Key Takeaways

- Strategic projects and increased public sector sales may boost revenue, with specific contributions from Piura Airport, aiding long-term growth and diversification.

- AI-driven solutions and sustainability initiatives are likely to improve operational efficiency, reduce costs, and enhance brand reputation, supporting future earnings.

- Leadership changes and project cost overruns pose transitional and financial risks, while digital transformation and market dependencies add operational and revenue unpredictability.

Catalysts

About Cementos PacasmayoA- A cement company, produces, distributes, and sells cement and cement-related materials in Peru.

- The company anticipates a stronger demand scenario in 2025, supported by increased sales to the public sector and projects like the Piura Airport, which could positively impact revenue growth.

- The successful implementation of a dynamic pricing strategy, along with improved operational efficiencies, suggests a potential increase in revenue and profitability, potentially enhancing net margins.

- Significant efforts in digital transformation, including the adoption of AI-driven solutions and data management for optimizing supply chain efficiency, are expected to boost operational performance and reduce costs, positively affecting earnings.

- The involvement in value-added building solutions and strategic projects, such as the reconstruction of the Piura Airport, indicates potential for revenue diversification and growth, which could improve long-term revenue and earnings.

- Proactive efforts in sustainability, such as achieving Environmental Product Declarations and maintaining a strong ESG profile, could bolster brand reputation and client trust, potentially driving future revenue growth.

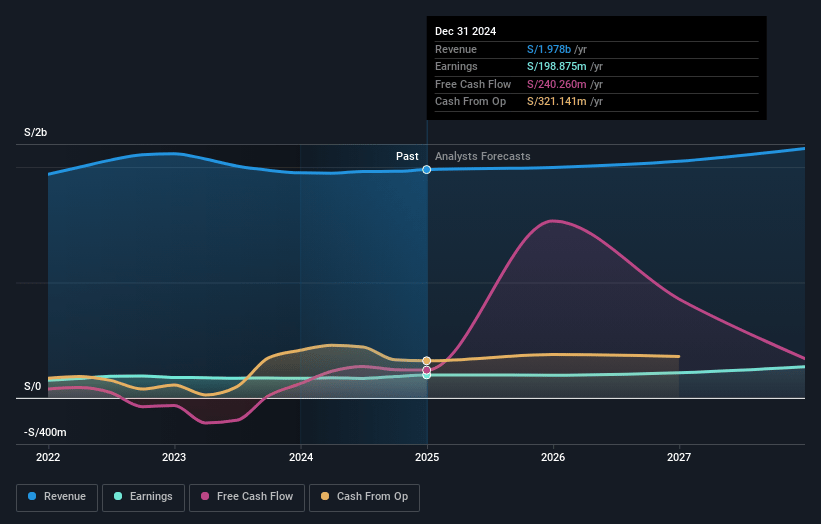

Cementos PacasmayoA Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Cementos PacasmayoA's revenue will grow by 5.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.1% today to 12.4% in 3 years time.

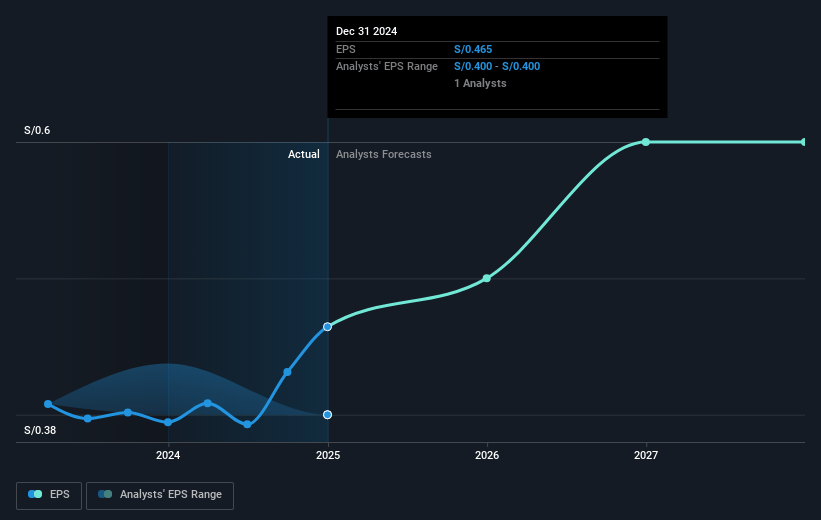

- Analysts expect earnings to reach PEN 287.0 million (and earnings per share of PEN 0.6) by about March 2028, up from PEN 198.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.3x on those 2028 earnings, up from 9.1x today. This future PE is greater than the current PE for the US Basic Materials industry at 5.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 17.07%, as per the Simply Wall St company report.

Cementos PacasmayoA Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The retirement of CFO Manuel Ferreyros and subsequent leadership changes, despite being part of a planned succession, might introduce transitional risks affecting financial strategy and management efficiency, which could impact net margins and overall financial stability.

- Higher costs linked to the execution of the Piura Airport project, combined with exchange rate discrepancies, have already affected gross margins. Such cost overruns might signal potential risks in project execution, potentially affecting future earnings.

- The increased administrative and selling expenses, due to a larger workforce and higher third-party service costs, could put pressure on operating expenses, potentially impacting net income if not managed effectively.

- The ongoing digital transformation efforts, while essential for modernization, carry inherent cybersecurity risks, which if not adequately managed, could lead to disruptions and increased costs affecting net margins.

- Vulnerability to external factors like security threats and elections, combined with dependencies on specific market segments like self-construction, might influence sales volumes and revenue unpredictably.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of PEN5.15 for Cementos PacasmayoA based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be PEN2.3 billion, earnings will come to PEN287.0 million, and it would be trading on a PE ratio of 12.3x, assuming you use a discount rate of 17.1%.

- Given the current share price of PEN4.25, the analyst price target of PEN5.15 is 17.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.