Key Takeaways

- Aggressive capital expansion and acquisitions expose Ma’aden to heightened execution, cost, and leverage risks that could constrain earnings and financial flexibility.

- Overly optimistic growth assumptions and increasing regulatory, market, and environmental pressures may limit profitability, despite favorable commodity trends.

- Strong demand for critical minerals, operational efficiency, capacity expansions, prudent debt management, and exploration efforts position Ma'aden for resilient growth and diversified revenue.

Catalysts

About Saudi Arabian Mining Company (Ma'aden)- Operates as a mining and metals company in the Kingdom of Saudi Arabia, India, Pakistan, Bangladesh, Singapore, Korea, the United States, Europe, Australia, Brazil, Africa, GCC, and internationally.

- Current valuations may be assuming a prolonged continuation of the recent surge in commodity prices—especially for phosphate, aluminum, and gold—despite the risk that rising global supply (e.g., higher bauxite and alumina availability) and cyclical corrections could normalize prices, pressuring revenue and EBITDA growth.

- The significant multi-year capital expansion program (such as Phosphate 3 and aluminum capacity/recycling projects), while critical for scale, exposes Ma’aden to elevated execution and cost overrun risks; if demand growth for critical minerals and fertilizers slows or projects are delayed, anticipated earnings and margin expansion may not materialize as expected.

- Investor optimism about Ma’aden’s exposure to the growing global energy transition and food security efforts may be overly aggressive, as long-term demand for some commodity segments could be moderated by technological disruption, resource substitution, or increased recycling—potentially limiting top-line growth.

- Heightened international environmental standards and escalating regulatory scrutiny of mining operations can increase compliance and operating costs over time, possibly tightening net margins and affecting long-term profitability more than current valuations reflect.

- The company’s continued heavy capex spending and acquisition activity (such as the ALBA and Alcoa deals) has led to rising leverage and net debt; if cash flows soften or capital market conditions tighten (e.g., due to ESG scrutiny or geopolitical risks), this could pressure balance sheet strength and constrain future earnings growth.

