Key Takeaways

- Strategic alliances and a focus on risk-sharing bolster innovation and efficiency, driving potential revenue growth and strong EBITDA margins.

- Expanding presence in Indian engineering and renewable projects enhances revenue potential, promising improved net margins and stable earnings.

- Financial pressures from legacy renewable losses and heavy regional dependencies are compounded by geopolitical risks, straining profitability and limiting growth flexibility.

Catalysts

About Aker Solutions- Provides solutions, products, systems, and services to the oil and gas industry in Norway, the United States, Brazil, the United Kingdom, Malaysia, Angola, Brunei, Canada, India, and internationally.

- The growing engineering presence in India allows Aker Solutions to deliver high-quality engineering services at competitive prices, potentially leading to higher revenue growth and improved margins in both oil and gas and renewables segments.

- Aker Solutions has shown significant improvement in commercial models for new renewable projects compared to legacy ones, suggesting future projects will have balanced risk-reward profiles, potentially enhancing net margins and stabilizing earnings.

- The strategic alliance model, particularly with Aker BP, focuses on sharing risks and rewards, fostering innovation and efficiency. This collaboration is expected to deliver high-quality projects faster, potentially boosting revenue and maintaining strong EBITDA margins.

- The expanding tender pipeline, including advancements in carbon capture and storage projects, coupled with the strategic focus on more standardized, fabrication-friendly designs, promises continued order backlog growth and future revenue streams.

- The anticipated dividend from Aker Solutions' 20% ownership in OneSubsea, alongside a robust subsea market outlook, can contribute positively to earnings and provide a strong cash flow position for further investment and shareholder returns.

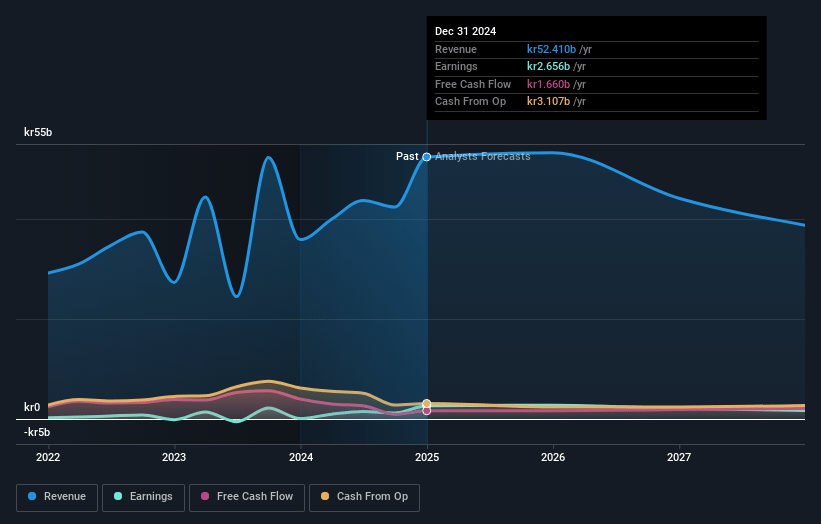

Aker Solutions Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Aker Solutions's revenue will decrease by 9.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 5.1% today to 4.4% in 3 years time.

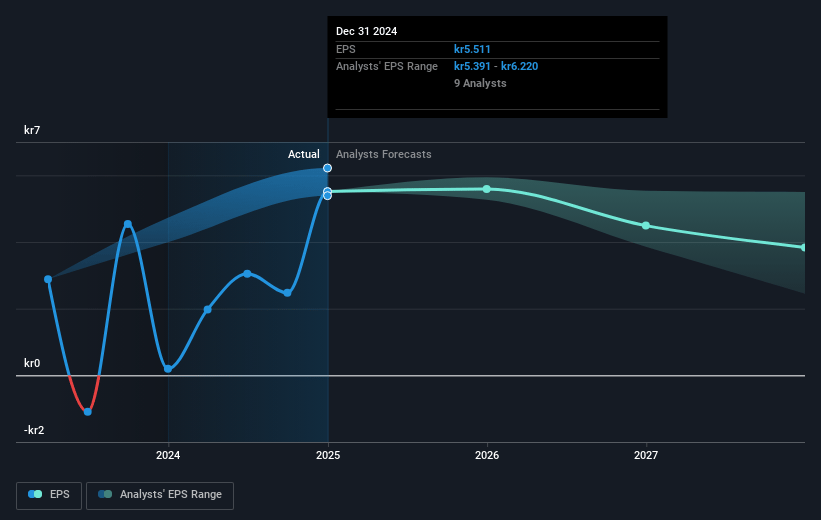

- Analysts expect earnings to reach NOK 1.7 billion (and earnings per share of NOK 3.82) by about April 2028, down from NOK 2.7 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting NOK2.6 billion in earnings, and the most bearish expecting NOK939 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.9x on those 2028 earnings, up from 5.3x today. This future PE is greater than the current PE for the GB Energy Services industry at 7.8x.

- Analysts expect the number of shares outstanding to decline by 1.88% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.25%, as per the Simply Wall St company report.

Aker Solutions Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The legacy renewables projects have seen increased carryover work from subcontractors, resulting in additional losses, which could negatively impact net margins and profitability.

- The financial performance is adversely affected by losses in the legacy renewable portfolio, which may impact overall earnings and financial stability until these projects are completed in 2025.

- Geopolitical instability and volatile energy prices present risks to market outlook and future revenue projections.

- A significant dependency on specific regions for engineering work, such as India, could expose Aker Solutions to geopolitical or regional economic risks, potentially affecting operational efficiency and revenues.

- The substantial recent dividend payments and continued capital investment requirements may impact future cash flow and might limit financial flexibility for potential growth investments or cushion against downturns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NOK36.7 for Aker Solutions based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK46.0, and the most bearish reporting a price target of just NOK30.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be NOK39.3 billion, earnings will come to NOK1.7 billion, and it would be trading on a PE ratio of 11.9x, assuming you use a discount rate of 7.3%.

- Given the current share price of NOK29.04, the analyst price target of NOK36.7 is 20.9% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.