Key Takeaways

- Production consolidation to Växjö and Poland is set to enhance efficiency and cut costs, improving net margins and earnings.

- Strategic investments in local design and the maritime resurgence could drive revenue growth in key markets.

- Project delays and competitive challenges in Scandinavia negatively impact revenue and cash flow, while increased debt signals potential financial strain despite refinancing efforts.

Catalysts

About Balco Group- Engages in developing, manufacturing, selling, and installing balcony systems for tenant-owner associations, private landlords, municipal housing, architects, builders, and shipping companies.

- The consolidation of production facilities to Växjö and Poland is expected to improve production efficiency and reduce costs, providing annual savings of approximately SEK 60 million, positively impacting net margins and earnings.

- Increased customer activity in the renovation segment, particularly in Sweden and Norway, along with a rebound in the Finnish new build market, is expected to boost future revenue growth.

- The strategic investment in local design resources for the New Build segment, especially in the U.K. and Germany, aims to increase competitiveness and win more projects, potentially driving revenue increases.

- The maritime segment has reopened, with new ship orders at shipyards, which could lead to increased project opportunities and revenue growth in this sector.

- The extended banking agreement with Danske Bank, offering a sustainability-linked credit facility, secures liquidity and financial stability, supporting future operations and potentially reducing interest expenses and improving net margins.

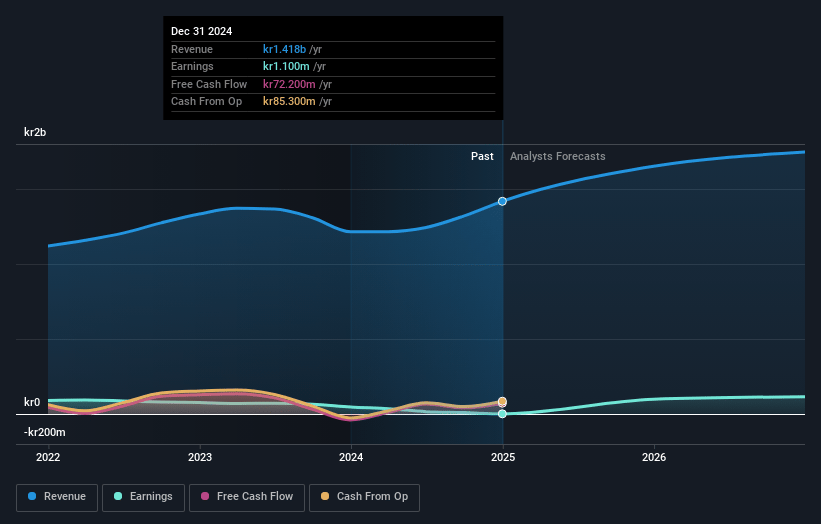

Balco Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Balco Group's revenue will grow by 14.1% annually over the next 3 years.

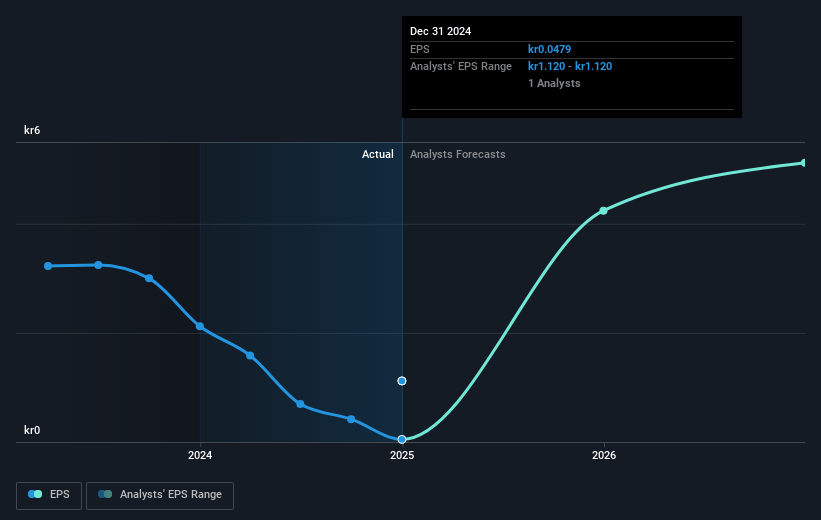

- Analysts assume that profit margins will increase from -2.0% today to 19.1% in 3 years time.

- Analysts expect earnings to reach SEK 399.3 million (and earnings per share of SEK 17.59) by about May 2028, up from SEK -28.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 4.2x on those 2028 earnings, up from -19.1x today. This future PE is lower than the current PE for the SE Building industry at 21.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.7%, as per the Simply Wall St company report.

Balco Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Delays in processes, such as permission and new-build project delays in Sweden, UK, and Finland, have negatively impacted both revenue and cash flow, leading to a weak adjusted EBITA margin of -0.9%.

- Overcapacity in production, due to project delays, has led to inefficiencies and increased costs that cannot be compensated for in the short term, affecting net margins.

- Weaker order intake compared to the previous year, particularly in Denmark, suggests potential challenges in maintaining revenue growth, as the order intake for the quarter was SEK 275 million, down from SEK 352 million.

- Strain in competitive situations for Danish and Swedish facade companies and hesitant consumer behavior in Denmark could impact revenue and growth in these markets.

- An increased net debt-to-adjusted EBITDA ratio of 4.0, up from 3.2, reflects potential financial strain and risks to earnings, despite refinancing efforts and a sustainability-linked credit facility.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK58.0 for Balco Group based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK2.1 billion, earnings will come to SEK399.3 million, and it would be trading on a PE ratio of 4.2x, assuming you use a discount rate of 7.7%.

- Given the current share price of SEK23.9, the analyst price target of SEK58.0 is 58.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.