Key Takeaways

- Strategic initiatives in energy transition and export position OQGN for growth as hydrogen infrastructure demand rises.

- Development of pipelines and improved project delivery efficiency could enhance revenue and reduce costs, boosting net margins and earnings.

- Delays and increased costs in construction projects, alongside future growth challenges in new sectors, threaten short-term revenue and profit margins.

Catalysts

About OQ Gas Networks SAOG- Acquires, constructs, operates, maintains, repairs, and augments gas transportation pipelines in Oman.

- OQGN's strategic involvement in the energy transition, alongside government initiatives to export green hydrogen by 2030, positions it favorably for future revenue growth as demand for hydrogen transportation infrastructure escalates.

- The expansion of OQGN’s gas network with projects like the 42-inch Fahud-Sohar Loopline and potential CO2 transportation pipelines signals expected future increases in revenue due to enhanced infrastructure and service capabilities.

- Improved cost recovery in operational expenditures and infrastructure investment efficiency suggests potential for higher net margins as these efforts lead to stabilized or reduced operational costs over time.

- The reduction of the company's USD facility interest rate indicates potential savings on finance costs that could positively impact net earnings, given reduced interest expenses going forward.

- The ongoing development of frameworks for project delivery efficiency, including supplier agreements, could bolster OQGN's capacity to expedite future projects, thus potentially increasing revenue streams related to construction and pipeline connectivity sooner.

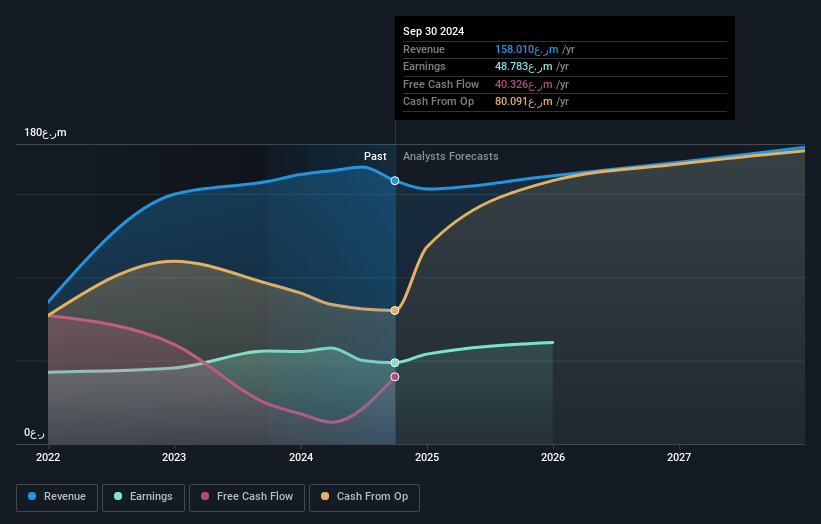

OQ Gas Networks SAOG Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming OQ Gas Networks SAOG's revenue will grow by 6.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 31.9% today to 38.0% in 3 years time.

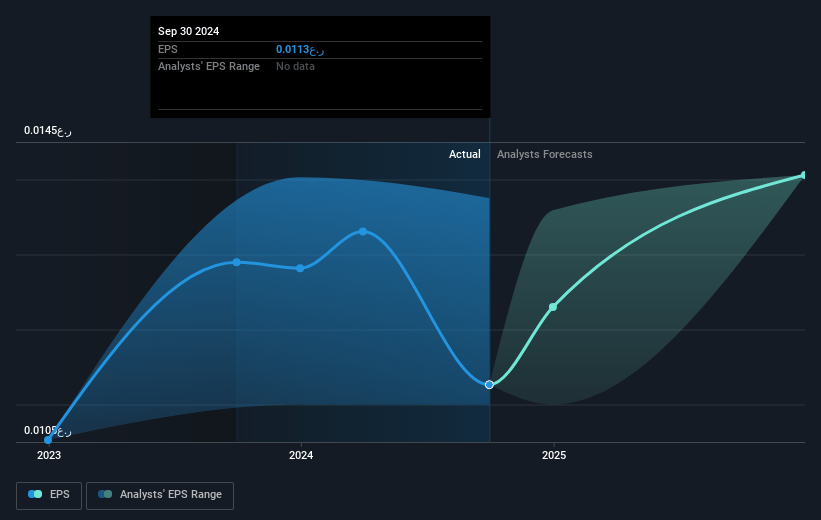

- Analysts expect earnings to reach OMR 67.0 million (and earnings per share of OMR 0.01) by about April 2028, up from OMR 46.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.5x on those 2028 earnings, up from 11.8x today. This future PE is greater than the current PE for the OM Oil and Gas industry at 11.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 23.79%, as per the Simply Wall St company report.

OQ Gas Networks SAOG Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Delays in construction projects due to adverse weather conditions have impacted revenue streams, as evidenced by the drop in construction revenue in the Sur areas. This could result in lower revenue growth and profitability in the short to medium term.

- Insurance claims and liquidated damages related to past projects have led to reductions in asset base and construction revenue. This could affect net margins if these kinds of issues continue to arise.

- Cost recovery related to regulatory fees and increased expenditures such as employee compensation and cybersecurity are becoming challenging. Rising operational costs could put pressure on net profit margins if not adequately managed.

- Although there is growth potential in the hydrogen and CO2 transportation sectors, these are mostly future opportunities and involve significant initial investments and regulatory challenges. Delayed realization of these projects could impact future revenue projections.

- Despite strong cash generation, lower operating cash flow due to reduced construction expenses could affect the company’s ability to fund growth projects from internal resources, impacting future earnings and dividend distribution levels.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of OMR0.16 for OQ Gas Networks SAOG based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be OMR176.2 million, earnings will come to OMR67.0 million, and it would be trading on a PE ratio of 19.5x, assuming you use a discount rate of 23.8%.

- Given the current share price of OMR0.13, the analyst price target of OMR0.16 is 19.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.