Key Takeaways

- A positive outlook for iron ore and bauxite exports suggests higher demand and potential revenue growth in key markets.

- Strategic fleet management, low cost structures, and vessel upgrades enhance net margins and future revenue potential.

- Volatility in commodity markets, high debt, and geopolitical risks could hinder revenue stability and impact dividend yields and earnings.

Catalysts

About 2020 Bulkers- Owns and operates large dry bulk vessels worldwide.

- With the scheduled ramp-up of the Simandou mine in Guinea and increased iron ore exports anticipated from 2027, there is potential for substantial ton-mile demand in the Capesize and Newcastlemax markets, directly impacting future revenue growth.

- The ongoing growth in bauxite exports from Guinea, alongside improvements in Chinese import demand, suggests a positive outlook for cargo volumes, which could bolster future earnings as fleet utilization increases.

- The fleet's low cash breakeven cost and the ability to sustain operations in weaker markets offer a strategic advantage in maintaining net margins, especially given current cost structures and debt positioning.

- Investments in vessel upgrades during dry docks, such as low-frequency paint for fuel optimization, are expected to enhance vessel performance and lower operating expenses, aiding in margin improvement.

- The forecasted increase in dry docks due to mandatory surveys will tighten supply, potentially driving up charter rates which, combined with the young age of the 2020 Bulkers fleet, may elevate revenue and dividend capacity in the near-term.

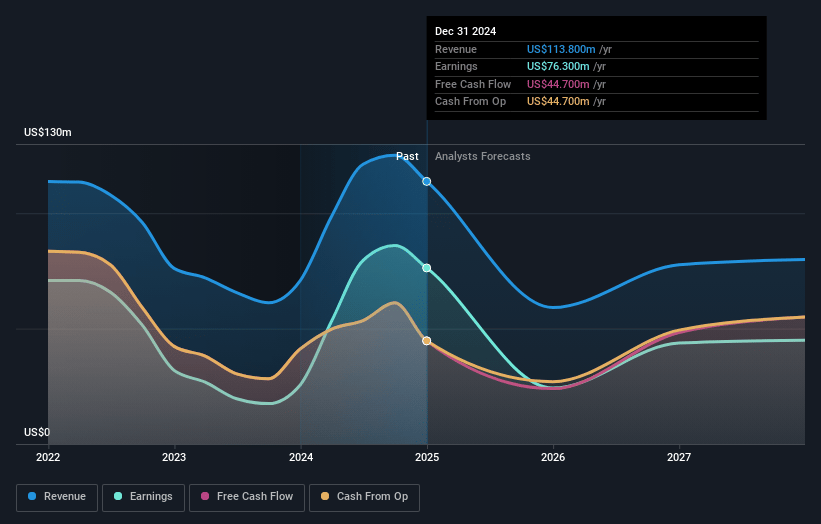

2020 Bulkers Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming 2020 Bulkers's revenue will decrease by 11.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 66.9% today to 56.2% in 3 years time.

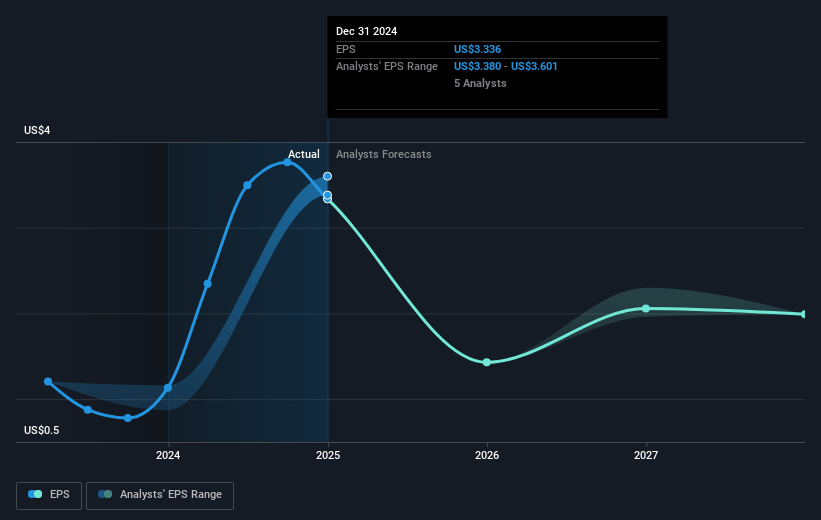

- Analysts expect earnings to reach $45.0 million (and earnings per share of $1.99) by about May 2028, down from $76.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.1x on those 2028 earnings, up from 3.2x today. This future PE is greater than the current PE for the NO Shipping industry at 3.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.77%, as per the Simply Wall St company report.

2020 Bulkers Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The potential volatility and uncertainties in global commodity markets, particularly coal demand, could impact revenue as shifts in smaller vessel markets cannibalize Capesize volumes.

- Dependence on the continued growth of Chinese imports and fragile geopolitical landscapes, such as the situation in Ukraine, introduce risks that may result in fluctuating revenues or unstable trading conditions.

- The high leverage and interest-bearing debt, while non-amortizing, suggests exposure to interest rate risks affecting net margins and potentially reducing earnings.

- Significant upcoming dry dockings and special surveys create risks regarding operational downtime and potential cost overruns, indirectly risking dividend yield and cash flow predictability.

- Any failure to realize expected operational efficiencies or performance upgrades from dry dockings may impede efforts to maintain competitive advantage and could negatively impact earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NOK141.828 for 2020 Bulkers based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK160.82, and the most bearish reporting a price target of just NOK116.12.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $80.0 million, earnings will come to $45.0 million, and it would be trading on a PE ratio of 8.1x, assuming you use a discount rate of 6.8%.

- Given the current share price of NOK110.9, the analyst price target of NOK141.83 is 21.8% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.