Last Update04 Sep 25

With both the Future P/E and consensus revenue growth forecasts essentially unchanged, analysts have maintained their fair value estimate for Saudi Arabian Oil at SAR28.65.

What's in the News

- BlackRock is in discussions with Saudi Aramco to potentially sell its stake in Aramco’s natural-gas pipeline network back to the company, with alternative options being considered if an agreement is not reached.

Valuation Changes

Summary of Valuation Changes for Saudi Arabian Oil

- The Consensus Analyst Price Target remained effectively unchanged, at SAR28.65.

- The Future P/E for Saudi Arabian Oil remained effectively unchanged, moving only marginally from 29.43x to 29.77x.

- The Consensus Revenue Growth forecasts for Saudi Arabian Oil remained effectively unchanged, at -3.0% per annum.

Key Takeaways

- Increasing global energy demand and rapid production scalability strengthen revenue resilience, while downstream expansion helps diversify earnings and reduce volatility.

- Digitalization and cost efficiency initiatives lower operating costs, supporting free cash flow and enhancing long-term financial stability and shareholder returns.

- Dependence on oil and weak diversification efforts heighten vulnerability to market shifts, technological change, and transition risks, potentially curbing growth and undermining financial stability.

Catalysts

About Saudi Arabian Oil- Operates as an integrated energy and chemical company in the Kingdom of Saudi Arabia and internationally.

- Sustained growth in global energy demand, particularly from major emerging markets such as China, is supporting robust oil consumption and higher utilization of Aramco's core crude and downstream assets, indicating potential for stronger long-term revenue and cash flow growth.

- The company's ability to rapidly increase production using spare capacity-at minimal incremental cost-positions it to capitalize on tightening supply-demand balances resulting from underinvestment in non-OPEC sources, which supports both revenue resilience and stronger net margins during upcycles.

- Expanding downstream and petrochemicals integration (including liquids-to-chemicals projects and growth in major markets) is expected to enhance value capture across the supply chain, diversify earnings, and reduce earnings volatility, potentially driving higher and more stable margins.

- Company-wide digitalization and AI-driven operational efficiency programs are already providing significant cost savings and productivity improvements, which are expected to further lower operating costs, boost operating margins, and support free cash flow expansion over the coming years.

- Strong capital discipline, industry-low upstream production costs, and shareholder-friendly policies (such as a progressive dividend and high cash returns) enhance financial stability and total returns, potentially catalyzing a market re-rating and supporting higher long-term earnings and dividend sustainability.

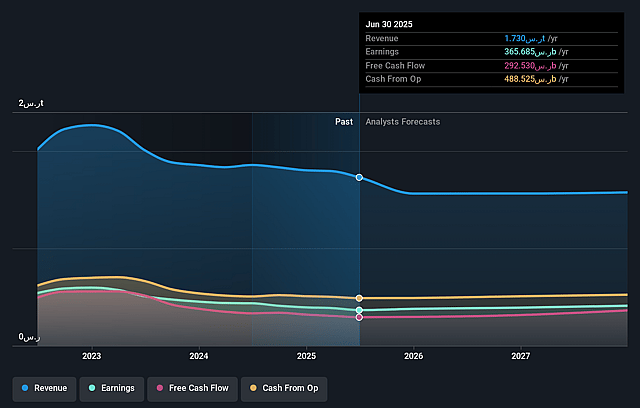

Saudi Arabian Oil Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Saudi Arabian Oil's revenue will decrease by 3.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 21.1% today to 25.3% in 3 years time.

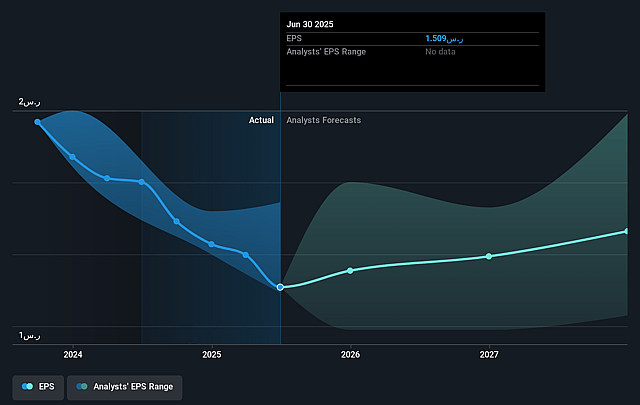

- Analysts expect earnings to reach SAR 400.0 billion (and earnings per share of SAR 1.63) by about September 2028, up from SAR 365.7 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting SAR481.6 billion in earnings, and the most bearish expecting SAR352.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 29.4x on those 2028 earnings, up from 15.6x today. This future PE is greater than the current PE for the SA Oil and Gas industry at 13.1x.

- Analysts expect the number of shares outstanding to grow by 0.25% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 19.03%, as per the Simply Wall St company report.

Saudi Arabian Oil Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Increasing reliance on a single commodity-crude oil-leaves Saudi Aramco's revenues and earnings highly vulnerable to secular demand shocks and price volatility, especially as the global energy transition accelerates and oil faces competition from renewables and electric vehicles.

- Downward pressure on long-term oil demand from the adoption of renewable energy, progress in battery technology, and rising electric vehicle market share could structurally reduce Aramco's addressable market, eventually eroding topline revenues and margin stability.

- Weak chemical margins and ongoing overcapacity in the petrochemicals sector pose a risk to downstream diversification efforts; persistent weakness here would undermine the strategy of using chemicals as a hedge against upstream volatility and could reduce net margins.

- High state ownership and the government's expectation for significant and growing dividends may constrain Aramco's ability to reinvest in future diversification, potentially limiting growth opportunities and exposing free cash flow and earnings to downside risk.

- Delays or inability to secure hydrogen offtake agreements and slower-than-expected progress in new energy projects (hydrogen, CCUS, renewables) increase exposure to transition risk and may leave the company vulnerable to stricter global climate policies, threatening future revenue streams and market access.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SAR28.647 for Saudi Arabian Oil based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SAR34.7, and the most bearish reporting a price target of just SAR25.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SAR1579.0 billion, earnings will come to SAR400.0 billion, and it would be trading on a PE ratio of 29.4x, assuming you use a discount rate of 19.0%.

- Given the current share price of SAR23.6, the analyst price target of SAR28.65 is 17.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.