Key Takeaways

- Launching ReCare is expected to boost revenue and capture market share in Scandinavia with competitive service offerings.

- Integration of Batterilagret and Finnish turnaround efforts are anticipated to drive growth and improve profitability through cost efficiencies.

- Decreased organic growth, profitability struggles, high rental costs, and inventory issues could strain liquidity and challenge revenue growth and margin targets.

Catalysts

About Alligo- Offers workwear, personal protection equipment, tools, and consumables in Sweden, Norway, and Finland.

- The launch of ReCare is anticipated to significantly enhance future revenue by offering a competitive service package at attractive price points, potentially capturing market share and increasing customer base in Sweden, Norway, and Finland.

- The integration of Batterilagret, expanding the number of stores and enhancing the product offering, is expected to drive revenue growth through increased sales in the battery segment, particularly benefiting from seasonal demand peaks.

- The Finnish turnaround project aims to improve profitability by addressing the Tools business' challenges, which could contribute to higher net margins as cost reduction and efficiency measures take effect.

- Targeted cost reductions totaling SEK 100 million are projected to improve efficiencies and reduce expenses, thus helping to protect net margins and improve overall earnings.

- The increased share of own brands and strategic procurement from China could enhance gross margins, resulting in cost savings and increased profitability, aided by favorable dollar exchange rates.

Alligo Future Earnings and Revenue Growth

Assumptions

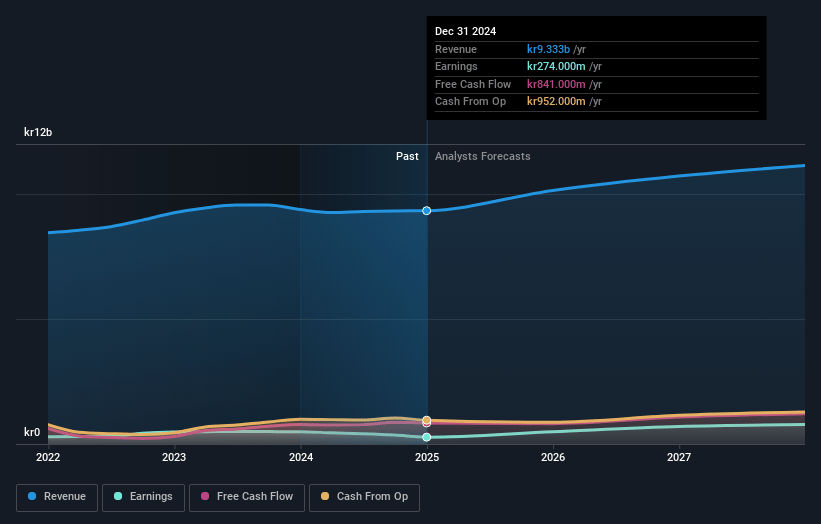

How have these above catalysts been quantified?- Analysts are assuming Alligo's revenue will grow by 5.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.8% today to 7.6% in 3 years time.

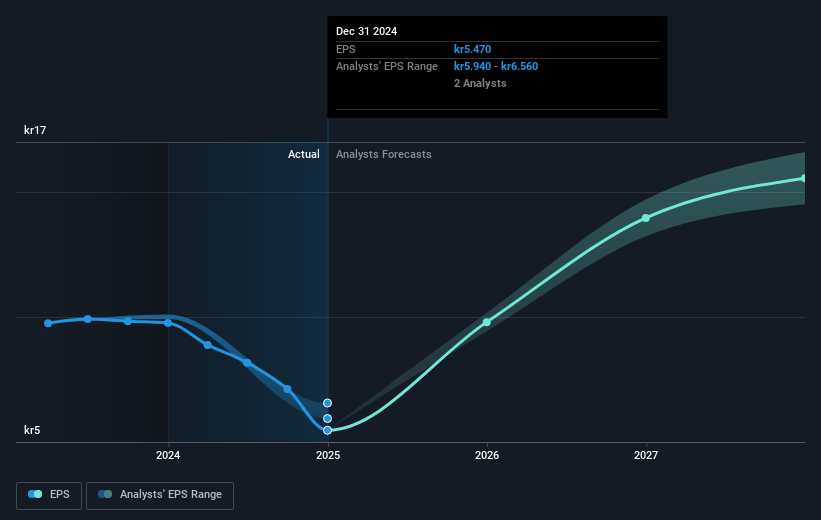

- Analysts expect earnings to reach SEK 842.0 million (and earnings per share of SEK 13.67) by about May 2028, up from SEK 268.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.0x on those 2028 earnings, down from 20.6x today. This future PE is lower than the current PE for the GB Trade Distributors industry at 31.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.22%, as per the Simply Wall St company report.

Alligo Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- A decrease in organic growth and weak demand, particularly in Sweden, may indicate potential challenges in maintaining revenue growth without relying on acquisitions.

- A notable struggle to maintain profitability in the Finnish branch of the Tools business, which targets only a 5% profitability, might adversely impact overall net margins.

- High dependence on rental costs, with an approximate SEK 0.5 billion in shop rental expenses, limits flexibility in cost reduction, potentially pressuring earnings if revenue growth does not materialize.

- Increased inventory levels, coupled with temporary invoicing issues in Norway, are negatively affecting cash flow. Persistent challenges in optimizing working capital could strain liquidity and profitability.

- The shift towards increased acquisitions with lower gross margins might dilute overall group margins, putting pressure on achieving the strategic target of 10% EBITDA margin.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK150.0 for Alligo based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK11.1 billion, earnings will come to SEK842.0 million, and it would be trading on a PE ratio of 11.0x, assuming you use a discount rate of 7.2%.

- Given the current share price of SEK110.2, the analyst price target of SEK150.0 is 26.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.