Key Takeaways

- Extension of concession and water rights acquisition enhance profitability through lower royalties, tax exemptions, and improved margins.

- Forex risk mitigation and resource efficiency boost cash flow predictability and support profit growth despite competitive pressures.

- Dependence on unsustainable construction revenues and high net debt could lead to revenue volatility and financial strain amid competitive pressures and operational challenges.

Catalysts

About Mega First Corporation Berhad- An investment holding company, engages in renewable energy, resources, packaging, property, plantation, oleochemical, and automation equipment manufacturing businesses in Malaysia, Lao PDR, other ASEAN countries, India, Bangladesh, Papua New Guinea, Australia, New Zealand, and internationally.

- The extension of the concession period for Don Sahong and the acquisition of water rights significantly reduce future royalty expenses and extend tax exemptions, which should enhance net margins and boost profitability over the long term.

- The reduction in receivable exposure to Forex risks by restructuring payments into a long-term, secured loan improves cash flow predictability and reduces financial risks, which can positively impact net earnings stability.

- The additional 15% stake in Don Sahong acquired previously has started contributing to earnings, and with the recent improvements in plant operations, we can expect further growth in net profit attributable to shareholders.

- The Renewable Energy division is poised to benefit from the completion of new solar projects and the full-year effect of the fifth turbine addition, supporting revenue growth and providing diversification within the company's energy portfolio.

- Ongoing enhancements in the company's resource efficiency and operational strategy, such as productivity gains and cost improvements in the Resources division, are likely to maintain or slightly grow overall profit margins despite competitive pressures in some segments.

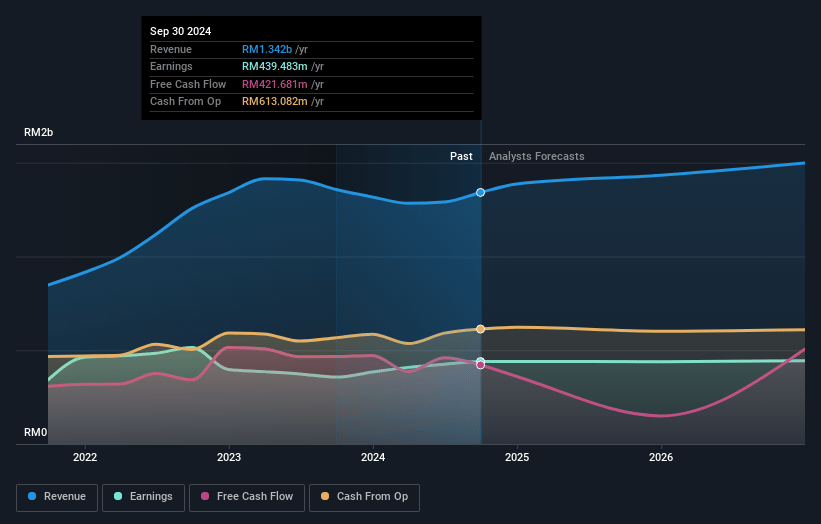

Mega First Corporation Berhad Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Mega First Corporation Berhad's revenue will decrease by 3.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 26.4% today to 30.6% in 3 years time.

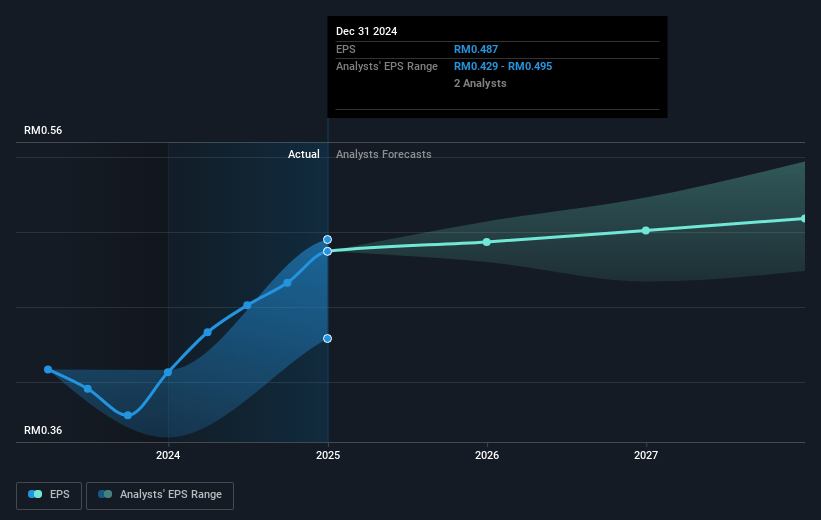

- Analysts expect earnings to reach MYR 480.2 million (and earnings per share of MYR 0.51) by about May 2028, up from MYR 459.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.2x on those 2028 earnings, up from 8.1x today. This future PE is greater than the current PE for the MY Renewable Energy industry at 8.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.69%, as per the Simply Wall St company report.

Mega First Corporation Berhad Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's revenue growth appears highly dependent on one-off construction revenues, which are not sustainable over the long term. This could lead to volatility in future revenues.

- The recognition of significant fair value losses on investment properties, such as the $8 million on PJ8, indicates potential risks to net margins and asset valuations.

- The packaging division is facing intense competition and margin pressure due to weak consumer demand and industry overcapacity, leading to almost a 50% drop in PBT, which could impact overall earnings negatively.

- The renewable energy segment is exposed to tariff reductions and increased operating expenses due to turbine overhauls, which may negatively affect net margins and revenue.

- The company's increased net debt of $878 million, coupled with high capital expenditure commitments, could strain financial flexibility and impact earnings if interest rates rise or revenue growth stalls.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of MYR5.258 for Mega First Corporation Berhad based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of MYR5.8, and the most bearish reporting a price target of just MYR4.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be MYR1.6 billion, earnings will come to MYR480.2 million, and it would be trading on a PE ratio of 13.2x, assuming you use a discount rate of 8.7%.

- Given the current share price of MYR3.96, the analyst price target of MYR5.26 is 24.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.