Key Takeaways

- Bonheur's Wind Service segment and new wind farms are poised for significant growth, boosting revenue and enhancing renewable energy capacity and earnings.

- Strategic financial policies and capital allocation aim to optimize financing, reduce risks, and support long-term shareholder value and dividend stability.

- Operational downtime and energy price declines are impacting revenue, while regulatory and supply chain challenges pose risks to future growth and financial performance.

Catalysts

About Bonheur- Engages in the renewable energy, wind service, and cruise businesses in Norway, Europe, Asia, the Americas, Africa, and Internationally.

- Bonheur's Wind Service segment is positioned for substantial revenue growth due to strong order intake and limited vessel availability in the market, indicating potential for sustained demand and improved earnings.

- The company anticipates an increase in net margins and earnings as they have implemented a financial policy aimed at optimizing financing at the subsidiary level, ensuring strong nonrecourse financing and minimizing financial risks.

- The investment decision to proceed with the Windy Standard III and Crystal Rig IV wind farms represents a forward-looking catalyst for revenue growth, with construction expected to begin soon, enhancing the renewable energy capacity and long-term EBITDA.

- Continued improvement in the Cruise Line segment, with stronger bookings and new operational upgrades, is expected to positively impact revenue and EBITDA, signaling recovery from previous low occupancy rates.

- The focus on capital allocation, including potential investments in new projects only if they present attractive risk-adjusted returns, aligns with efforts to ensure long-term shareholder value, supportive of maintaining a strong dividend policy and potentially boosting share price appreciation.

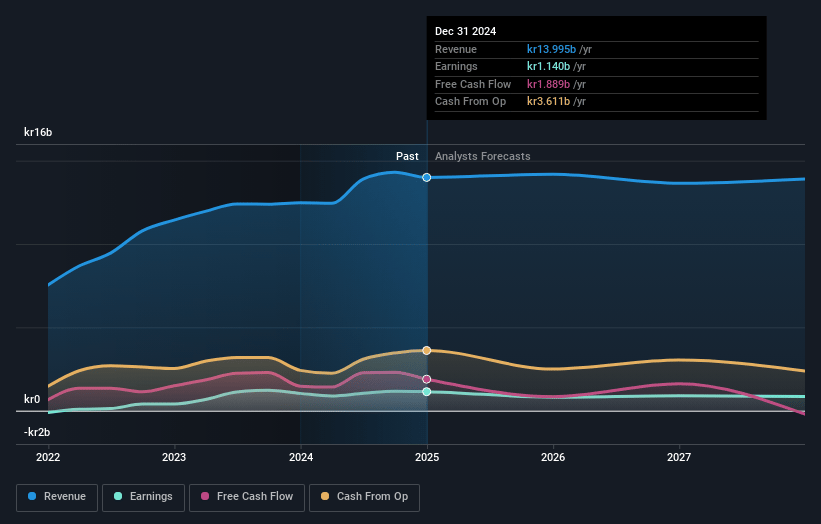

Bonheur Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Bonheur's revenue will decrease by 0.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 8.1% today to 6.2% in 3 years time.

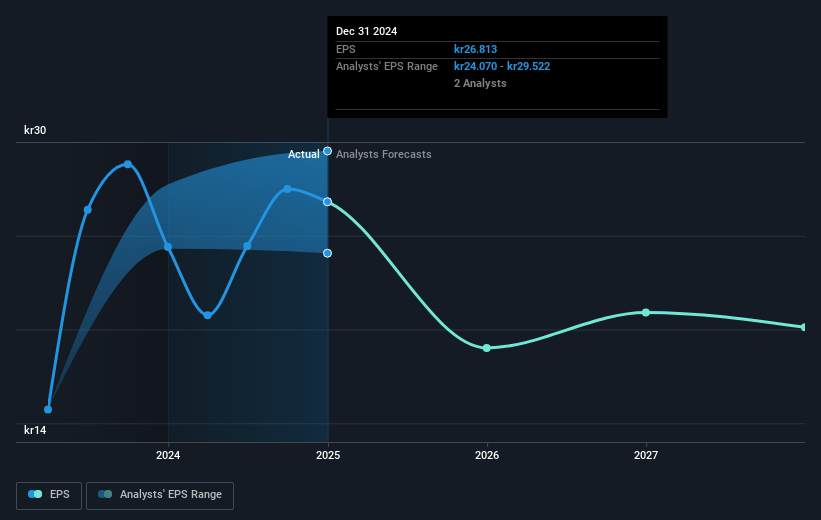

- Analysts expect earnings to reach NOK 856.0 million (and earnings per share of NOK 20.12) by about May 2028, down from NOK 1.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.7x on those 2028 earnings, up from 9.0x today. This future PE is greater than the current PE for the GB Industrials industry at 8.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.92%, as per the Simply Wall St company report.

Bonheur Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Key assets out of revenue-generating activities in the quarter, such as Brave Tern and Bold Tern, may indicate operational downtime and affect future revenue generation. Increased downtime from assets can lead to reduced revenue and negatively impact earnings.

- Declines in energy prices, particularly in regions like Sweden, can lower revenue and EBITDA from renewable energy operations, impacting profit margins and overall earnings.

- Operational challenges in existing wind farms, such as downtime due to technical failures at Mid Hill and Crystal Rig I, as well as supply chain delays impacting Hogaliden, can lead to lower production and revenue, thus affecting net margins.

- Uncertainty in timing for renewable projects due to regulatory processes, potential judicial reviews, and supply chain issues may prolong the time to revenue realization and add costs, impacting overall financial performance and creating investment risks.

- While strategic capital allocation is a goal, achieving competitive returns in a volatile market may force choices between investing in new capacities and maintaining shareholder returns, potentially affecting the company's ability to grow its asset base or dividends.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NOK345.0 for Bonheur based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK380.0, and the most bearish reporting a price target of just NOK310.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be NOK13.9 billion, earnings will come to NOK856.0 million, and it would be trading on a PE ratio of 20.7x, assuming you use a discount rate of 6.9%.

- Given the current share price of NOK240.0, the analyst price target of NOK345.0 is 30.4% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.