Last Update24 Oct 25Fair value Increased 3.52%

Analysts have raised their price target for Vodafone Qatar P.Q.S.C. from QAR 2.56 to QAR 2.65. They cite slight improvements in projected profit margins as a key factor in their updated valuation.

What's in the News

- An upcoming board meeting is scheduled for October 22, 2025 (Key Developments).

Valuation Changes

- Fair Value Estimate has risen slightly from QAR 2.56 to QAR 2.65.

- Discount Rate remains unchanged at 18.85%.

- Revenue Growth Projection has decreased from 2.16% to 1.95%.

- Net Profit Margin has increased modestly from 20.35% to 20.66%.

- Future P/E Ratio is nearly unchanged, moving slightly from 24.91x to 24.96x.

Key Takeaways

- Expansion in 5G, digital transformation, and smart city initiatives is driving sustainable revenue growth and increased profitability through improved customer reach and efficiency.

- Strategic focus on higher-margin enterprise solutions and rigorous cost optimization strengthens financial resilience and supports long-term profit improvement.

- Sustained pricing pressure, heavy investment needs, market concentration, reliance on nonrecurring revenues, and digital disruption pose risks to earnings growth and long-term profitability.

Catalysts

About Vodafone Qatar P.Q.S.C- Provides cellular mobile telecommunication, and fixed-line and broadband services in Qatar.

- Rapid increase in 5G network coverage and capacity, alongside ongoing investment in digital infrastructure, positions Vodafone Qatar to benefit from rising demand for high-speed data services and advanced connectivity, supporting sustainable top-line revenue growth as Qatar's population urbanizes and digital adoption accelerates.

- Significant advances in digital transformation-including streamlined onboarding, robust e-commerce growth (2.25x YoY increase in online sales), and AI-driven customer engagement-are expanding customer reach and improving efficiency, driving higher sales conversion and reducing operating expenses, which is likely to translate into improved net margins and earnings.

- Positive regulatory and governmental tailwinds, including the momentum from Qatar's national push for smart cities and digital innovation, are opening doors for enterprise contracts and large-scale infrastructure projects, providing new revenue streams and supporting stable long-term revenue growth.

- Expansion of the enterprise solutions portfolio and managed services (e.g., cloud, IoT, and wholesale/fixed services) is shifting the business mix toward higher-margin, recurring B2B offerings, enhancing EBITDA growth and supporting continued double-digit net profit CAGR as indicated in recent results.

- Ongoing focus on cost optimization and efficiency initiatives, evidenced by declines in OpEx intensity and strong free cash flow growth (16.8% YoY), strengthens financial resilience and profitability, enabling disciplined CapEx deployment and supporting further enhancement of net profit and return on equity over the medium term.

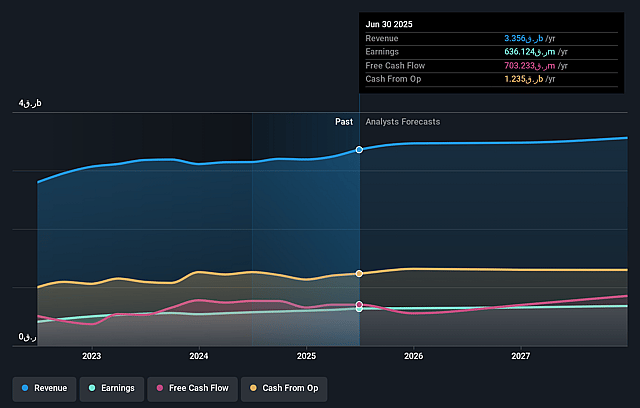

Vodafone Qatar P.Q.S.C Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Vodafone Qatar P.Q.S.C's revenue will grow by 2.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 19.0% today to 20.4% in 3 years time.

- Analysts expect earnings to reach QAR 728.3 million (and earnings per share of QAR 0.17) by about September 2028, up from QAR 636.1 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as QAR654 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.9x on those 2028 earnings, up from 16.1x today. This future PE is greater than the current PE for the QA Wireless Telecom industry at 16.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 18.85%, as per the Simply Wall St company report.

Vodafone Qatar P.Q.S.C Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intense price competition, especially in the high-value postpaid and enterprise segments, is already pushing pricing downward, with management expressing concern that such erosion is difficult to reverse-this sustained pricing pressure could suppress ARPU growth, inhibit top-line expansion, and erode net profit margins.

- Heavy reliance on capital expenditure for 5G and fixed network expansion, as well as digital transformation, is likely to keep CapEx intensity elevated (management guidance: 13–14.5% of revenue), which could compress free cash flow and limit the scope for further margin improvements over the long term.

- The company's operations remain highly concentrated within the Qatari market, making Vodafone Qatar vulnerable to local market saturation, limited organic growth opportunities, and exposure to macroeconomic fluctuations or regulatory shifts-this geographic concentration could constrain topline growth and earnings.

- A significant portion of non-service revenue growth has been attributed to equipment and contract-based enterprise sales, which are noted to be nonrecurring, raising concerns about the sustainability of these revenue streams and the risk of future revenue volatility affecting earnings stability.

- Sector-wide trends such as increasing adoption of over-the-top (OTT) communication services, digital disruptors, and potential entry of non-traditional connectivity providers threaten to disintermediate traditional telecom services, leading to potential erosion of core service revenues and long-term pressure on ARPU and net profits.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of QAR2.557 for Vodafone Qatar P.Q.S.C based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be QAR3.6 billion, earnings will come to QAR728.3 million, and it would be trading on a PE ratio of 24.9x, assuming you use a discount rate of 18.9%.

- Given the current share price of QAR2.43, the analyst price target of QAR2.56 is 5.0% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.