact overall revenue and earnings if the market does not recover soon.

- The Dental business area has been facing long-term slow growth in distribution markets and slight declines in margins, which could dampen future revenue growth and net margins in that division.

- There are mentions of temporary extra costs and possible inventory write-downs which, if persistent, may indicate inefficiencies or other operational challenges, potentially impacting earnings and margins negatively.

- Lifco's cash flow growth has been described as 'moderate,' indicating that despite strong historical performance, the company may face challenges in generating cash flow, which is crucial for sustaining future investment and dividend growth.

- The company's reliance on acquisitions to drive growth carries inherent risks, such as overpaying for acquisitions or integrating them ineffectively, which could jeopardize future revenue and earnings if not managed well.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK383.667 for Lifco based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK425.0, and the most bearish reporting a price target of just SEK306.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK36.2 billion, earnings will come to SEK5.1 billion, and it would be trading on a PE ratio of 39.6x, assuming you use a discount rate of 5.4%.

- Given the current share price of SEK353.4, the analyst price target of SEK383.67 is 7.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives