Key Takeaways

- Significant R&D spending could pressure net margins unless new products are launched and generate revenue quickly.

- Growing market potential presents opportunities, but reliance on defense budgets and geopolitical factors introduces revenue growth uncertainty.

- Strong market demand and strategic acquisitions, such as UltraLynx, enhance growth opportunities, while smart collaborations and innovation bolster revenue diversification and stability.

Catalysts

About Invisio- Develops and sells communication and hearing protection systems for professionals in the defense, law enforcement, and security sectors in Sweden, Europe, North America, and internationally.

- The acquisition of the UltraLynx product line is seen as a potential new growth opportunity, but significant revenues from this acquisition are not expected until 2026 and onwards. This delay may result in a slower incorporation of expected growth into revenue, affecting near-term financial expectations.

- The anticipation of a higher amount of depreciation in 2025, due to large projects being terminated and ready for sales, suggests escalating costs that could pressure net margins until these projects start generating revenue.

- Invisio's increased spending on research and development (R&D), which is approximately 15% of revenues, may impact net margins if these investments do not quickly translate into successful product launches and subsequent revenue streams.

- The broadening of Invisio's addressable market from SEK 14 billion to SEK 25 billion suggests potential for revenue growth, but this relies heavily on market conditions and successful execution, which may lead to volatile earnings if expectations are not met.

- The changing geopolitical environment and trends in digitalization may increase demand but also inject uncertainty, as Invisio's growth is partially reliant on defense budgets and modernization programs, which are unpredictable and could impact future revenue growth expectations.

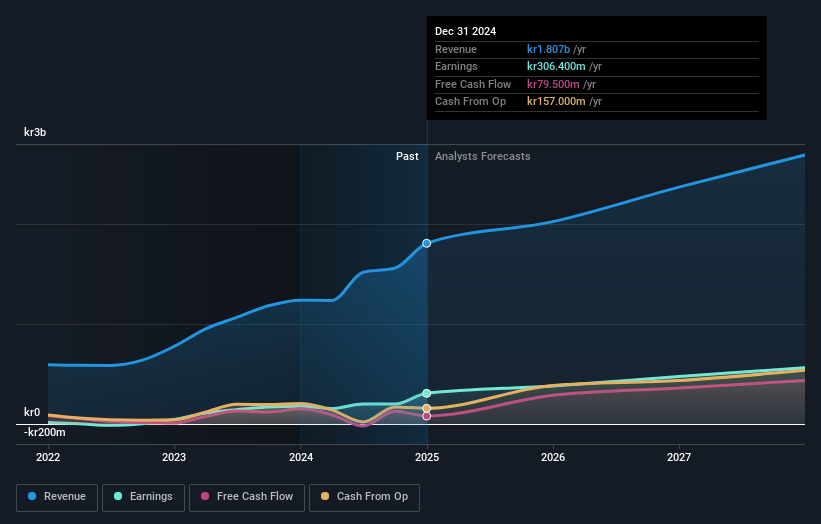

Invisio Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Invisio's revenue will grow by 14.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 17.0% today to 20.9% in 3 years time.

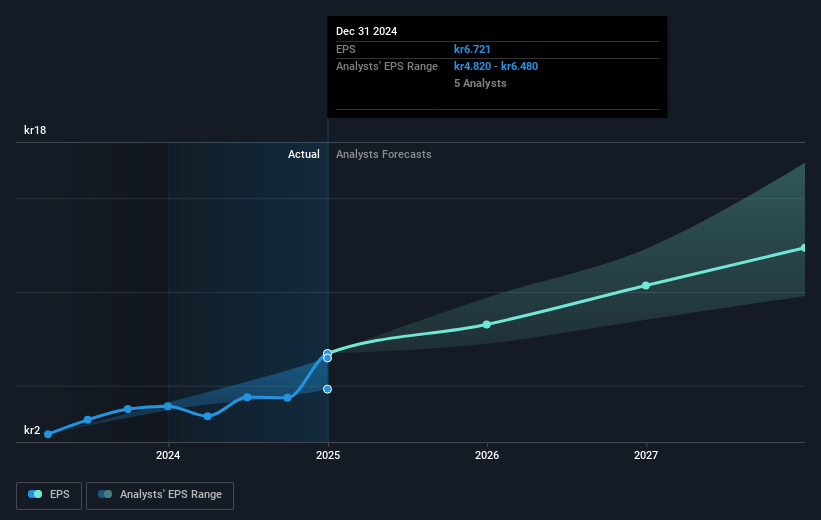

- Analysts expect earnings to reach SEK 563.7 million (and earnings per share of SEK 12.36) by about March 2028, up from SEK 306.4 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting SEK771 million in earnings, and the most bearish expecting SEK447 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 33.0x on those 2028 earnings, down from 62.0x today. This future PE is lower than the current PE for the GB Aerospace & Defense industry at 43.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.95%, as per the Simply Wall St company report.

Invisio Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Invisio has demonstrated record-breaking financial performance, with a significant increase in revenue and order intake in 2024, indicating strong market demand and potentially stabilizing future revenues.

- The company's acquisition of UltraLynx presents a new growth opportunity with a promising product line in the modern soldier systems market, which could positively impact future earnings.

- Invisio has managed to maintain strong gross margins and EBIT margins, supported by its agile business model and ability to respond quickly to customer needs, suggesting stable net margins.

- The expansion in addressable market estimates and continued investment in R&D suggest potential long-term revenue growth through product innovation and a larger customer base.

- Strategic collaborations, such as with the U.S. Defense Innovation Unit, and the introduction of new products like Invisio Link, could lead to higher sales and further diversification of revenue streams.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK357.5 for Invisio based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK400.0, and the most bearish reporting a price target of just SEK295.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK2.7 billion, earnings will come to SEK563.7 million, and it would be trading on a PE ratio of 33.0x, assuming you use a discount rate of 4.9%.

- Given the current share price of SEK421.5, the analyst price target of SEK357.5 is 17.9% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.