Key Takeaways

- The company's modern and strategically positioned fleet is set to capitalize on tight supply conditions and longer shipping routes, boosting revenue and earnings.

- Improved financing and compliance with sanctions are expected to enhance net margins, allowing the capture of premium rates and bolstering financial performance.

- Okeanis Eco Tankers faces high financial risk from debt levels, reliance on geopolitical sanctions, market volatility, and limited reinvestment due to high dividend payouts.

Catalysts

About Okeanis Eco Tankers- A shipping company, owns and operates tanker vessels worldwide.

- The company's modern fleet, which is the youngest crude oil tanker fleet among its peers, positions it well to capitalize on future tight supply conditions due to an aging global fleet and low newbuilding orders, potentially leading to increased revenues.

- OET has successfully improved financing margins, with 130 basis points of interest expense improvement, which should enhance net margins and earnings in the coming quarters as cost savings are realized.

- The anticipated increase in crude oil demand in 2025, alongside geopolitical factors that drive longer, more complex shipping routes, is expected to boost tonne mile demand and fleet utilization, resulting in higher revenue and earnings.

- The ongoing impact of expanded sanctions frameworks could further tighten supply for compliant fleets, enabling OET to capture premium rates, potentially increasing revenues and enhancing net margins.

- Strategic fleet positioning and fleet triangulation, such as repositioning vessels for optimal deployment and capturing higher earnings through selective trades, are expected to lead to increased revenue and improved earnings efficiency.

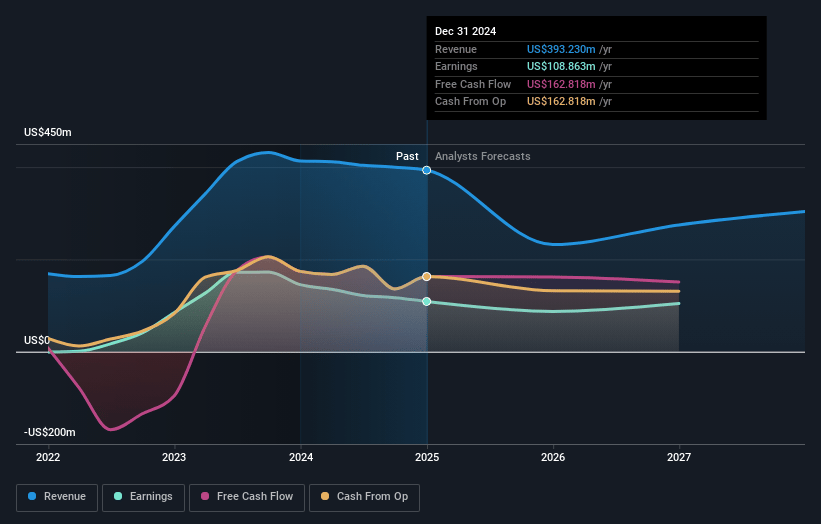

Okeanis Eco Tankers Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Okeanis Eco Tankers's revenue will decrease by 22.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 27.7% today to 56.5% in 3 years time.

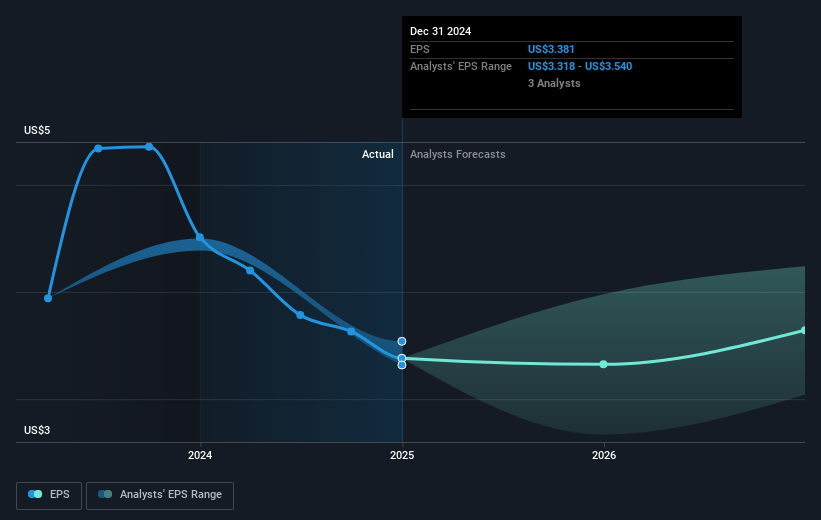

- Analysts expect earnings to reach $102.6 million (and earnings per share of $3.82) by about May 2028, down from $108.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.8x on those 2028 earnings, up from 6.9x today. This future PE is greater than the current PE for the NO Oil and Gas industry at 4.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.83%, as per the Simply Wall St company report.

Okeanis Eco Tankers Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Okeanis Eco Tankers has a high level of debt, with a book leverage of 59%, which could impact net margins and increase financial risk if market conditions deteriorate.

- The company is significantly reliant on ongoing sanctions on Russian and Iranian oil to strengthen market rates. Changes in geopolitical factors could lead to a shift in sanctions, potentially affecting revenue.

- The tanker market is experiencing a structural supply imbalance due to an aging fleet and low new-building orders. If new vessel orders increase or shipbuilding costs decrease, the improved market rates may not materialize, impacting future revenue expectations.

- OET’s dependency on spot market rates makes it vulnerable to market volatility, potentially impacting earnings and net income if rates decline unexpectedly.

- Given the high percentage of net earnings distributed as dividends (89% over the last year), Okeanis may face constraints in reinvesting in fleet maintenance or expansion, which can affect long-term revenue growth and operational efficiency.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NOK328.629 for Okeanis Eco Tankers based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK383.7, and the most bearish reporting a price target of just NOK290.93.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $181.7 million, earnings will come to $102.6 million, and it would be trading on a PE ratio of 13.8x, assuming you use a discount rate of 11.8%.

- Given the current share price of NOK241.5, the analyst price target of NOK328.63 is 26.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.