Key Takeaways

- Expansion into U.S. and Asian markets with large fish aims to leverage unmet demand, offering potential for substantial revenue growth.

- Strategic focus on large smolt production and feed capacity expansion is expected to enhance operational efficiency and improve net margins over time.

- Regulatory changes, market shifts, and operational challenges are likely to strain Bakkafrost's margins, risking future revenue and profit stability.

Catalysts

About P/F Bakkafrost- Produces and sells salmon products in North America, Western Europe, Eastern Europe, Asia, and internationally.

- Bakkafrost's plan to produce large, high-quality smolt in Scotland is expected to fundamentally transform its farming operations, reducing costs and improving biological performance, which should positively impact earnings in the medium to long term.

- The expansion of feed production capacity at the Havsbrún plant, expected to be operational in a year, will double current capacity, supporting sustainable growth and potentially reducing feed costs, enhancing net margins over the coming years.

- Improvements in the Faroese farming operations, including good biological performance, larger average fish weights, and a 22% increase in supply growth, are anticipated to boost harvest volumes and operational efficiency, likely driving revenue growth.

- The strategic shift to focus on larger fish production in Scotland, with expected better control over maturation issues due to new hatchery capabilities, is aimed at enhancing the value of harvested fish, potentially increasing average selling prices and improving net margins.

- Bakkafrost's expansion into the U.S. and Asian markets with large fish offers untapped potential for revenue growth, leveraging the strong demand in these underdeveloped salmon markets.

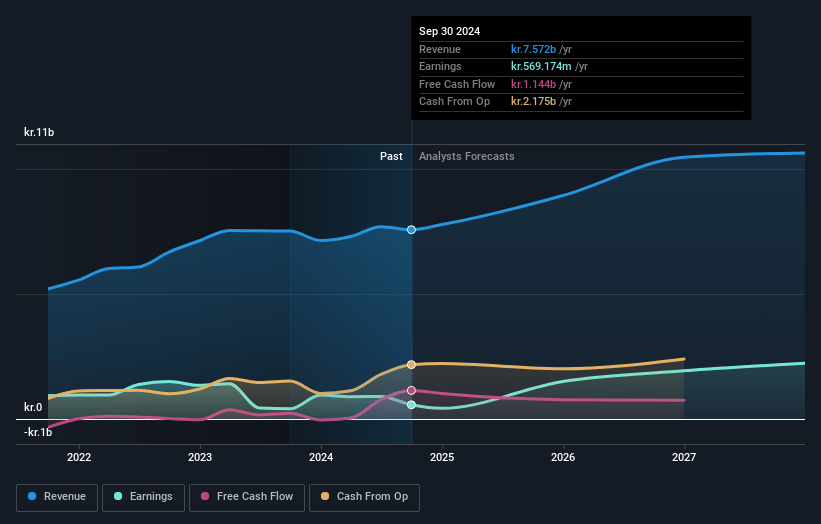

P/F Bakkafrost Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming P/F Bakkafrost's revenue will grow by 18.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.6% today to 20.6% in 3 years time.

