Key Takeaways

- Expanding Omega-3 market share, new products, and major retail partnerships could significantly boost revenue and sales volumes.

- Centralizing resources and managing tariffs are expected to improve efficiency, reduce costs, and preserve net margins.

- Exposure to tariffs and trade tensions, operational restructuring risks, and challenges in market expansion could pressure profits and disrupt revenue growth.

Catalysts

About Aker BioMarine- A biotech innovator, develops and supplies krill-derived products for consumer health and wellness worldwide.

- The launch of new Lysoveta products, pending successful human clinical trials, could expand Aker BioMarine's product portfolio and generate new revenue streams through health claims focused on cognitive benefits. This can drive revenue growth.

- Restructuring the Human Health Ingredients segment by centralizing resources in Houston is expected to enhance production efficiency and reduce costs. This could lead to improved net margins over time.

- Expanding market share from 5% to a targeted 15-20% in the global Omega-3 market could drive substantial revenue growth, leveraging increased distribution and consumer awareness. This would likely positively impact revenue.

- Successful entry into large retailers like Whole Foods and BJ's indicates a heightened distribution strategy for Consumer Health Products in the U.S. market, which could boost sales volumes and subsequently improve earnings.

- Initiatives to manage tariffs and supply chain efficiencies, such as the duty drawback program and optimized China export routes, are expected to mitigate potential tariff impacts, preserving net margins and stabilizing earnings.

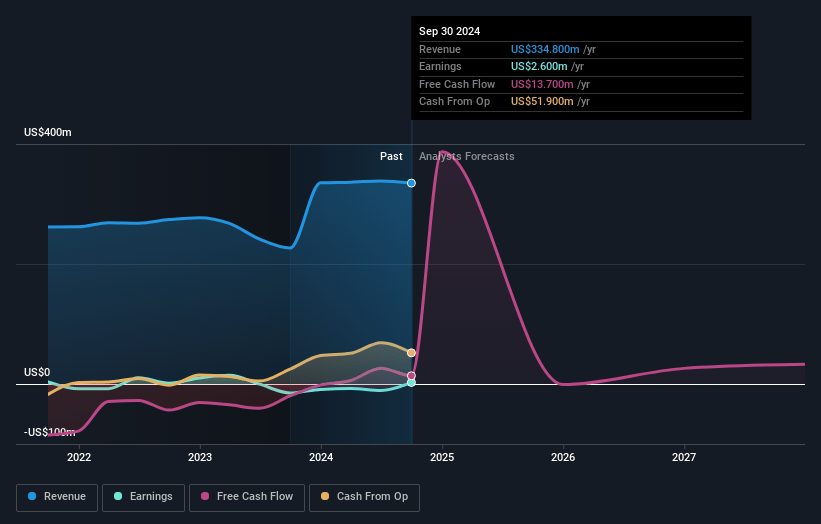

Aker BioMarine Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Aker BioMarine's revenue will grow by 10.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from -7.2% today to 8.6% in 3 years time.

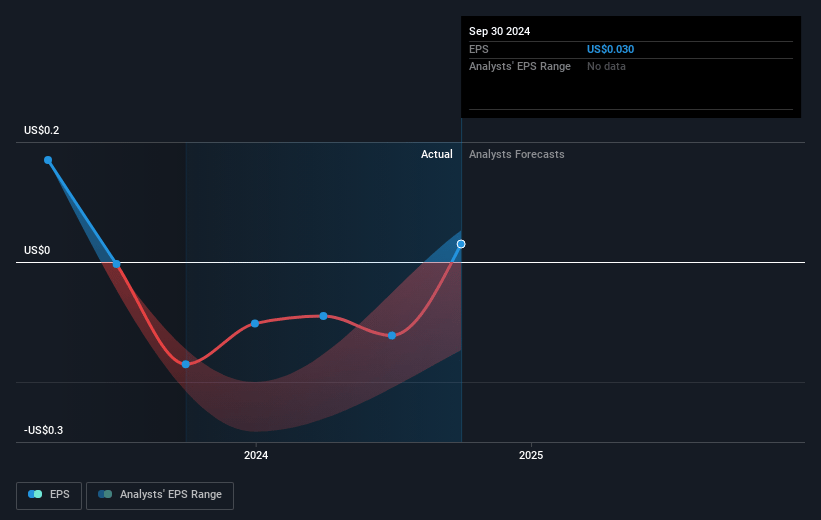

- Analysts expect earnings to reach $23.2 million (and earnings per share of $0.26) by about May 2028, up from $-14.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 29.4x on those 2028 earnings, up from -31.4x today. This future PE is greater than the current PE for the NO Food industry at 20.8x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.94%, as per the Simply Wall St company report.

Aker BioMarine Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Exposure to tariffs and international trade tensions, particularly between the U.S. and China, could affect costs and profit margins due to import/export duties impacting krill oil supply chains and affecting revenue streams.

- Continued restructuring, such as the relocation of resources from Norway to Houston, represents a potential operational risk that could disrupt production and incur additional costs that might impact net margins.

- The decline in the Emerging Business segment, which saw a 32% decrease due to changes in revenue recognition, might indicate potential vulnerabilities in revenue diversification and could affect overall earnings.

- High levels of interest-bearing debt ($157 million) increase financial risk and may put pressure on net profits if market conditions change unfavorably, impacting EBITDA and cash flow.

- Challenges in executing the market expansion strategy, as seen with the paused campaigns in South Korea due to political turmoil, could slow down market share gains and potential revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NOK55.504 for Aker BioMarine based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK64.55, and the most bearish reporting a price target of just NOK46.45.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $269.6 million, earnings will come to $23.2 million, and it would be trading on a PE ratio of 29.4x, assuming you use a discount rate of 5.9%.

- Given the current share price of NOK53.0, the analyst price target of NOK55.5 is 4.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.