Key Takeaways

- Innovations in sea-based and post-smolt technology are expected to drive revenue and efficiency through reduced mortality and enhanced production.

- Strategic expansion in land-based systems and digital segment synergy integration positions AKVA for enhanced revenue and market reach.

- Revenue shortfalls, reliance on large contracts, digital segment volatility, and financial strains could affect AKVA group's future earnings and financial flexibility.

Catalysts

About AKVA group- Designs, purchases, manufactures, assembles, sells, and installs technology products; and provides rental and consulting services for the aquaculture industry.

- AKVA Group's growth in its Sea Based segment, driven by innovations such as the deep farming solution and Nautilus technology, is anticipated to expand revenue due to the significant order backlog and heightened demand for lower mortality and improved fish quality.

- The company's focus on post-smolt technology is expected to fuel growth by improving capacity utilization and reducing mortality, thereby boosting earnings potential from optimized production processes and enhanced operational efficiency.

- The successful acquisition and integration of AI capabilities from Observe provide potential for significant synergies in AKVA’s Digital segment, with expected improvements in net margins through the enhancement of existing products and leveraging advanced digital solutions.

- AKVA's strategic expansion into Land Based systems, supported by key contracts like the Cermaq Chile RAS facility and the Laxey project, could significantly enhance revenue streams by meeting increasing demand for more sustainable and efficient aquaculture solutions.

- Planned commercialization efforts and resource reallocation in the Digital segment are poised to drive top-line growth, with anticipated EBITDA margin improvements from scalable digital sales and a broadening market reach.

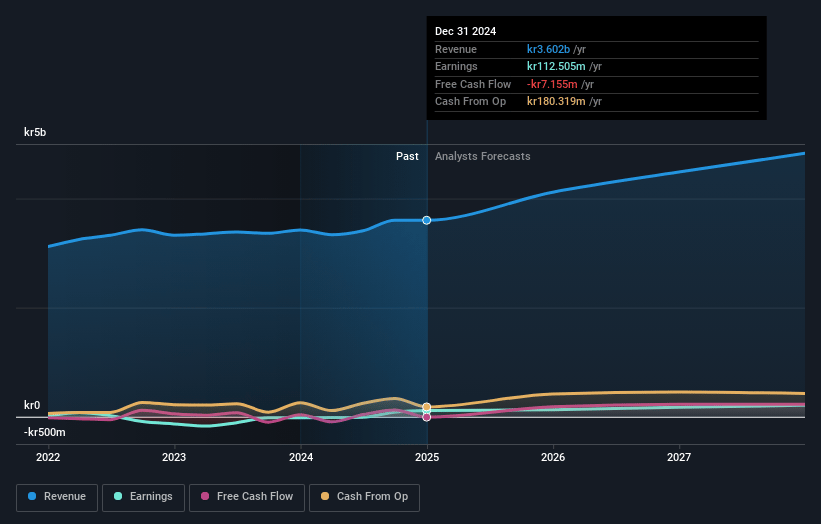

AKVA group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming AKVA group's revenue will grow by 11.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.7% today to 4.2% in 3 years time.

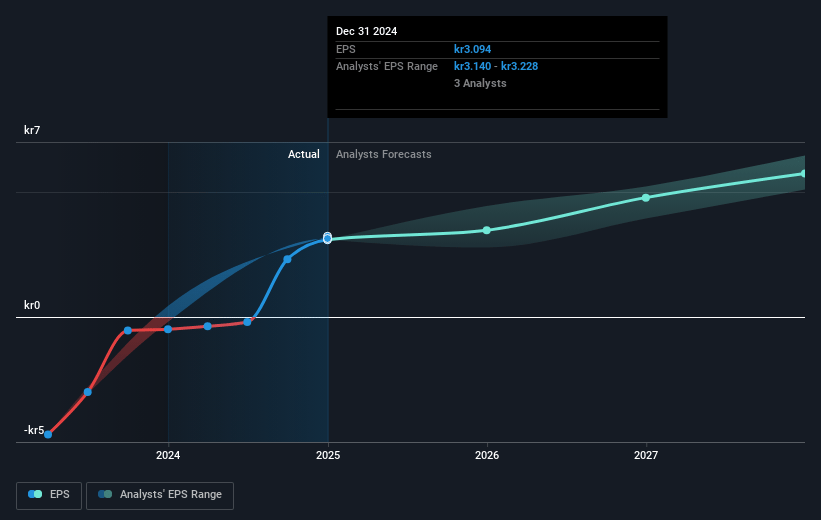

- Analysts expect earnings to reach NOK 203.9 million (and earnings per share of NOK 5.59) by about May 2028, up from NOK 130.2 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as NOK234.7 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.2x on those 2028 earnings, up from 17.5x today. This future PE is greater than the current PE for the GB Machinery industry at 14.9x.

- Analysts expect the number of shares outstanding to decline by 0.35% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.38%, as per the Simply Wall St company report.

AKVA group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- AKVA group's revenue for Q4 was lower than expected, largely due to delayed order intake that did not translate into immediate revenue, which could impact future revenue projections if similar delays occur.

- The company's Land-Based segment showed significant growth due to increased activity and improved project margins. However, the success seems dependent on specific large contracts, suggesting potential volatility in future earnings if such contracts are not consistently secured.

- The Digital segment exhibited a decline in both revenue and order intake, with non-recurring upgrades contributing to revenue fluctuations. This inconsistency may affect the net margins negatively if not addressed through increased sales and commercial focus.

- While AKVA has seen strong order intake in Sea Based activities, more than half of their revenue comes from OpEx-based recurring revenue, which means any potential disruptions in ongoing operations could significantly affect their profit margins.

- AKVA group's high financial costs and currency losses have been reported, along with increased net interest-bearing debt driven by net working capital changes and other investments, which could strain future earnings and limit financial flexibility.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NOK83.333 for AKVA group based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be NOK4.8 billion, earnings will come to NOK203.9 million, and it would be trading on a PE ratio of 18.2x, assuming you use a discount rate of 8.4%.

- Given the current share price of NOK62.6, the analyst price target of NOK83.33 is 24.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.