Key Takeaways

- Re-domiciliation to Sweden could lower capital requirements and expand market opportunities, thus improving net margins.

- Expected macroeconomic improvements and declining loan loss ratios may boost profitability through enhanced debt capacity and risk-adjusted margins.

- Re-domiciling to Sweden with regulatory changes could raise execution risks and costs, while loan yield declines and niche bank competition may suppress margins and earnings.

Catalysts

About Morrow Bank- Provides unsecured financing to private individuals in the Norway, Finland, Sweden, and German markets.

- Morrow Bank is benefiting from a scalable banking platform, which has enabled a 38% growth in the loan book and a 21% increase in income, potentially leading to improved revenues and earnings.

- The re-domiciliation to Sweden and Swedish banking license application could lower capital requirements and expand market opportunities, positively impacting net margins due to efficiencies and potential market share growth.

- Strong macroeconomic conditions, with expected decreases in inflation and interest rates, are anticipated to enhance debt servicing capacity and demand, positively influencing future revenues.

- The steady decline in loan loss ratios, reaching 4.6% in Q4 2024, is expected to continue, which could increase risk-adjusted margins and subsequent profitability.

- The implementation of CRR3 regulation is projected to reduce operational risk exposure and required capital, potentially increasing earnings and improving shareholder returns through efficient use of capital.