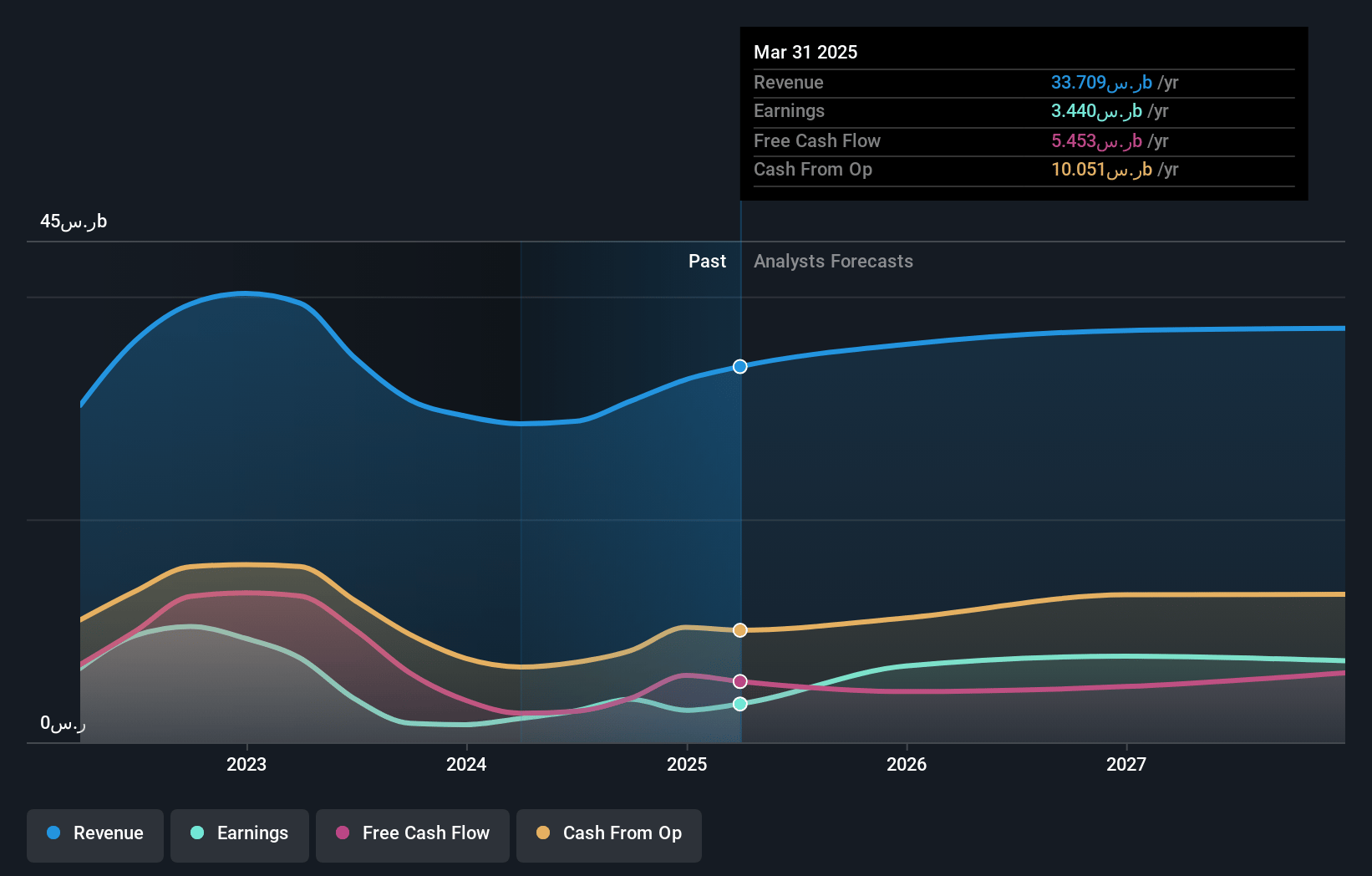

Saudi Arabian Mining Company (Ma'aden) Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Saudi Arabian Mining Company (Ma'aden)'s revenue will grow by 4.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.2% today to 23.5% in 3 years time.

