Key Takeaways

- Strategic projects and government backing for new units enhance earnings potential, operational efficiency, and financial stability through increased capacity and risk mitigation.

- Diversification into nuclear technology and medical isotopes aligns with sustainability and revenue growth, positioning the company as a leader in innovation.

- Declining electricity prices, rising costs, and reliance on government aid pose risks to Nuclearelectrica's profitability and project execution.

Catalysts

About S.N. Nuclearelectrica- Engages in the production and transmission of electricity and thermal energy in Romania.

- The signed Engineering, Procurement, and Construction Management (EPCM) contract for Units 3 and 4 is a key milestone, with completion expected around 2026. This project, backed by government support and expected investment decisions in 2027, could significantly boost future earnings through additional electricity generation capacity.

- The refurbishment of Cernavoda Unit 1, with a substantial contract valued at EUR 1.9 billion, is expected to enhance operational efficiency and extend the unit's life. This can potentially lead to increased revenue and improved net margins once the project is finalized.

- The Tritium Removal Facility Project, anticipated to be completed by 2027, positions Nuclearelectrica as a leader in nuclear technology. This initiative supports sustainability goals and can attract increased future investment, impacting financial assets positively.

- The medical isotope production project (Lutetium-177) in collaboration with Framatome, aimed for commercial application by 2028, taps into the lucrative medical segment. This diversification could significantly enhance revenue streams and net margins.

- Government-backed contributions and loan guarantees for new unit constructions provide financial security and reduce risk, which is likely to improve financial stability and investor confidence, bolstering long-term earnings potential.

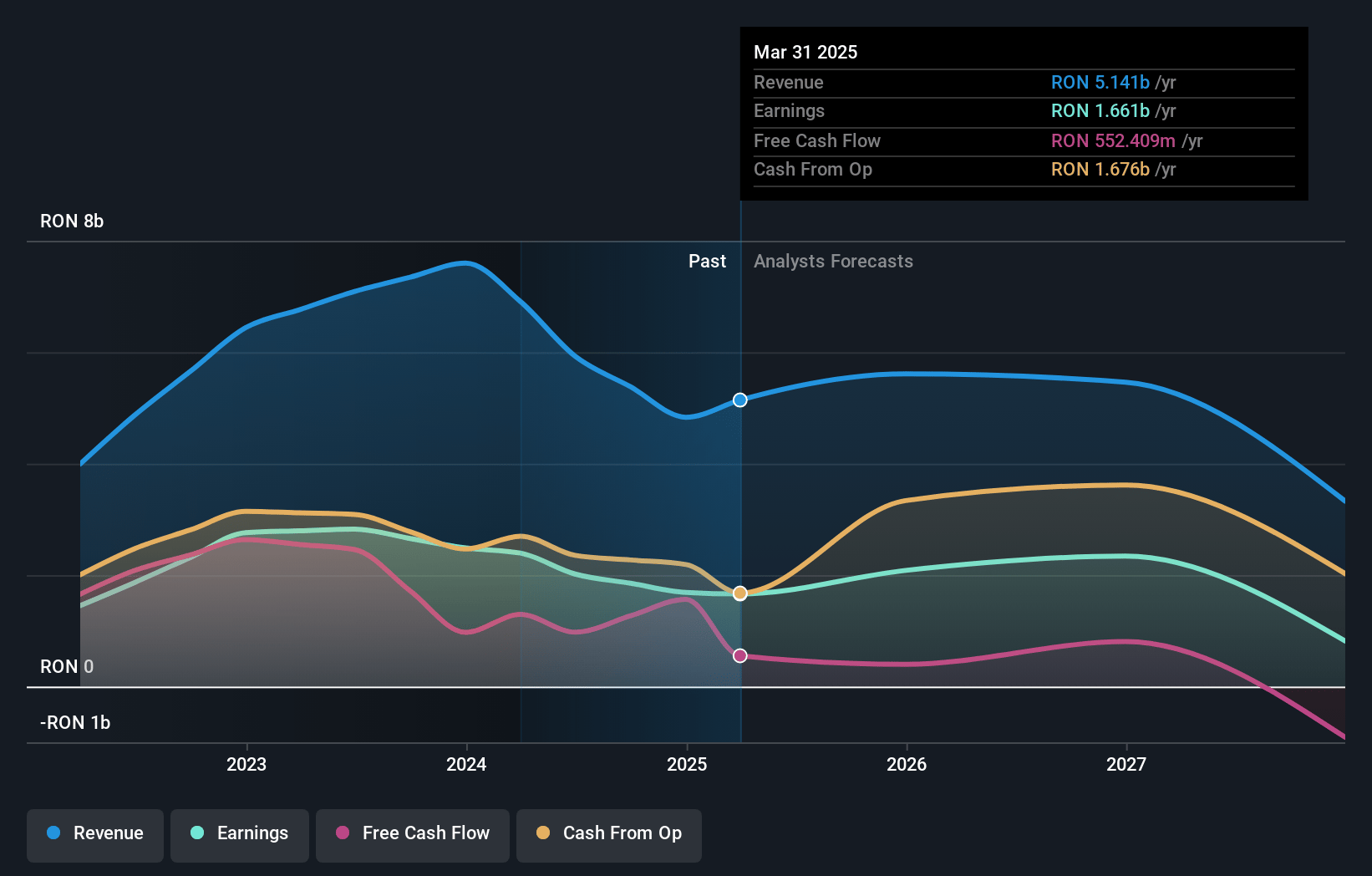

S.N. Nuclearelectrica Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming S.N. Nuclearelectrica's revenue will decrease by 18.8% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 34.7% today to 17.7% in 3 years time.

