Key Takeaways

- Gulf Bank's digital transformation and new investment arm may boost competitiveness, customer experience, and earnings positively impacting margins and revenue.

- Sustainability focus and potential Shariah-compliance could enhance operations, investor appeal, and Islamic market presence, driving efficiency and growth.

- Rising expenses and increased credit costs, alongside elevated project costs, are pressuring Gulf Bank's profitability, potentially impacting operational efficiency and net margins.

Catalysts

About Gulf Bank K.S.C.P- Provides various banking products and services to individual, corporate, and institutional customers in Kuwait.

- Gulf Bank's digital transformation efforts, including the completion of phase 2 of their core banking system and the launch of a new mobile banking application, are expected to improve customer experience and increase market competitiveness, potentially boosting revenue.

- The strategic introduction of Invest GB, Gulf Bank's investment arm, is aimed at providing clients with sophisticated financial solutions, which could enhance asset management capabilities and contribute positively to earnings and margins.

- Gulf Bank's focus on sustainability, including eco-friendly branch redesigns and a 2030 sustainability strategy, is likely to improve operational efficiency and appeal to environmentally conscious investors, potentially impacting net margins positively.

- The feasibility study for transforming into a Shariah-compliant bank, if approved, may open up new market segments and enhance the bank's position in the Islamic finance market, potentially leading to revenue growth.

- Strengthening the core business while optimizing operating expenses, despite current elevated costs, suggests potential improvement in net margins as Gulf Bank aims to control expenses through cost optimization beyond the transformation and transition expenses.

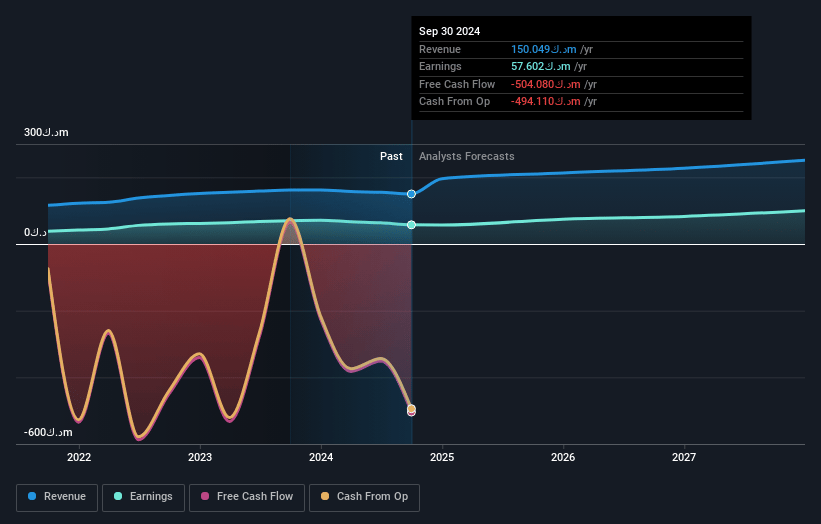

Gulf Bank K.S.C.P Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Gulf Bank K.S.C.P's revenue will grow by 16.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 38.6% today to 32.9% in 3 years time.

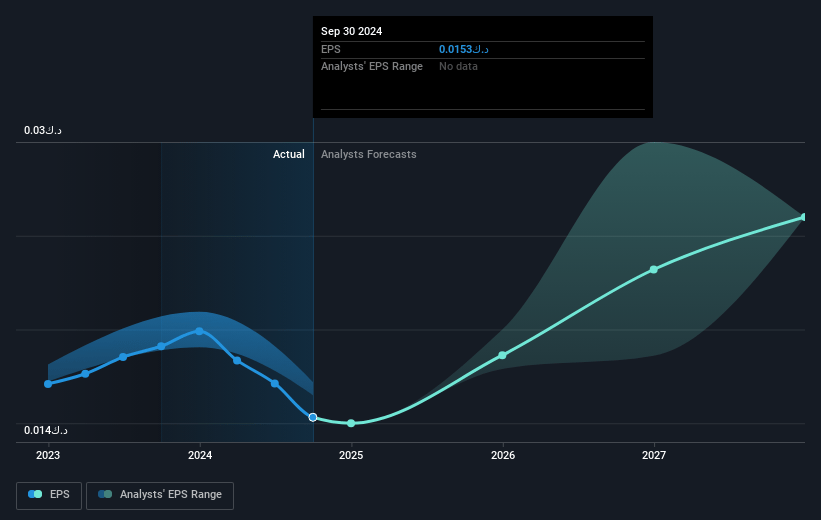

- Analysts expect earnings to reach KWD 79.8 million (and earnings per share of KWD 0.02) by about May 2028, up from KWD 60.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 30.5x on those 2028 earnings, up from 22.2x today. This future PE is greater than the current PE for the KW Banks industry at 21.9x.

- Analysts expect the number of shares outstanding to decline by 0.24% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 19.08%, as per the Simply Wall St company report.

Gulf Bank K.S.C.P Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Gulf Bank's net profit declined by 15.5% in 2024, which could signal challenges in maintaining earnings growth and thus indicate potential pressure on future profitability.

- The increase in credit costs by KWD 13.3 million and operating expenses by KWD 5.7 million suggest the bank faces challenges in controlling costs, impacting net margins adversely.

- Despite asset growth, the increase in interest expenses outpaced the growth in interest income, suggesting potential difficulties in maintaining current net interest margins, affecting overall earnings.

- Considerable project costs related to the potential merger and Shariah-compliance feasibility study indicate ongoing elevated operating expenditures, potentially straining net margin if these costs are not carefully managed.

- The bank's cost-to-income ratio increased, exceeding the 2023 level due to Q4 expense rises associated with IT transformation and advisory fees, which might pressure operational efficiency and net profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of KWD0.365 for Gulf Bank K.S.C.P based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be KWD243.0 million, earnings will come to KWD79.8 million, and it would be trading on a PE ratio of 30.5x, assuming you use a discount rate of 19.1%.

- Given the current share price of KWD0.34, the analyst price target of KWD0.37 is 8.0% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.