Key Takeaways

- Strategic industrial investments and divestment of office assets aim to enhance revenue, streamline operations, and improve net margins with focus on high-yield properties.

- Efforts to enhance market liquidity and refinancing plans are expected to raise share prices, improve earnings per share, and optimize financial performance.

- Geopolitical uncertainty and market risks could impact occupancy, revenue, and the success of office divestments and acquisitions for Fibra MtyP.I. de.

Catalysts

About Fibra MtyP.I. de- FIBRA MTY, S.A.P.I. de C.V. operates as a real estate investment trust in Mexico.

- Fibra Monterrey's strategic industrial investments, particularly the acquisitions of the Aerotech portfolio in Querétaro and Batach portfolio in Nuevo León, are expected to enhance future revenue by increasing occupancy with high-quality tenants and providing stable cash flows from long-term leases.

- The company has signed expansion agreements with an expected cap rate of over 8%, and is actively pursuing investments to meet a $700 million target, potentially boosting revenue and offering higher risk-adjusted returns compared to market averages.

- The ongoing divestment of the office portfolio, including the sale of properties like the former Axtel building and Fortaleza, aims to streamline operations and focus on more profitable industrial assets, potentially improving net margins by reallocating resources towards higher-yield investments.

- Efforts to enhance market liquidity have resulted in increased trading volume post-capital issuance, which is expected to drive higher share price valuations and improve earnings per share through continued share repurchases at undervalued levels.

- Refinancing efforts in 2024 to reduce financial costs and extend debt maturity are anticipated to optimize financial performance, securing better net margins and consistent cash flow generation without leveraging the company's balance sheet beyond a 35% LTV ratio.

Fibra MtyP.I. de Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Fibra MtyP.I. de's revenue will grow by 10.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 268.8% today to 72.1% in 3 years time.

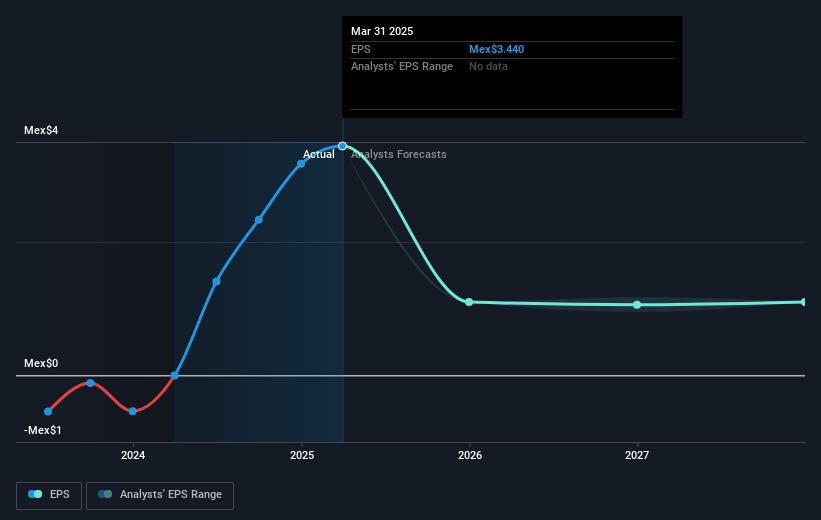

- Analysts expect earnings to reach MX$2.7 billion (and earnings per share of MX$1.1) by about April 2028, down from MX$7.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.2x on those 2028 earnings, up from 3.9x today. This future PE is greater than the current PE for the MX Industrial REITs industry at 4.3x.

- Analysts expect the number of shares outstanding to decline by 2.9% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.8%, as per the Simply Wall St company report.

Fibra MtyP.I. de Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The slowdown in demand and increase in new construction in key markets like Monterrey, Tijuana, and Mexico City could lead to an increase in vacancy rates, potentially impacting revenue and net operating income.

- Exposure to the unstable Juarez industrial market, which has a high vacancy rate driven by energy scarcity, could pose a risk to occupancy and revenue stability.

- The timeline and successful execution of office portfolio divestments carry execution risk, especially if market conditions deteriorate, which may affect revenue and cash flow generation plans.

- Potential overreliance on off-market deals for acquisitions could expose the company to valuation risks, impacting the cost of capital and return on investments.

- The ongoing geopolitical uncertainty, particularly concerning U.S. tariffs on Mexican exports, presents a risk to tenant stability and demand, potentially affecting occupancy rates and revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of MX$14.078 for Fibra MtyP.I. de based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of MX$16.0, and the most bearish reporting a price target of just MX$12.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be MX$3.7 billion, earnings will come to MX$2.7 billion, and it would be trading on a PE ratio of 18.2x, assuming you use a discount rate of 15.8%.

- Given the current share price of MX$11.75, the analyst price target of MX$14.08 is 16.5% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.