Key Takeaways

- Market optimism may be overestimating sustained revenue and margin growth, ignoring uncertainties in demand, political shifts, and execution challenges on backlog conversion.

- Rising regulatory scrutiny and potential budget shifts toward sustainability could dampen long-term defense order flow, compressing margins and restricting earnings growth.

- Heightened defense spending, technological leadership, and global expansion are positioning Kongsberg for sustained revenue growth, margin improvement, and lasting earnings stability.

Catalysts

About Kongsberg Gruppen- Provides high-tech systems and solutions primarily to customers in the maritime and defense markets.

- The market may be pricing in uninterrupted multi-year revenue growth fueled by persistent geopolitical tensions and increased defense spending in Europe and allied nations, despite management emphasizing that the duration and magnitude of such elevated demand is uncertain and subject to changing political priorities—raising the risk that current elevated order intake and backlog prove peak rather than baseline, with future revenue trajectories more volatile than assumed.

- Investors appear to be embedding aggressive forecasts for margin expansion driven by rapid adoption of Kongsberg’s digital and automated maritime solutions; however, management notes sector headwinds including long lead times, the need for substantial fleet upgrades due to aging vessels, and moderating newbuild activity, all of which could restrain the pace of incremental sales and gross margin improvement in out-years.

- Current valuations seem to overlook the risk that government priorities could shift toward environmental and sustainability initiatives, gradually diverting budgets away from defense procurement and limiting the runway for earnings growth from Kongsberg’s defense-focused portfolio.

- There may be an overestimation of the company’s ability to consistently convert its swelling multi-year order backlog into high-margin, timely revenues, given management’s comments about project mix (e.g., low-margin development contracts vs. more profitable export deals) and the structural volatility inherent to large government defense programs—potentially resulting in more erratic quarterly margins and earnings than implied by smooth growth models.

- The upbeat price may dangerously underweight emerging threats such as tighter arms export controls and rising regulatory scrutiny, both of which have the potential to slow international order flow, extend sales cycles, elevate compliance costs, and ultimately impede long-term revenue scalability and net margin expansion.

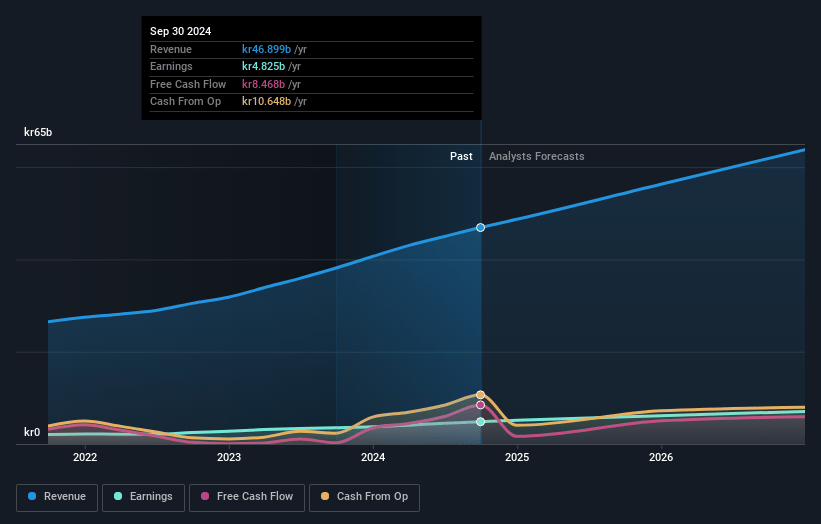

Kongsberg Gruppen Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Kongsberg Gruppen's revenue will grow by 15.1% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 12.1% today to 11.6% in 3 years time.

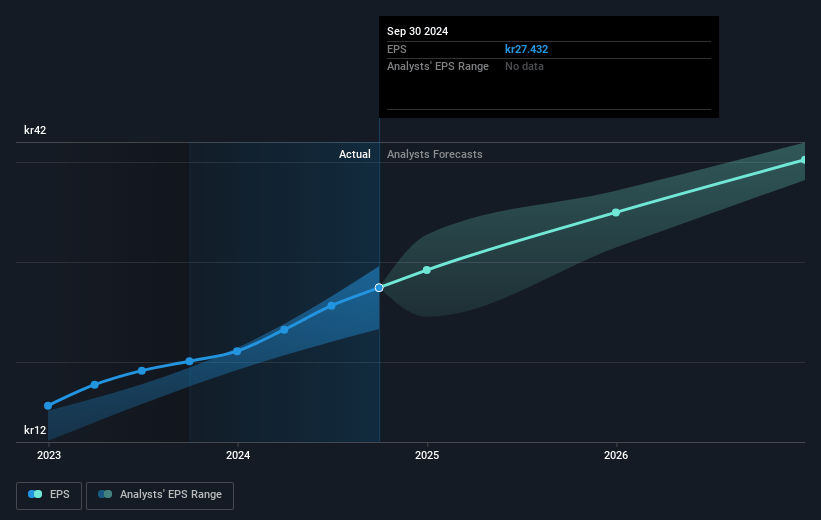

- Analysts expect earnings to reach NOK 9.2 billion (and earnings per share of NOK 52.4) by about May 2028, up from NOK 6.3 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting NOK10.6 billion in earnings, and the most bearish expecting NOK7.7 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 33.7x on those 2028 earnings, down from 46.7x today. This future PE is lower than the current PE for the GB Aerospace & Defense industry at 45.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.45%, as per the Simply Wall St company report.

Kongsberg Gruppen Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Steadily rising geopolitical tensions, especially in Europe, and greater government prioritization on defense and security are driving increased defense spending and large-scale, multi-year order inflows for Kongsberg; this robust demand is likely to support revenue growth and strong order backlog for years to come.

- Accelerating global focus on maritime decarbonization and digitalization is boosting demand for Kongsberg’s advanced maritime and subsea technology solutions, ensuring long-term sales opportunities as the global fleet modernizes—supporting both top-line growth and recurring aftermarket and retrofit revenues.

- Expansion of proprietary high-value product offerings, such as autonomous underwater vehicles, advanced missiles (e.g., NASAMS, JSM), and space/satellite solutions, provides a pathway for gross margin expansion and earnings resilience due to technological leadership and differentiation.

- Large and growing backlog of government and export contracts—further cemented by recent wins, expanded facilities in the U.S. and Australia, and participation in multi-billion NOK projects—gives multi-year visibility on revenues and supports stable earnings, increasing investor confidence in long-term financial performance.

- Ongoing investments in digital solutions and global footprint (over 100 locations in 40 countries) enable Kongsberg to remain agile amidst shifting regulations, tariffs, and competitive landscapes, reducing operational risks and supporting sustained margin improvement.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NOK1469.5 for Kongsberg Gruppen based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK1800.0, and the most bearish reporting a price target of just NOK1250.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be NOK79.3 billion, earnings will come to NOK9.2 billion, and it would be trading on a PE ratio of 33.7x, assuming you use a discount rate of 6.5%.

- Given the current share price of NOK1668.5, the analyst price target of NOK1469.5 is 13.5% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.