Key Takeaways

- Expanding blue light cystoscopy in Europe and the U.S. through strategic initiatives is expected to enhance market access and drive revenue growth.

- Success in partnerships and technology launches is likely to fuel growth, while regulatory reclassification and approvals could unlock new revenue streams.

- Over-reliance on FDA reclassification, market expansion challenges, and investments may pressure revenue growth and profitability due to potential delays and market variability.

Catalysts

About Photocure- Engages in the research, development, production, distribution, marketing, and sale of pharmaceutical products in Nordic countries, Germany, France, Austria, the United Kingdom, the BeNeLux, Italy, other European Countries, Canada, and the United States.

- Expanding the use of blue light cystoscopy in Europe and the U.S. through strategic initiatives like the Richard Wolf Flexible system can increase market penetration and drive revenue growth as it opens access to a $1.3 billion market.

- Successful partnerships and the launch of new technologies, such as Olympus's Viscera III Elite in the Nordics, are expected to fuel growth and enhance revenue streams in those regions.

- The increasing adoption of ForTec’s mobile strategy in the U.S. is expected to lessen capital cost challenges and potentially increase market penetration, directly impacting revenue growth.

- The ongoing efforts to reclassify blue light equipment in the U.S. with the FDA could lead to expanded market access and increased equipment placement, which would drive higher revenue from increased usage of related products.

- The potential approval of Cevira in China through the Asieris partnership could unlock significant milestone payments and revenue contributions, positively impacting earnings and EBITDA.

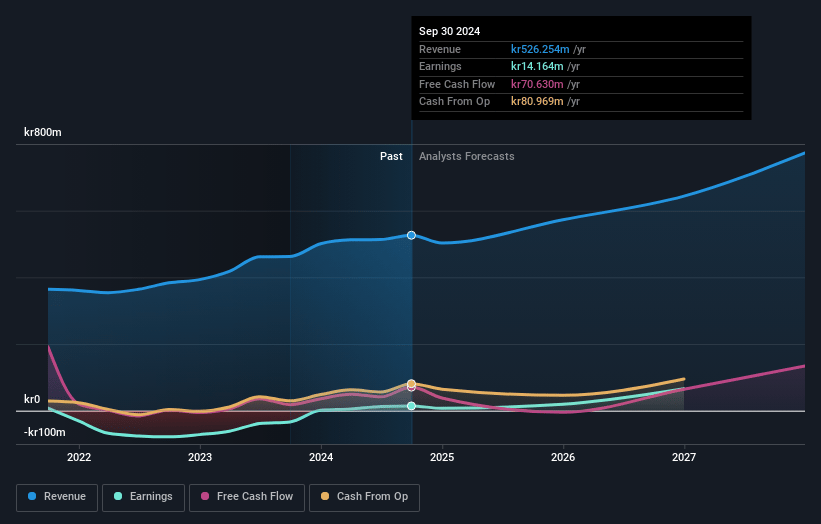

Photocure Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Photocure's revenue will grow by 13.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from -0.6% today to 14.4% in 3 years time.

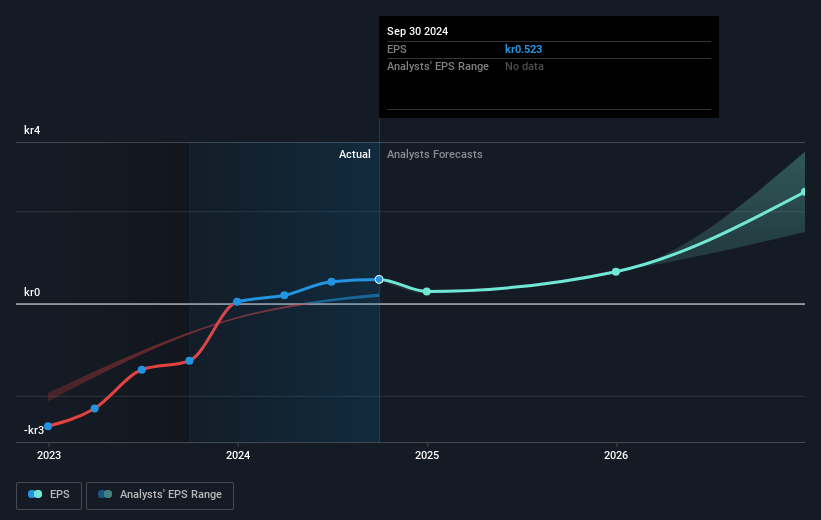

- Analysts expect earnings to reach NOK 111.0 million (and earnings per share of NOK 2.71) by about May 2028, up from NOK -3.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 23.0x on those 2028 earnings, up from -427.0x today. This future PE is lower than the current PE for the GB Pharmaceuticals industry at 155.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.94%, as per the Simply Wall St company report.

Photocure Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Dependence on FDA reclassification for more manufacturers to enter the U.S. market could lead to delays in new equipment availability, potentially affecting revenue growth from expanded market access.

- Flex equipment phase-down poses a risk of reduced market presence unless adequately replaced with new high-definition towers, which could impact revenues if not addressed promptly.

- Despite ongoing investments to stay relevant, failure to capture the potential opportunities presented by expanding into China and other markets could limit revenue growth.

- Costly investments in maintaining relevance and expanding market access, while necessary, may pressure net margins if revenue growth does not accelerate as anticipated.

- Dependence on certain key markets, like Italy and Germany, and potential disruptions due to unforeseen failures or regulatory changes could result in variability in revenue and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NOK82.5 for Photocure based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be NOK772.0 million, earnings will come to NOK111.0 million, and it would be trading on a PE ratio of 23.0x, assuming you use a discount rate of 5.9%.

- Given the current share price of NOK53.6, the analyst price target of NOK82.5 is 35.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.