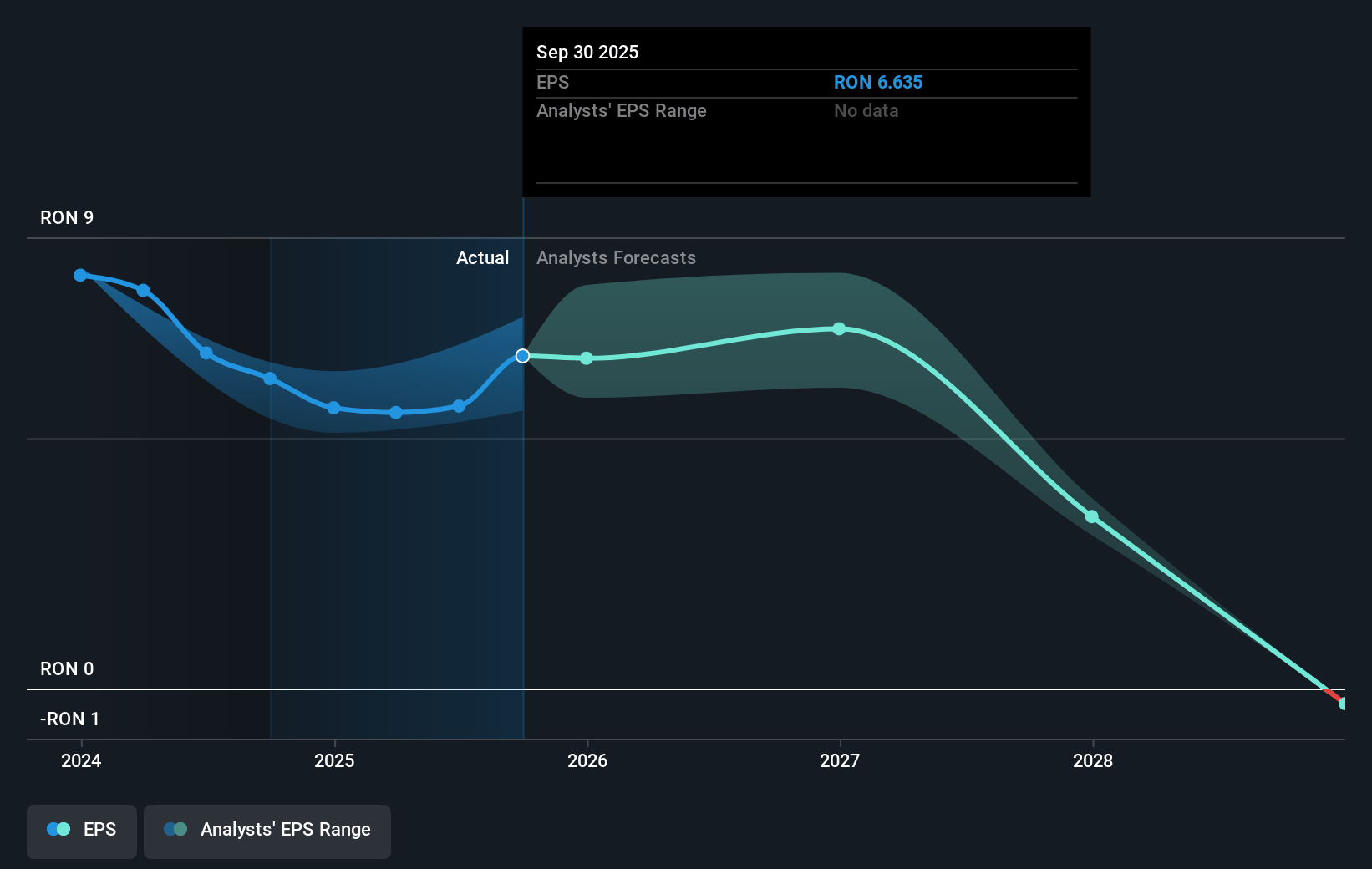

- Analysts expect earnings to reach RON 460.6 million (and earnings per share of RON 1.18) by about May 2028, down from RON 1.7 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting RON688 million in earnings, and the most bearish expecting RON75.8 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 41.5x on those 2028 earnings, up from 7.2x today. This future PE is greater than the current PE for the RO Electric Utilities industry at 7.2x.

- Analysts expect the number of shares outstanding to decline by 0.07% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.12%, as per the Simply Wall St company report.

S.N. Nuclearelectrica Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's revenue has been significantly impacted by a 37% decrease in average electricity prices in 2024 as compared to 2023, reflecting a decrease in revenue from electricity sales, which remains a critical part of Nuclearelectrica's earnings.

- Operational expenses (OpEx) have increased by 14.4% due to economic trends and inflation, which could further compress the company's net margins if these costs continue to rise disproportionate to revenue.

- A 32.4% increase in uranium fuel costs represents a growing expense due to commodity price increases, potentially leading to lower profitability and impacting net margins.

- The company's substantial increase in financial commitments and CapEx (capital expenditures) for significant projects like refurbishment of Unit 1 and construction of Units 3 and 4 could heavily affect cash flows and financial health, especially if there are delays or budget overruns, impacting net earnings.

- The reliance on government contributions and guarantees for projects introduces execution risk, particularly if political or economic conditions change, affecting the company's ability to complete these projects on time, thereby impacting future revenue streams and earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of RON45.235 for S.N. Nuclearelectrica based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of RON50.6, and the most bearish reporting a price target of just RON38.1.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be RON2.6 billion, earnings will come to RON460.6 million, and it would be trading on a PE ratio of 41.5x, assuming you use a discount rate of 12.1%.

- Given the current share price of RON40.5, the analyst price target of RON45.24 is 10.5% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.