Key Takeaways

- Expanding global production and investing in R&D may strain short-term margins, but aim for long-term growth and diversification.

- High order intake and strategic moves risk operational bottlenecks, integration challenges, and investor pressures if aggressive growth goals aren't met.

- A solid order backlog and strategic investments suggest strong revenue growth, profitability, and innovation, while partnerships and financial health enhance market competitiveness.

Catalysts

About Kongsberg Gruppen- Provides high-tech systems and solutions primarily to customers in the maritime and defense markets.

- The significant expansion of missile production capacity in Norway, Australia, and the United States, as well as new facility in India, suggests high capital expenditure and operational investment, which could impact Kongsberg's net margins in the short term as these investments take time to generate proportional revenue.

- High order intake, such as the record-breaking NOK 44.8 billion in Q4 alone, indicates a robust backlog that may lead to increased revenues, yet it could also lead to operational bottlenecks or execution risks impacting earnings if not managed efficiently.

- The ongoing investments in R&D, such as the NOK 2.7 billion in self-funded R&D, despite critical to scouting future growth areas, could strain margins in the short term and indicate that revenue growth might not catch up quickly.

- The ambitious revenue goal to reach NOK 120 billion by 2033 positions Kongsberg towards aggressive growth expectations, which, if not achieved, can lead to possible investor disappointment and stock overvaluation pressures.

- The planned strategic moves, like transferring Kongsberg Digital's maritime portfolio to Kongsberg Maritime and other acquisitions such as Naxys Technologies, indicate a pursuit of diversified revenue streams. However, these might dilute current focus and impact earnings efficiency due to integration challenges and potential restructuring costs.

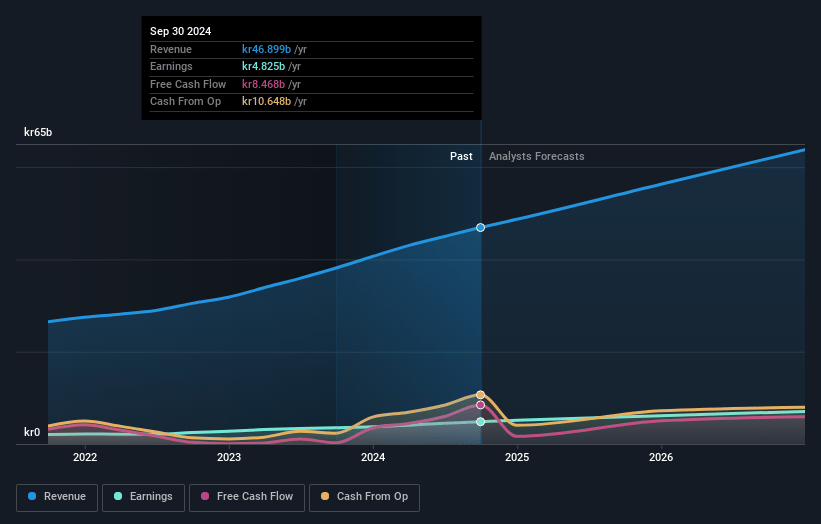

Kongsberg Gruppen Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Kongsberg Gruppen's revenue will grow by 14.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.5% today to 11.4% in 3 years time.

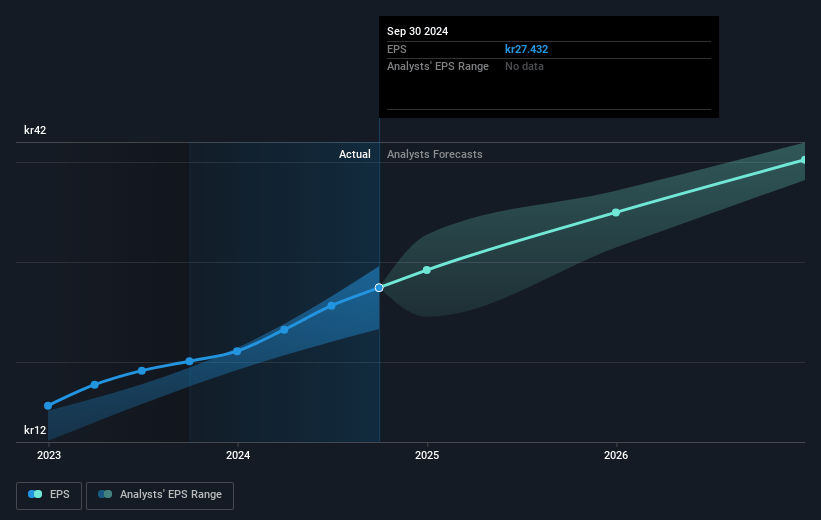

- Analysts expect earnings to reach NOK 8.3 billion (and earnings per share of NOK 47.5) by about May 2028, up from NOK 5.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 33.4x on those 2028 earnings, down from 57.2x today. This future PE is lower than the current PE for the GB Aerospace & Defense industry at 54.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.96%, as per the Simply Wall St company report.

Kongsberg Gruppen Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Kongsberg's solid order backlog of NOK 127.9 billion and strong demand across its business portfolio suggest potential for continued revenue growth and financial stability.

- The company's high investment in research and development, around 10% of revenue annually, supports innovation and new product development, which can lead to increased market share and higher future earnings.

- Strategic partnerships and recognition by the European Union indicate a competitive advantage in defense and space, potentially increasing revenues in these sectors.

- A robust financial performance in 2024, with a 20% increase in revenues and improved operating and EBIT margins, suggests strong potential for maintaining or further increasing profitability.

- Kongsberg's increased dividend payout and a strong cash position demonstrate financial health and investor confidence, potentially supporting stable shareholder returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NOK1339.0 for Kongsberg Gruppen based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK1500.0, and the most bearish reporting a price target of just NOK1250.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be NOK72.9 billion, earnings will come to NOK8.3 billion, and it would be trading on a PE ratio of 33.4x, assuming you use a discount rate of 6.0%.

- Given the current share price of NOK1668.0, the analyst price target of NOK1339.0 is 24.6% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.