Key Takeaways

- Strategic acquisitions and fleet restructuring aim to enhance profitability, potentially leading to higher net margins.

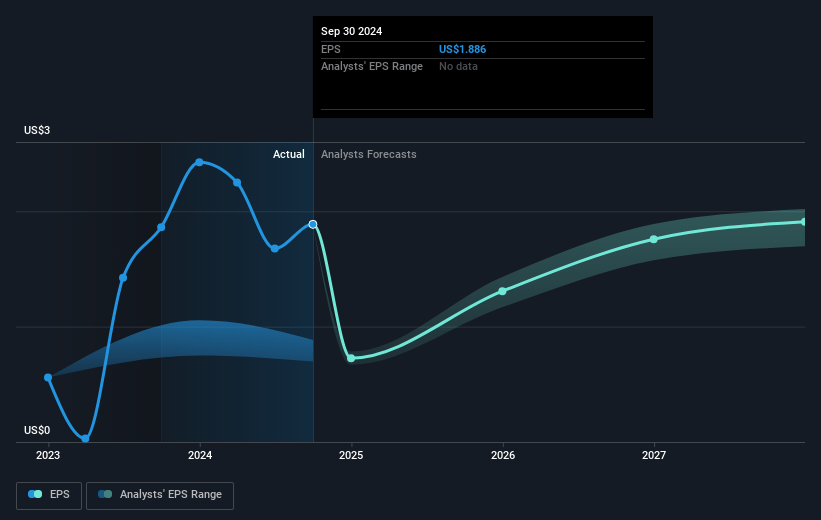

- Refinancing efforts and capital distributions are poised to improve cash flow management and enhance earnings per share.

- The acquisition of DOF Denmark and high debt levels introduce challenges in integration, financial targets, and margins, compounded by currency volatility and strategic asset management pressures.

Catalysts

About DOF Group- Owns and operates a fleet of offshore and subsea vessels.

- The company has a strong backlog of $3.25 billion, expected to increase significantly in the next 3 to 6 months due to high tender activity and strong pipeline, which can positively impact future revenue growth.

- The acquisition of DOF Denmark is anticipated to boost earnings as the company transitions the fleet into their commercial model, aiming to enhance vessel and subsea services profitability, potentially leading to higher net margins.

- The refinancing efforts underway, with commitments from major banks, are expected to streamline cash management and reduce financial costs, potentially improving net margins and facilitating dividend payouts.

- Plans to implement a share buyback program and dividends, supported by a strong cash flow and debt reduction, could enhance earnings per share (EPS) by decreasing the share count and returning cash to shareholders.

- The company is strategically optimizing its fleet by potentially selling non-core or older vessels, which could lead to improved asset utilization and operational efficiency, positively affecting net margins and overall earnings.

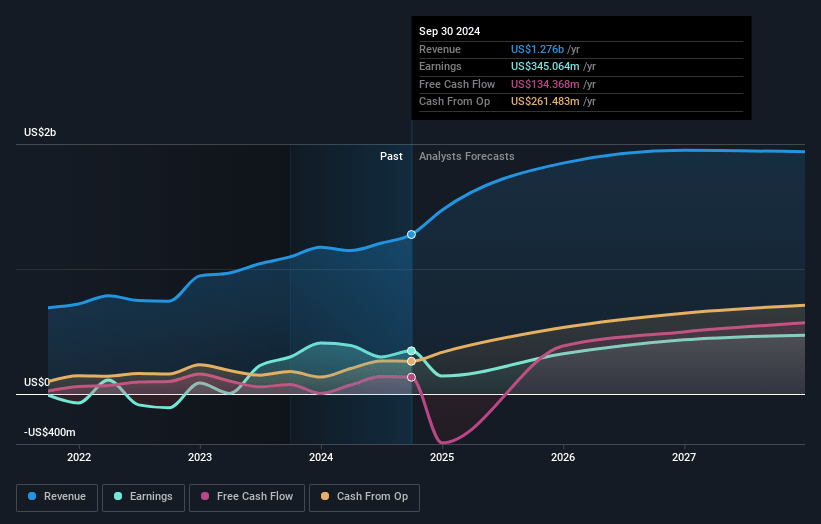

DOF Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming DOF Group's revenue will grow by 12.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 12.9% today to 24.1% in 3 years time.

- Analysts expect earnings to reach $477.5 million (and earnings per share of $1.86) by about May 2028, up from $178.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $555.6 million in earnings, and the most bearish expecting $396.2 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.7x on those 2028 earnings, down from 10.8x today. This future PE is greater than the current PE for the GB Energy Services industry at 8.6x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.61%, as per the Simply Wall St company report.

DOF Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The acquisition of DOF Denmark presents integration and backlog challenges, as the backlog on takeover was lower than usual for DOF, leading to greater uncertainty in achieving financial targets and potentially affecting revenue and margins if not managed effectively.

- Currency exchange rate fluctuations between BRL and USD have led to significant noncash P&L effects, introducing volatility in reported earnings and potential investor concerns about the financial stability of operations in Brazil.

- The high levels of debt following the acquisition of DOF Denmark and other financial activities introduce risk due to interest costs and the potential impact on net margins if refinancing terms are not favorable.

- Significant capital expenditures, particularly for vessel and ROV upgrades, add pressure to cash flows and require successful execution and contract wins to ensure these investments translate into anticipated earnings and revenue growth.

- The potential sale of vessels, if not strategically managed, could lead to reduced operational capacity or market presence, impacting future revenue streams, especially if sold vessels become competitors or if high-demand vessels are sold at the wrong time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NOK124.0 for DOF Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK142.0, and the most bearish reporting a price target of just NOK100.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.0 billion, earnings will come to $477.5 million, and it would be trading on a PE ratio of 9.7x, assuming you use a discount rate of 8.6%.

- Given the current share price of NOK80.85, the analyst price target of NOK124.0 is 34.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.