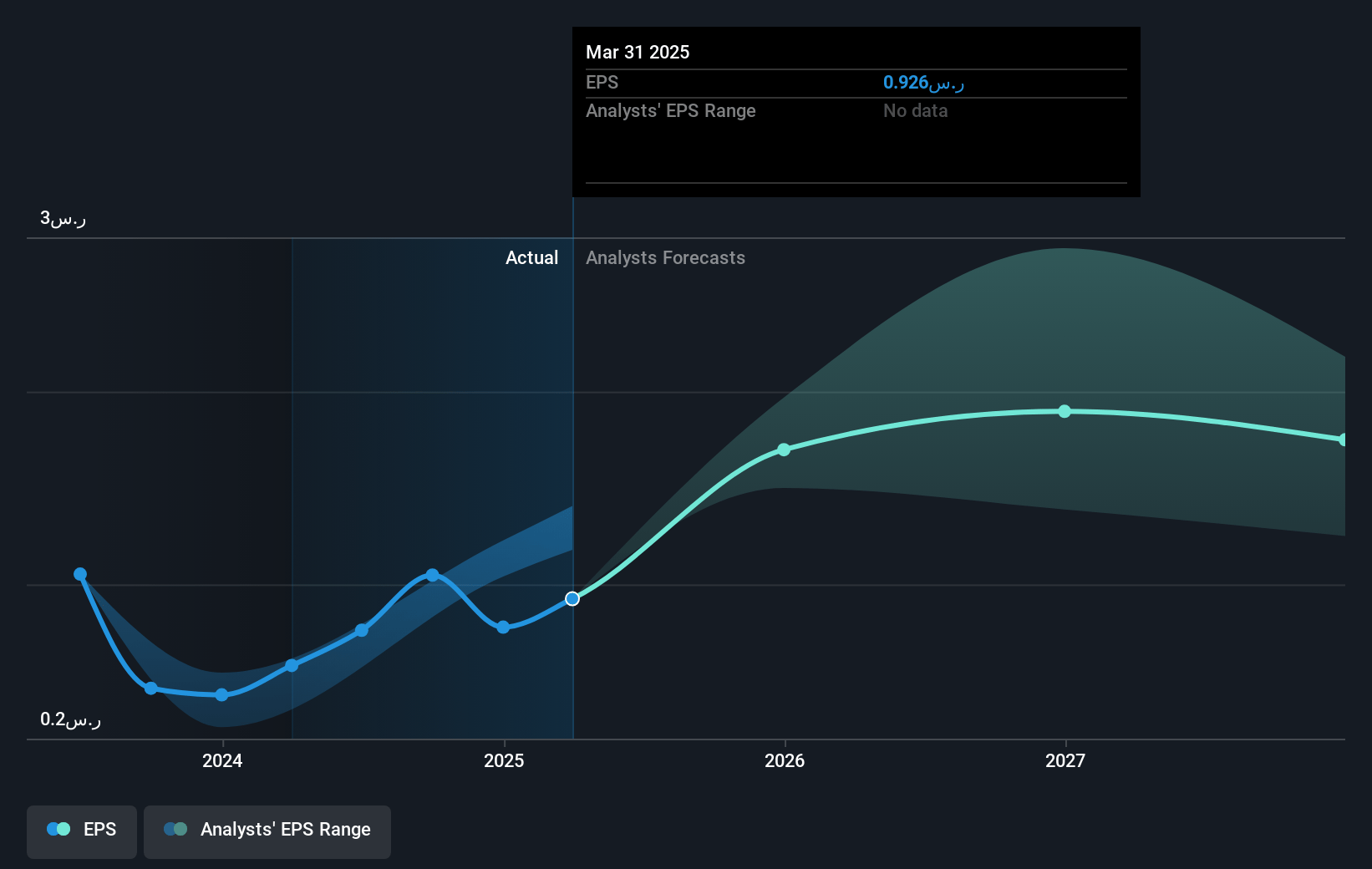

- Analysts expect earnings to reach SAR 9.0 billion (and earnings per share of SAR 1.74) by about July 2028, up from SAR 3.4 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 39.5x on those 2028 earnings, down from 61.5x today. This future PE is greater than the current PE for the SA Metals and Mining industry at 27.6x.

- Analysts expect the number of shares outstanding to grow by 2.89% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 20.08%, as per the Simply Wall St company report.

Saudi Arabian Mining Company (Ma'aden) Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained global demand for critical minerals—including phosphate, aluminum, and gold—driven by energy transition, food security priorities, and infrastructure development in emerging markets is likely to provide durable, long-term revenue growth and support elevated commodity prices, which could underpin Ma'aden’s top line and EBITDA.

- Ma'aden’s successful operational excellence initiatives—demonstrated by consistently improving production, safety, and efficiency—have so far produced significant cost reductions (SAR 3 billion realized), which management believes are sustainable and have further potential, supporting robust net margins and enhancing earnings resilience.

- Large-scale capacity expansions (Phosphate 3 project, increased stake in Wa'ad Al Shamal, planned Phase 2, and aluminum growth projects) are on track to materially boost sales volumes and global market share from 2027 onward, enabling higher future revenue and EBITDA growth.

- The company’s disciplined management of debt—with a healthy net debt-to-EBITDA at 1.9x, access to oversubscribed international Sukuk markets, and a sizeable cash position—supports ongoing investments, reduces financial risk, and improves the ability to fund long-term growth without severely compressing earnings.

- Diversification into new minerals and expansion of exploration activities (including the Aramco critical minerals JV and gold/copper projects) provide upside optionality, helping Ma'aden respond to secular demand for strategic minerals and broadening future revenue streams, thus mitigating revenue volatility and supporting long-term financial stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SAR48.738 for Saudi Arabian Mining Company (Ma'aden) based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SAR58.0, and the most bearish reporting a price target of just SAR31.9.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SAR38.3 billion, earnings will come to SAR9.0 billion, and it would be trading on a PE ratio of 39.5x, assuming you use a discount rate of 20.1%.

- Given the current share price of SAR54.5, the analyst price target of SAR48.74 is 11.8% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.