Key Takeaways

- Expansion into new renewable sectors and upgrading global energy infrastructure are set to boost recurring revenues and growth prospects amid broader energy transition trends.

- Strategic acquisitions and operational efficiencies are driving margin improvements, strengthening service offerings, and positioning for resilient, long-term earnings growth.

- Heavy reliance on acquisitions and dividends amid weak core performance and volatile end markets threatens profitability, future earnings quality, and long-term competitiveness.

Catalysts

About ABL Group- An investment holding company, provides energy, and marine and engineering consultancy services to renewables, maritime, and oil and gas industries worldwide.

- Diversification beyond offshore wind—evidenced by shifting mix into onshore wind, solar, hydro, and water management—positions ABL Group to capture emerging growth opportunities as global investment ramps up in broader energy transition infrastructure, supporting top-line (revenue) expansion.

- Ongoing global upgrades and decommissioning of aging energy infrastructure, especially across offshore and complex markets (e.g., Brazil, Asia), is sustaining high activity levels for ABL’s technical advisory and project management offerings, likely to drive recurring revenues even amid sector volatility.

- Strategic acquisitions (e.g., Proper Marine, Ross Offshore, Hidromod) are broadening service capabilities and geographies, increasing cross-selling potential and laying the groundwork for increased earnings and resilient long-term revenue growth as integration synergies are realized.

- Management’s restructuring efforts, especially headcount adjustments and operational efficiency programs in OWC and ABL segments, are already generating sequential improvement in margins, pointing to further normalized margin recovery (and thus higher net margins and earnings) as market conditions stabilize.

- Lowered acquisition multiples industry-wide create an attractive environment for disciplined M&A, enabling ABL Group to strengthen its portfolio and future cash flow generation at accretive valuations, ultimately enhancing long-term earnings power.

ABL Group Future Earnings and Revenue Growth

Assumptions

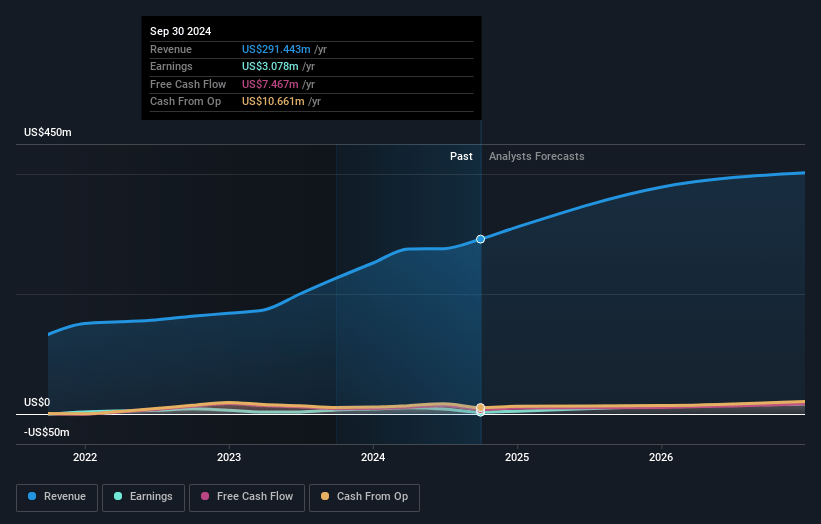

How have these above catalysts been quantified?- Analysts are assuming ABL Group's revenue will grow by 12.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.7% today to 5.1% in 3 years time.

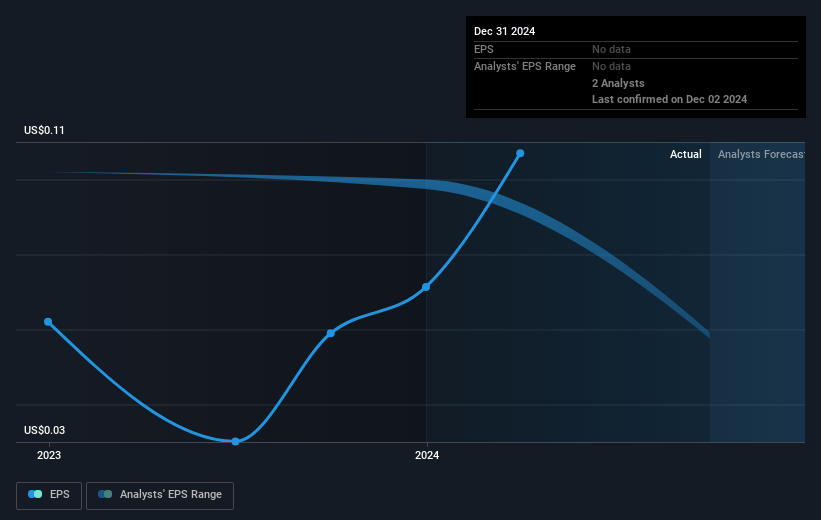

- Analysts expect earnings to reach $23.2 million (and earnings per share of $0.13) by about May 2028, up from $2.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.5x on those 2028 earnings, down from 55.6x today. This future PE is greater than the current PE for the GB Energy Services industry at 6.7x.

- Analysts expect the number of shares outstanding to grow by 2.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.76%, as per the Simply Wall St company report.

ABL Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- ABL Group’s EBIT margin is significantly below their mid-cycle guidance (3.8% vs. 6.5%), with no clear, near-term recovery in sight, especially as core business segments like ABL and OWC have either been flat or loss-making over the last 12 months; this persistent underperformance, if unaddressed, risks continuing net margin pressure and weaker long-term earnings.

- Recent revenue growth is primarily attributable to acquisitions (Ross Offshore, Proper Marine), not underlying organic expansion, and these acquired businesses are structurally lower-margin, suggesting ABL is increasingly reliant on M&A for growth, with added integration risks and little immediate improvement to profitability—overall impacting net margins and future earnings quality.

- The renewables sector, a major area for long-term growth, remains highly volatile with delayed or uncertain project timelines, slow recovery, and continued market turmoil in key regions (e.g., Europe), exposing ABL to cyclical downturns and prolonged revenue headwinds if the sector fails to rebound robustly.

- Exposure to oil and gas markets remains high, and recent declines in oil prices, reduced E&P capital spending, and geopolitical volatility in the industry (with pronounced regional swings) create risk of reduced client budgets and fewer new projects, threatening future revenue stability and increasing the likelihood of earnings volatility.

- Despite growing cash dividends and active M&A, operating income and pro-forma EBIT are down year-on-year; continued increases in shareholder payouts amid deteriorating fundamentals could result in underinvestment in innovation or digital transformation, risking longer-term competitive positioning and margin resilience versus more diversified or technologically advanced peers.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NOK11.843 for ABL Group based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $455.3 million, earnings will come to $23.2 million, and it would be trading on a PE ratio of 8.5x, assuming you use a discount rate of 7.8%.

- Given the current share price of NOK10.0, the analyst price target of NOK11.84 is 15.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.