Last Update 02 Dec 25

SNG: Upcoming Board Decisions Will Likely Weigh On Share Price Momentum

Analysts have modestly raised their price target on SNGN Romgaz, as ongoing improvements in projected revenue growth and profit margins support a recalibration of fair value to RON 7.26 per share.

What's in the News

- A Memorandum of Understanding was signed between Electrica and Romgaz to jointly develop renewable energy production and storage capacities of up to 400 MW. The partnership will focus exclusively on Greenfield projects and aims to create a dedicated investment vehicle (Key Developments).

- A Special/Extraordinary Shareholders Meeting is scheduled for October 20, 2025, to approve issuing a second tranche of notes under the EMTN Program, authorize trading on regulated markets, and empower the Board of Directors with related tasks (Key Developments).

- A subsequent Special/Extraordinary Shareholders Meeting will be held on November 11, 2025, focusing on the revocation and election of interim board members, mandate terms, and other business items (Key Developments).

- An additional Special/Extraordinary Shareholders Meeting is planned for December 18, 2025, at the company’s Bucharest location (Key Developments).

Valuation Changes

- Fair Value: Consensus analyst price target remains unchanged at RON 7.26 per share.

- Discount Rate: No change and holding steady at 12.43%.

- Revenue Growth: Projected revenue growth has risen moderately from 13.67% to 15.32%.

- Net Profit Margin: Forecasted net profit margin has increased slightly from 34.85% to 35.55%.

- Future P/E: The expected future price-to-earnings ratio has fallen from 9.38x to 8.73x.

Key Takeaways

- Government price controls and rising regulation restrict Romgaz's ability to benefit from high European gas prices, limiting near-term profit potential despite market optimism.

- Long-term growth faces headwinds from renewables expansion, declining fossil fuel demand, maturing fields, and increasing regulatory, taxation, and financing challenges.

- Execution of key projects, domestic demand, operational enhancements, and strong financial management position Romgaz for stable growth and resilience amid evolving energy and regulatory landscapes.

Catalysts

About SNGN Romgaz- Explores for, produces, and supplies natural gas in Romania.

- The company's financials are likely being buoyed by strong thematic optimism around anticipated increased demand for Romanian gas as the EU reduces dependence on Russian imports; however, immediate growth is capped by Romanian government regulation, which locks a large and rising share of Romgaz's sales at a fixed, regulated price (over 84% in 2025 and over 87% in Q1 2026), restricting its ability to fully monetize elevated European gas prices and limiting near-term revenue and margin upside.

- Market enthusiasm for Romgaz shares reflects expectations that future EU energy security concerns and underinvestment in gas infrastructure will materially support long-term prices; however, the rapid acceleration of renewable energy investments and EU decarbonization policy will steadily erode the size and growth potential of the regional gas market, creating medium

- to long-term headwinds for topline revenue and earnings growth.

- Romgaz's production growth remains heavily dependent on the timely and cost-effective delivery of the Neptun Deep project, yet large-scale developments like this across the industry are prone to delays and cost overruns; any slippage relative to the expected 2027 first gas date could significantly postpone the anticipated uplift to EBITDA and net income.

- New regulatory interventions, including higher windfall taxes, escalating gas royalties tied to increased regulated sales, and the possibility of future EU carbon pricing, are already increasing the company's cost base and compressing net margins; future increases in regulation or taxation would put further pressure on profitability, undermining optimistic forward valuations.

- The current rally in Romgaz shares may reflect an overestimation of its insulation from long-term declines in regional fossil fuel demand, as maturing Romanian gas fields face depletion and extraction costs rise, while the transition to renewables and tightening ESG financing criteria restrict Romgaz's access to low-cost capital-posing risks to both future revenue and margins.

