Last Update01 May 25

Key Takeaways

- Modernization and integration efforts at ÖoB are projected to enhance profitability and sales through clearance sales, category upgrades, and increased margin efficiency.

- Expansion in Norway and IT platform upgrades in Norway and Sweden are expected to boost revenue and net margins by improving market reach and operational efficiency.

- Volatile currency markets, integration challenges, and increased competition are limiting Europris' profitability and market share growth despite strategic efforts.

Catalysts

About Europris- Operates as a discount variety retailer in Norway.

- The integration and modernization efforts at ÖoB, including clearance sales and category upgrades, are expected to enhance sales and profitability as the turnaround process gains traction. This is projected to impact future revenue and EBIT positively by increasing sales volume and improving margin efficiency.

- The expansion strategy in Norway, exemplified by three new store openings and the upcoming store in Larvik, aims to increase Europris' market reach and footfall, potentially driving revenue growth as more consumers access the brand through new locations.

- The successful implementation of new IT platforms, including ERP systems both in Norway and Sweden, is expected to improve operational efficiency and customer experience, potentially boosting net margins by reducing costs and enhancing sales processes across the group.

- Investment in the home & interior category, which is a high-margin area and drives seasonal sales, along with leveraging social media trends like TikTok, is anticipated to increase sales and improve gross margins through enhanced product offerings and marketing strategies.

- Harmonizing systems and supply chains through IT improvements and joint sourcing strategies, especially between Europris and ÖoB, is expected to optimize operational efficiency and reduce costs, enhancing net margins and improving earnings long-term as the integration continues.

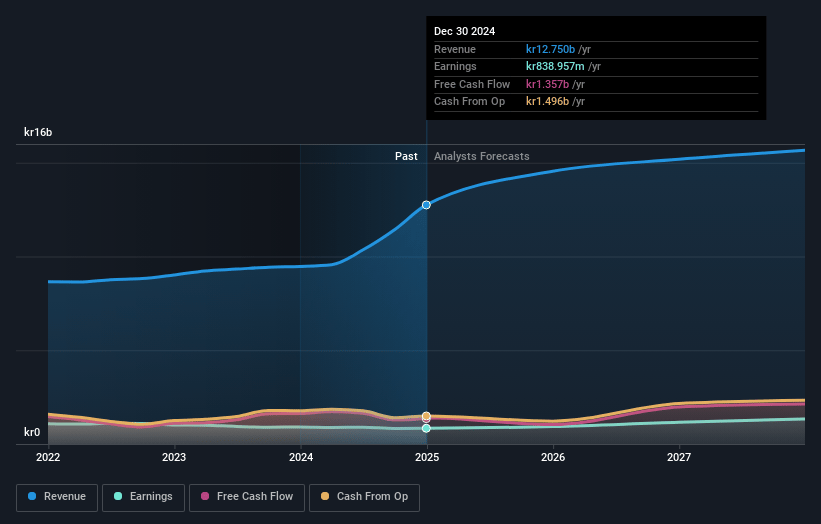

Europris Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Europris's revenue will grow by 6.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.2% today to 8.4% in 3 years time.

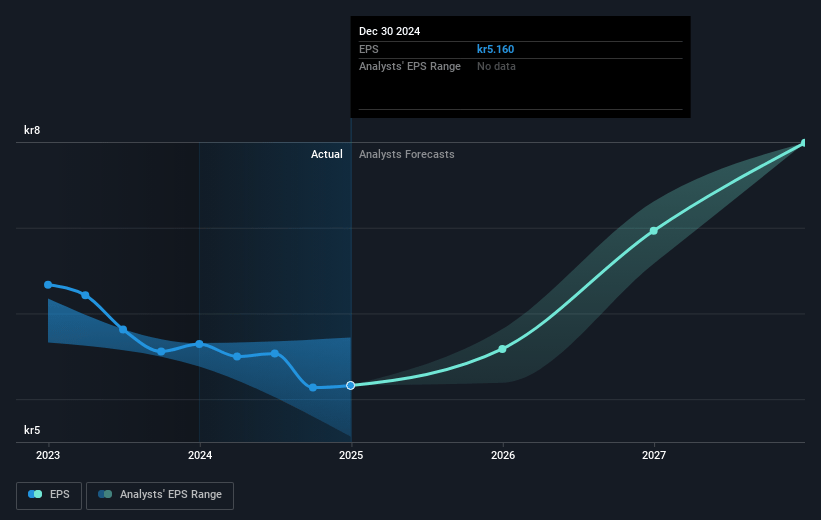

- Analysts expect earnings to reach NOK 1.4 billion (and earnings per share of NOK 7.22) by about May 2028, up from NOK 710.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.1x on those 2028 earnings, down from 17.8x today. This future PE is lower than the current PE for the GB Multiline Retail industry at 17.5x.

- Analysts expect the number of shares outstanding to grow by 1.62% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.29%, as per the Simply Wall St company report.

Europris Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Volatile currency markets have significantly impacted Europris' financial performance, leading to unrealized losses on currency hedging contracts, which negatively affect net margins and reported EBIT.

- The ÖoB acquisition in Sweden has yet to show improved sales and customer traffic, with current efforts primarily directed at inventory clearance and store remodeling, which could delay potential revenue recovery and profit growth.

- High net working capital and negative cash flow from operations, exacerbated by planned inventory buildup and integration costs, may pressure liquidity and raise financial risk if sales do not meet expectations.

- Continued integration and upgrade expenses in Sweden, such as costs associated with ERP system implementation, weigh on operating expenses and reduce earnings in the short term until benefits are realized.

- Increased competition, particularly on seasonal and nonfood products, and a cautious approach to changing consumer behavior could limit Europris' ability to capture market share and achieve desired revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NOK89.0 for Europris based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be NOK16.3 billion, earnings will come to NOK1.4 billion, and it would be trading on a PE ratio of 14.1x, assuming you use a discount rate of 8.3%.

- Given the current share price of NOK77.1, the analyst price target of NOK89.0 is 13.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.