Key Takeaways

- Completion of capacity expansion and cost reduction programs strengthens Hexagon Purus's revenue capacity and path to profitability amid rising hydrogen demand.

- Strategic partnerships and regulatory support in Europe, North America, and China enhance growth prospects in hydrogen mobility markets.

- Regulatory challenges and slower energy transitions threaten Hexagon Purus's revenue projections, leading to cost reductions and operational adjustments amid uncertain market conditions.

Catalysts

About Hexagon Purus- Provides hydrogen and battery energy storage solutions.

- The multiyear capacity expansion program has been completed, significantly increasing Hexagon Purus's global manufacturing footprint and potential revenue capacity, particularly in hydrogen infrastructure and mobility. This improved capacity should positively impact future revenue and earnings as demand scales up.

- Management has embarked on a cost reduction program to adjust the cost base, aiming to reduce annual costs by NOK 200 million. This strategic effort should improve net margins and hasten the path to profitability and cash breakeven, positively impacting future earnings.

- Solid demand outlook in transit bus markets across both Europe and North America, particularly for hydrogen buses, is supported by strong regulatory frameworks. This optimistic commercial momentum is expected to bolster revenue growth in forthcoming periods.

- The company's partnership in China offers significant growth potential as the region accelerates hydrogen adoption. Once local certification is achieved, Hexagon Purus could leverage increased demand for hydrogen distribution and mobility, impacting future revenue streams positively.

- Hexagon Purus's commitment to capital discipline and prioritization of high-return businesses over more speculative technologies such as liquid hydrogen storage positions the company to efficiently manage cash flow and drive earnings towards breakeven.

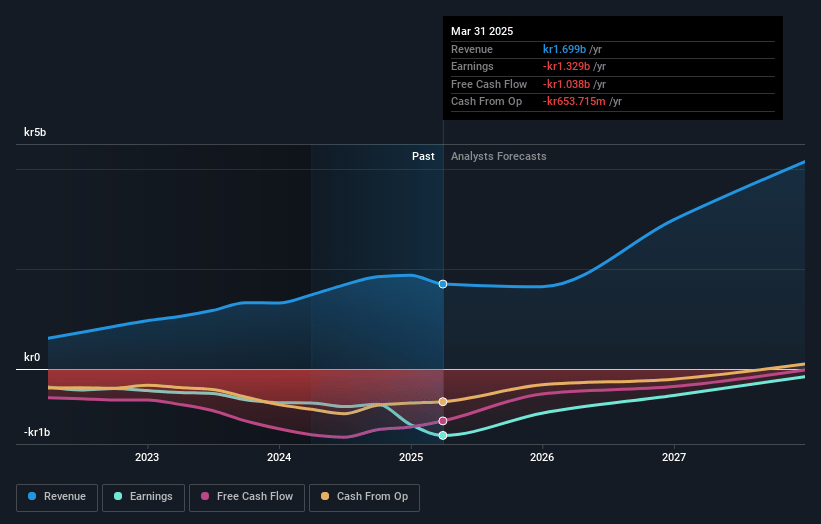

Hexagon Purus Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Hexagon Purus's revenue will grow by 30.3% annually over the next 3 years.

- Analysts are not forecasting that Hexagon Purus will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Hexagon Purus's profit margin will increase from -59.2% to the average NO Machinery industry of 6.5% in 3 years.

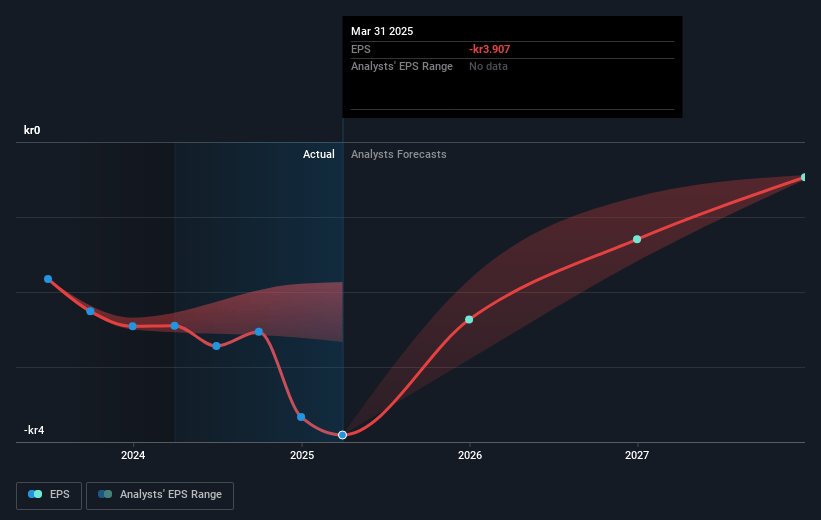

- If Hexagon Purus's profit margin were to converge on the industry average, you could expect earnings to reach NOK 267.8 million (and earnings per share of NOK 0.51) by about May 2028, up from NOK -1.1 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.3x on those 2028 earnings, up from -0.7x today. This future PE is lower than the current PE for the NO Machinery industry at 14.9x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.14%, as per the Simply Wall St company report.

Hexagon Purus Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The new U.S. administration's actions have created regulatory uncertainty, negatively impacting the demand and market outlook for zero-emission mobility in North America. If key policies and subsidies are reversed or delayed, it could deter customer purchasing decisions and investments, impacting Hexagon Purus's revenue projections.

- The company is facing delays in its hydrogen infrastructure and mobility markets due to slower-than-expected energy transitions in Europe and North America, which can affect project completions and revenue recognition timelines, potentially leading to revenue shortfalls.

- Despite a completed multiyear capacity expansion program, the uncertain market landscape is forcing Hexagon Purus to implement a significant cost reduction program, including workforce reductions. This indicates pressure on net margins and earnings, as the company adjusts to lower forward visibility on customer demand.

- Ongoing operational challenges, such as order delays and the requirement to exit specific ventures like Cryoshelter, reveal operational vulnerabilities. Such challenges could lead to unexpected costs or impairments that may negatively affect the company's earnings.

- Hexagon Purus's growth strategy hinges on emerging markets and technologies like hydrogen distribution and mobility, which are susceptible to regulatory changes, competition, and technological adoption rates. Misjudgments in these areas could impede revenue growth and overall financial performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NOK3.08 for Hexagon Purus based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK6.2, and the most bearish reporting a price target of just NOK1.8.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be NOK4.1 billion, earnings will come to NOK267.8 million, and it would be trading on a PE ratio of 8.3x, assuming you use a discount rate of 11.1%.

- Given the current share price of NOK1.92, the analyst price target of NOK3.08 is 37.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.