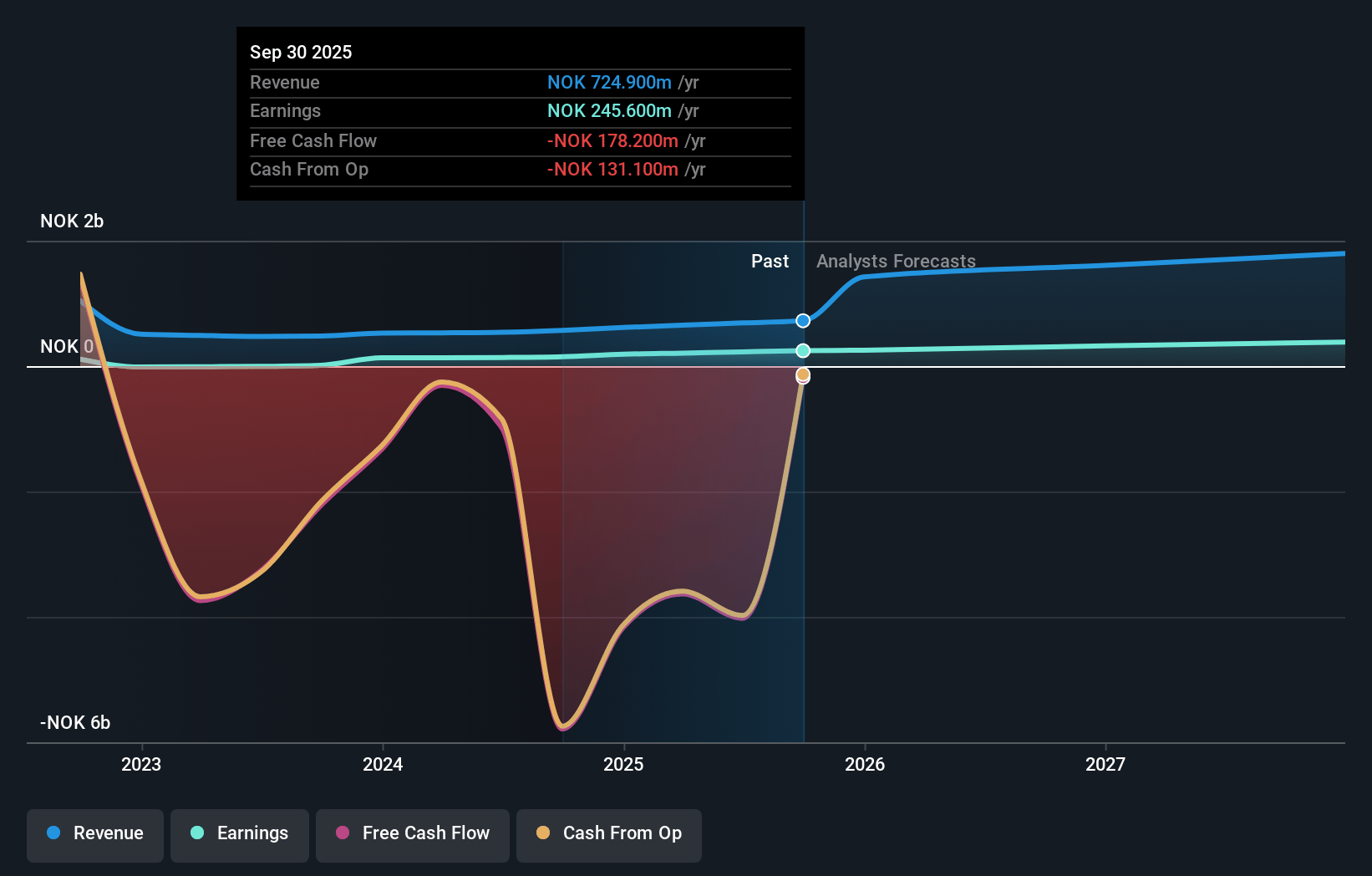

Morrow Bank Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Morrow Bank's revenue will grow by 37.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 30.7% today to 21.8% in 3 years time.

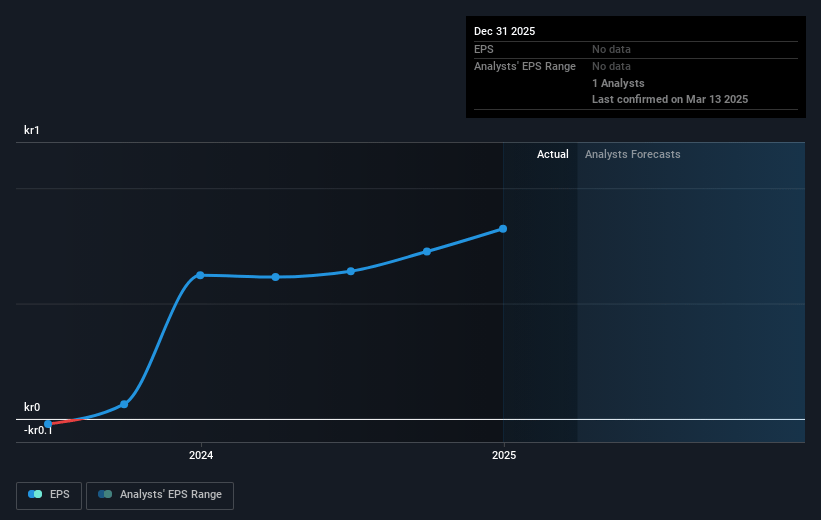

- Analysts expect earnings to reach NOK 349.4 million (and earnings per share of NOK 1.47) by about May 2028, up from NOK 189.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.8x on those 2028 earnings, down from 12.2x today. This future PE is lower than the current PE for the NO Banks industry at 10.9x.

- Analysts expect the number of shares outstanding to grow by 0.28% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.83%, as per the Simply Wall St company report.

Morrow Bank Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The re-domiciliation to Sweden and the associated regulatory changes could introduce execution risks and potential additional costs impacting net margins.

- The decline in loan yields due to market conditions and acquiring lower-yielding portfolios could negatively impact future income and earnings.

- Strong dependence on niche bank competition in Sweden may lead to fluctuating funding costs, affecting net margins.

- The potential for regulatory changes in capital requirement regulations introduces uncertainty, impacting capital adequacy and profitability.

- The target for annual growth of only 5% might mean slower revenue increases compared to prior aggressive growth, potentially impeding earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NOK12.0 for Morrow Bank based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be NOK1.6 billion, earnings will come to NOK349.4 million, and it would be trading on a PE ratio of 9.8x, assuming you use a discount rate of 6.8%.

- Given the current share price of NOK10.0, the analyst price target of NOK12.0 is 16.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.