Key Takeaways

- Launching new CCP services and facilitating security-based variation margins are expected to enhance trading volume and revenue from the transactional business.

- New derivative products and updated fee structures aim to diversify offerings and stabilize market share, potentially boosting trading activity and revenue.

- Rising operating expenses and capital expenditure on technology upgrades may strain net margins if not matched by sufficient revenue growth.

Catalysts

About Bolsa Mexicana de Valores. de- Bolsa Mexicana de Valores, S.A.B. de C.V.

- The launch of the new central counterparty (CCP) services for bonds and repos is expected to improve risk management and increase trading volume, potentially enhancing revenue from transactional business.

- The introduction of liquidity alternatives for Asigna, allowing securities as variation margin instead of only cash, is set to attract more volume from the OTC and international markets, positively influencing revenue growth and trading volume.

- The new fee structures for equity trading and potential reductions in conversion fees aim to maintain market share and enhance competition, which could stabilize or increase revenue from equity trading and clearing.

- The partnership with IPC for virtualized colocation services is likely to attract new participants and increase current participation in equities, improving trading activity and subsequently boosting revenue.

- The impending launch of new derivative products like mini dollar contracts and ESG index contracts, as well as futures on international tech stocks, is expected to cater to retail market growth, diversifying product offerings and potentially increasing revenue from derivatives trading.

Bolsa Mexicana de Valores. de Future Earnings and Revenue Growth

Assumptions

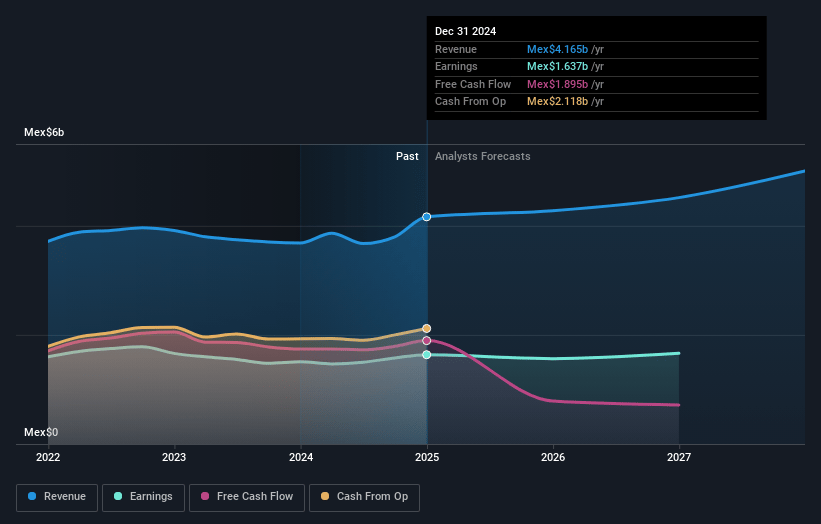

How have these above catalysts been quantified?- Analysts are assuming Bolsa Mexicana de Valores. de's revenue will grow by 4.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 39.3% today to 37.2% in 3 years time.

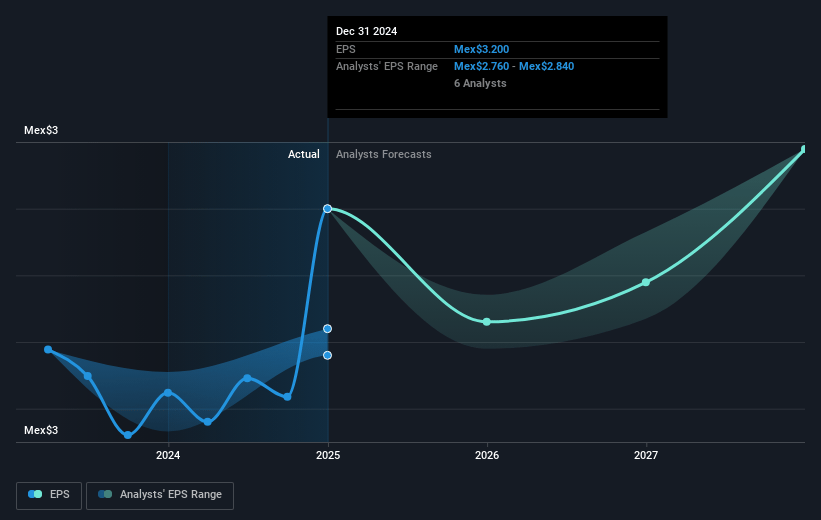

- Analysts expect earnings to reach MX$1.8 billion (and earnings per share of MX$3.25) by about May 2028, up from MX$1.7 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.3x on those 2028 earnings, up from 13.1x today. This future PE is greater than the current PE for the MX Capital Markets industry at 10.1x.

- Analysts expect the number of shares outstanding to decline by 1.78% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.12%, as per the Simply Wall St company report.

Bolsa Mexicana de Valores. de Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The implementation of a new pricing structure for equity trading, if aggressive, may erode revenue as it could lead to lower fee income, especially compared to competitor BIVA's pricing.

- Operating expenses are expected to continue rising above inflation due to technology investments, FX impact, and variable compensation, which could pressure net margins if revenue growth does not outpace these increases.

- The exposure to FX fluctuations due to international market activity poses a risk to consistent revenue and earnings, as changes in exchange rates affect both costs and income from foreign markets.

- Heavy reliance on technology upgrades, such as the adoption of NASDAQ technology, implies capital expenditure that could strain financial resources and affect net margins if not adequately offset by increased revenues.

- Increased sub-custody fees from growing assets under custody and FX variations could reduce net income if these cost increases are not balanced by similar growth in revenue.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of MX$39.667 for Bolsa Mexicana de Valores. de based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of MX$45.0, and the most bearish reporting a price target of just MX$36.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be MX$5.0 billion, earnings will come to MX$1.8 billion, and it would be trading on a PE ratio of 17.3x, assuming you use a discount rate of 15.1%.

- Given the current share price of MX$39.86, the analyst price target of MX$39.67 is 0.5% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.