Key Takeaways

- Strategic partnerships and technological advancements could significantly enhance market position and revenue growth through improved product efficiency and expanded market access.

- Future European market entry and expected operational cost reductions aim to boost Lifecare's financial stability and allow growth-focused investment.

- Uncertainties around technology validation, production scaling, regulatory approval, and partnership progression may impact Lifecare's future revenues and market entry plans.

Catalysts

About Lifecare- Engages in the research and development of medical sensors for health monitoring in Norway.

- Lifecare's ongoing collaboration with TTP for optimizing implant design for manufacturability is expected to lead to more consistent and efficient production processes, potentially improving net margins and reducing cost of goods sold.

- The development of a new sensor chemistry that enhances glucose sensitivity is expected to boost the precision and efficiency of their glucose sensors, potentially driving future revenue growth through competitive market positioning and increased adoption.

- The potential activation of commercial rights by Sanofi, following the achievement of key milestones, could significantly enhance Lifecare's market access and revenue streams through partnerships and collaborations.

- Lifecare's progression towards CE marking for the human market, anticipated around 2026, would enable the company to enter the European market, contributing to revenue growth and market expansion.

- Reduction in operating expenses expected in 2025 following significant R&D investments in 2024 could enhance net margins and financial stability, enabling more resources to be allocated toward growth initiatives.

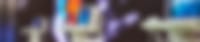

Lifecare Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Lifecare's revenue will grow by 60.5% annually over the next 3 years.

- Analysts are not forecasting that Lifecare will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Lifecare's profit margin will increase from -742.0% to the average NO Medical Equipment industry of 15.6% in 3 years.

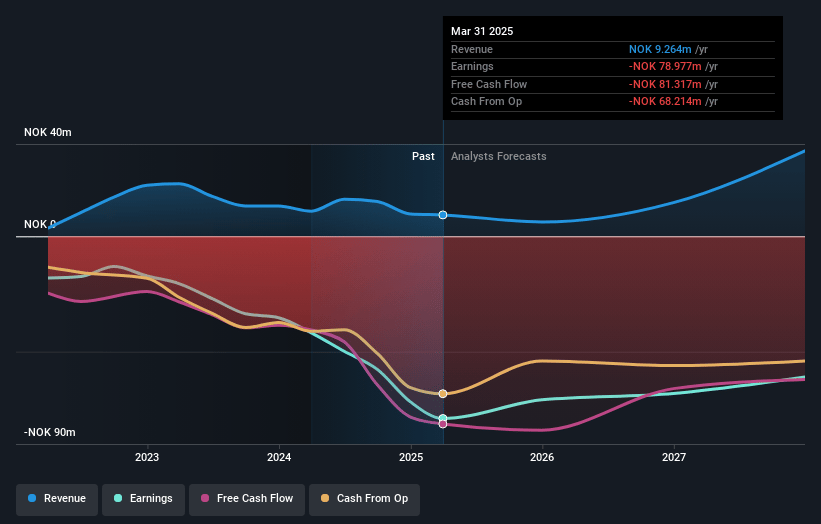

- If Lifecare's profit margin were to converge on the industry average, you could expect earnings to reach NOK 6.2 million (and earnings per share of NOK 0.33) by about May 2028, up from NOK -71.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 113.2x on those 2028 earnings, up from -2.0x today. This future PE is greater than the current PE for the NO Medical Equipment industry at 22.7x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Lifecare Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The implementation of new sensor chemistry, while promising, still requires extensive in-vivo validation, posing a risk if trials do not demonstrate the expected increase in sensitivity, potentially impacting future revenue if delays occur.

- Despite plans for automated production, there could be unforeseen technical challenges or delays in scaling up, which may impact the company’s ability to reduce costs and improve net margins as planned.

- Continuous improvements to implant design and manufacturability suggest a complex process. Any disruptions or setbacks during this optimization may delay product launch impacts earnings due to deferred revenue recognition.

- The CE marking for human use is optimistically projected for 2026, with acknowledgment that delays to 2027 are quite possible, creating uncertainty regarding the timeframe for entering the human market and realizing associated revenues.

- While the agreement with Sanofi includes potential commercial rights activation, there is no confirmation yet, adding uncertainty to future earnings if the partnership does not progress as planned.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NOK30.5 for Lifecare based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK36.0, and the most bearish reporting a price target of just NOK25.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be NOK40.0 million, earnings will come to NOK6.2 million, and it would be trading on a PE ratio of 113.2x, assuming you use a discount rate of 6.8%.

- Given the current share price of NOK8.92, the analyst price target of NOK30.5 is 70.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.