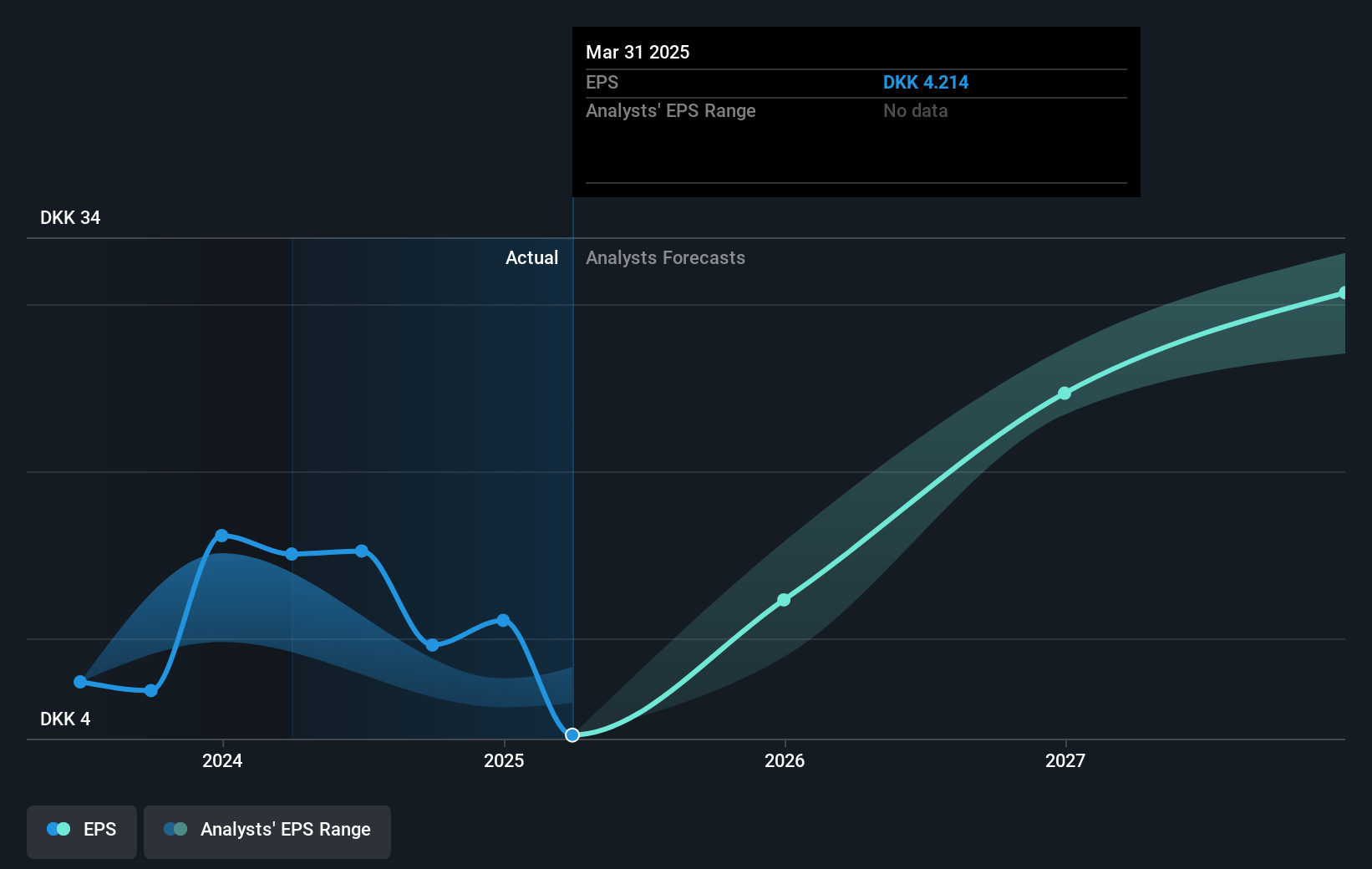

- Analysts expect earnings to reach DKK 2.4 billion (and earnings per share of DKK 29.17) by about July 2028, up from DKK 249.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.0x on those 2028 earnings, down from 63.2x today. This future PE is lower than the current PE for the GB Food industry at 22.2x.

- Analysts expect the number of shares outstanding to grow by 0.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.12%, as per the Simply Wall St company report.

P/F Bakkafrost Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Decreased external fishmeal and fish oil sales and reduced marine raw material sourcing could negatively impact Bakkafrost's revenue and net margins, especially if the trend continues.

- The new tax changes in the Faroese salmon industry could increase costs for Bakkafrost, particularly with the added 12% corporate tax on salmon farming activities, potentially affecting net earnings.

- Market disruptions and reduced VAP (Value Added Products) operations resulting in a shift towards more HOG (Head On Gutted) sales led to a weaker premium for Bakkafrost, which might impact profit margins.

- Challenges in the Scottish operations, such as maturation issues and elevated mortality rates, pose risks to production efficiency and operational EBIT in that region.

- Increased supply forecasts in global salmon markets may exert downward pressure on salmon prices, potentially reducing future revenue growth for Bakkafrost if demand does not correspondingly increase.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of DKK593.75 for P/F Bakkafrost based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be DKK11.7 billion, earnings will come to DKK2.4 billion, and it would be trading on a PE ratio of 11.0x, assuming you use a discount rate of 6.1%.

- Given the current share price of DKK423.2, the analyst price target of DKK593.75 is 28.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.