Key Takeaways

- Alinma Bank's digital and SME growth initiatives aim to enhance customer engagement, improve net interest margins, and boost revenue and profitability.

- Focus on expanding treasury services and CASA deposits is set to increase non-interest income, lower funding costs, and improve operational efficiency.

- Intense competition and higher funding costs could impact profitability, while ambitious loan growth and dependency on external instruments may strain capital resources and liquidity.

Catalysts

About Alinma Bank- Provides banking and investment services in the Kingdom of Saudi Arabia.

- Alinma Bank is focusing on expanding its digital banking services and has launched several initiatives, such as the new API for open banking and a corporate portal, which are expected to enhance customer experience and could drive higher revenue through improved customer engagement and retention.

- The bank is actively targeting growth in the mid-corporate and SME segments, which is expected to improve its net interest margins as these segments typically offer higher yields compared to large corporate and project finance lending, hence potentially boosting earnings.

- Alinma Bank plans to continue its expansion in the treasury and foreign exchange services, including cash flow hedging and cross-selling financial products like FX forward contracts. These efforts are expected to contribute to increased non-interest income and thus strengthen overall revenue growth.

- The strategic focus on growing the CASA (Current Account Savings Account) deposits, which have grown by 20% year-on-year, is set to improve the bank’s cost of funding. This should result in better net interest margins and increase profitability.

- The bank's ongoing efforts to automate customer value management and introduce cash management solutions could further enhance operational efficiency, contributing to lower cost-to-income ratios and improving net margins.

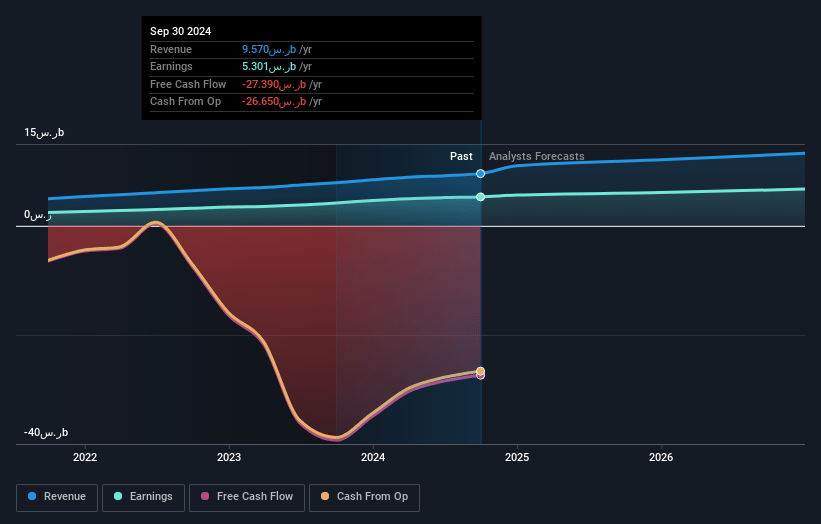

Alinma Bank Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Alinma Bank's revenue will grow by 13.7% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 55.7% today to 51.5% in 3 years time.