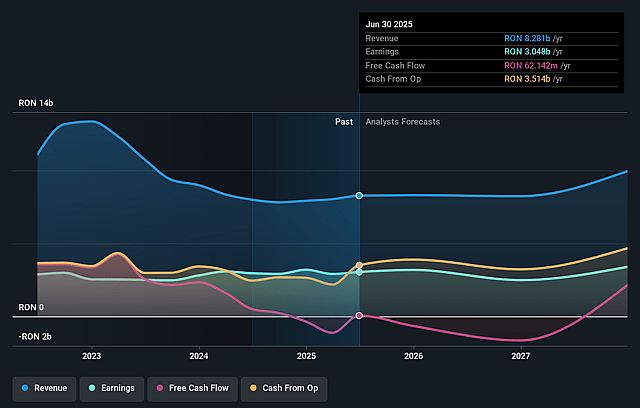

SNGN Romgaz Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming SNGN Romgaz's revenue will grow by 10.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 36.8% today to 34.9% in 3 years time.

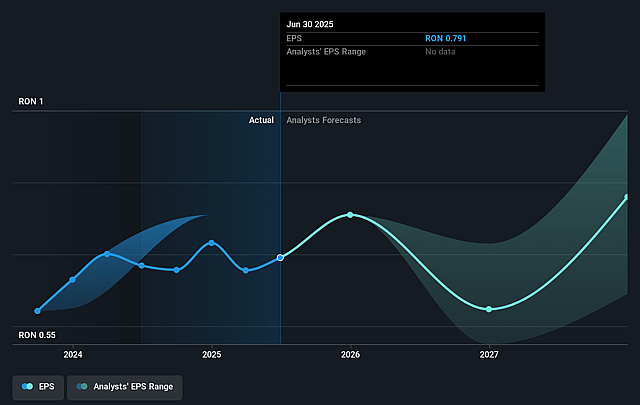

- Analysts expect earnings to reach RON 3.9 billion (and earnings per share of RON 0.96) by about September 2028, up from RON 3.0 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting RON4.6 billion in earnings, and the most bearish expecting RON2.5 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.4x on those 2028 earnings, down from 10.0x today. This future PE is lower than the current PE for the GB Oil and Gas industry at 14.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.44%, as per the Simply Wall St company report.

SNGN Romgaz Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The successful and on-schedule execution of the strategic Neptun Deep offshore project, with first gas targeted in 2027, could meaningfully increase Romgaz's production volumes, reserves, and revenue base, offsetting declines from mature fields and driving higher earnings from 2027/2028 onward.

- Long-standing European energy security concerns and the push to diversify away from Russian gas support sustained demand for domestically produced gas in Romania and the region, maintaining Romgaz's strong market share (47% of Romanian deliveries and 64% of domestically produced gas) and underpinning medium

- to long-term revenue stability.

- Ongoing production enhancement activities-reactivation of inactive wells, field optimization, and continuous investment in infrastructure-have enabled Romgaz to maintain or slightly increase output and grow condensate production by 53% year-over-year, which supports resilient top-line growth and strong EBITDA margins (54% in H1 2025).

- The transition to natural gas as a cleaner bridging fuel in the EU's decarbonization efforts, along with continued urbanization and industrial growth in Romania, could provide stable or increasing demand, mitigating long-term demand erosion and supporting both revenues and net margins.

- Solid balance sheet management, prudent capital allocation, and the potential for export growth-supported by strong storage utilization (93–94% reservation rate, aiming for 98–99% by year-end) and ongoing international partnerships-enhance Romgaz's ability to weather regulatory pressures, invest for growth, and protect or expand long-term profitability and shareholder value.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of RON6.042 for SNGN Romgaz based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of RON7.4, and the most bearish reporting a price target of just RON5.21.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be RON11.3 billion, earnings will come to RON3.9 billion, and it would be trading on a PE ratio of 8.4x, assuming you use a discount rate of 12.4%.

- Given the current share price of RON7.89, the analyst price target of RON6.04 is 30.6% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on SNGN Romgaz?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.