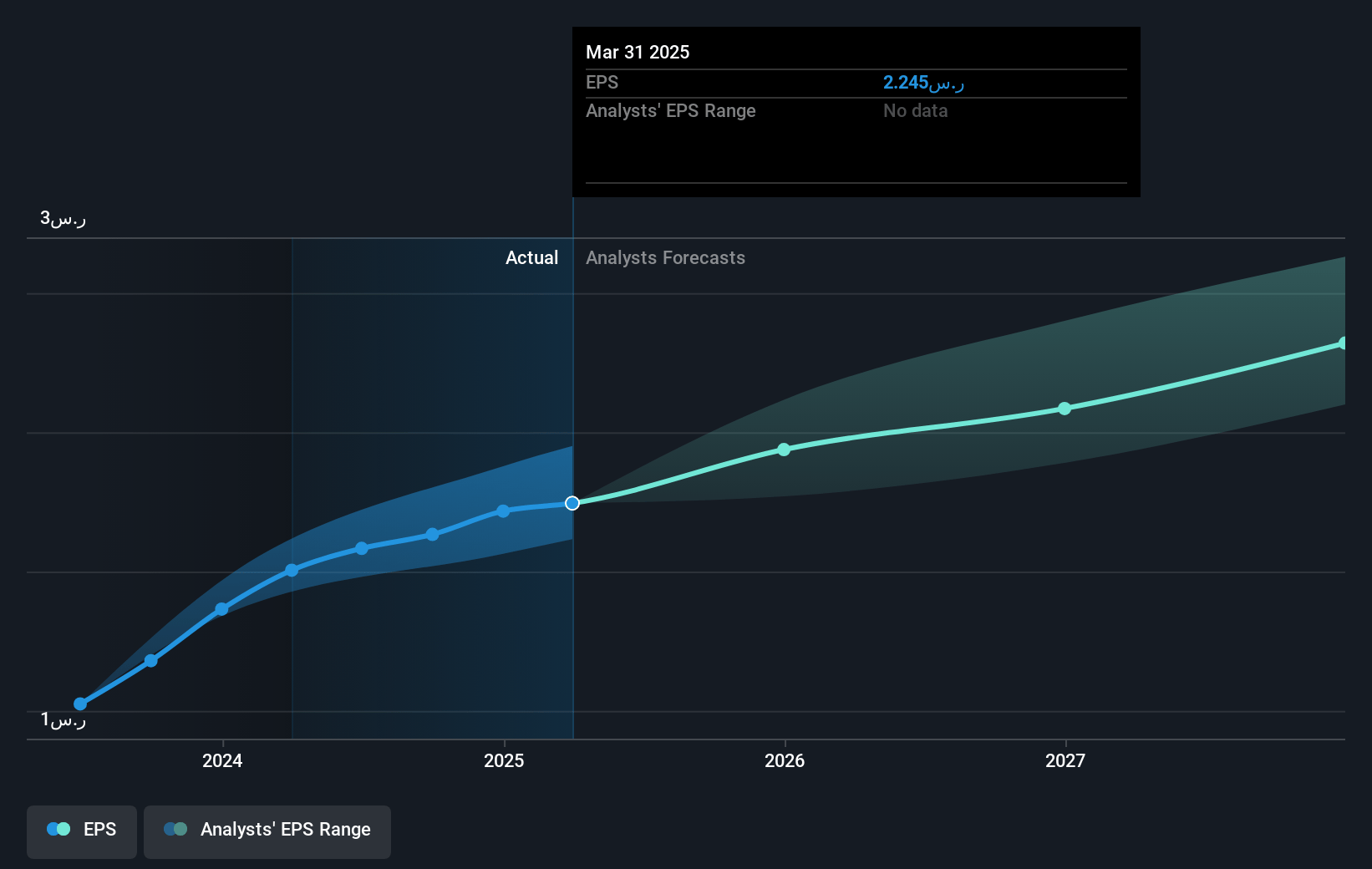

- Analysts expect earnings to reach SAR 7.5 billion (and earnings per share of SAR 2.92) by about May 2028, up from SAR 5.5 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as SAR8.3 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.1x on those 2028 earnings, up from 13.2x today. This future PE is greater than the current PE for the SA Banks industry at 10.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 20.01%, as per the Simply Wall St company report.

Alinma Bank Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The intense competition on customer deposits mentioned in the call has led to higher funding costs, potentially impacting net interest margins and profitability.

- With interest rates expected to decline, there is a risk of margin compression if the pace at which deposit costs decrease does not match the rate at which asset yields can be adjusted, impacting net earnings.

- The projected mid-teens loan growth, while ambitious, could strain capital resources and might not be sustainable without careful capital management, risking capital adequacy and affecting long-term profitability.

- Dependency on issuing Tier 1 instruments or Sukuk to manage funding and capital needs could become costlier if market conditions deteriorate or external borrowing costs increase, impacting liquidity and funding strategies.

- Project finance, although substantial in the portfolio, comes with higher risk weights for capital adequacy calculations, which could put pressure on capital ratios and limit the bank's ability to expand its lending book.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SAR34.771 for Alinma Bank based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SAR41.0, and the most bearish reporting a price target of just SAR31.4.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SAR14.5 billion, earnings will come to SAR7.5 billion, and it would be trading on a PE ratio of 20.1x, assuming you use a discount rate of 20.0%.

- Given the current share price of SAR29.0, the analyst price target of SAR34.77 is 16.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.