Key Takeaways

- Expansion into AI innovations and digital transformation aims to enhance customer experiences and reduce operating costs, potentially boosting revenue and net margins.

- Strategic resource reallocation and shareholder return commitments may enhance profitability and increase earnings per share, driving shareholder value.

- Regulatory changes and market stagnation create financial vulnerabilities for LG Uplus, while restructuring, AI investment, and 5G adoption pose risks to future earnings.

Catalysts

About LG Uplus- Provides various telecommunication services primarily in South Korea.

- LG Uplus plans to accelerate AI-driven innovations, such as expanding AI capabilities within its mobile and Smart Home sectors, which could enhance customer experience and drive service adoption. Expected impact: increase in revenue and potentially improve net margins through higher-value services.

- The company is focusing on digital transformation and improving operational efficiency, aiming to reduce costs associated with physical customer service and acquisition channels. Expected impact: reduction in operating expenses, potentially leading to higher net margins.

- LG Uplus is expanding its data center (IDC) infrastructure to accommodate increasing demand and support AI services, aiming to become a first mover in the AI infrastructure market. Expected impact: increase in revenue contribution from B2B infrastructure business.

- Strategic focus on phasing out underperforming businesses and reallocating resources to more profitable sectors, which is expected to streamline operations and enhance profitability. Expected impact: improvement in operating profit and overall earnings.

- Commitment to shareholder returns through buybacks and dividend enhancements as part of a corporate value up plan, aiming for a higher payout ratio aligned with profit. Expected impact: potential increase in earnings per share and shareholder value.

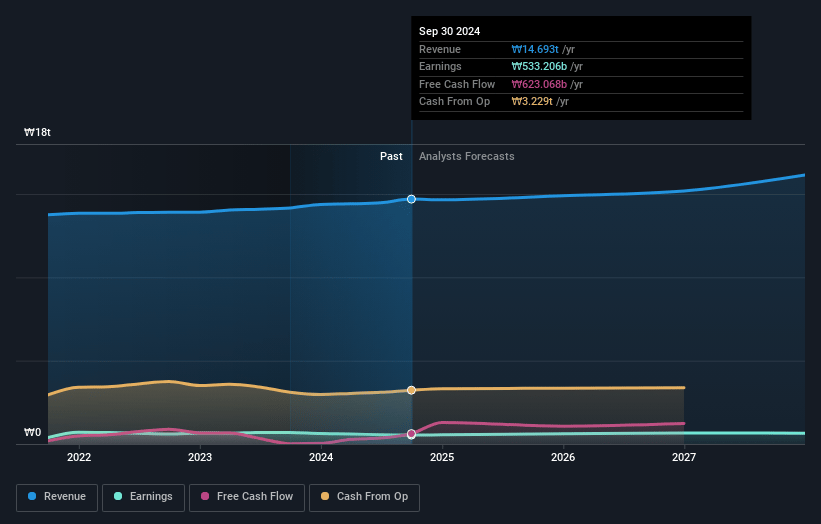

LG Uplus Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming LG Uplus's revenue will grow by 1.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.6% today to 4.5% in 3 years time.

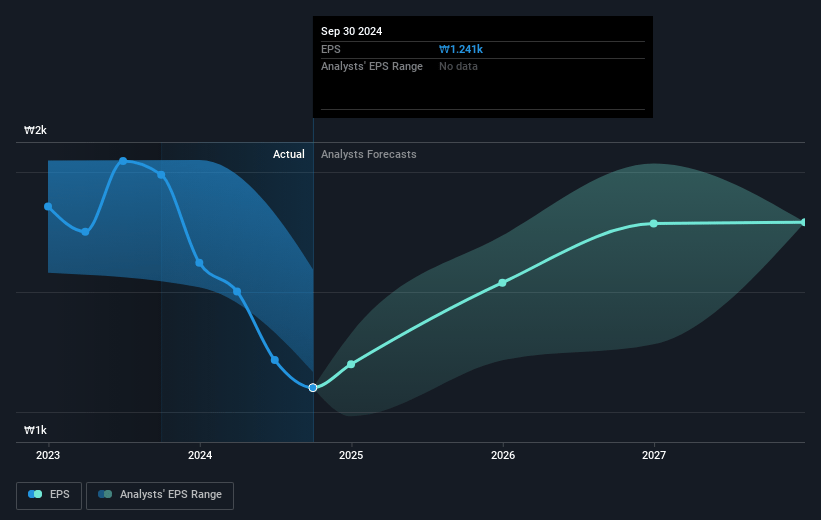

- Analysts expect earnings to reach ₩698.0 billion (and earnings per share of ₩1622.94) by about May 2028, up from ₩374.5 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ₩825.1 billion in earnings, and the most bearish expecting ₩597.5 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.4x on those 2028 earnings, down from 13.8x today. This future PE is lower than the current PE for the KR Telecom industry at 24.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.71%, as per the Simply Wall St company report.

LG Uplus Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The expected regulatory changes following the decision to abolish the Handset Subsidy Act add uncertainties and may lead to an unstable competitive landscape in the telco market, potentially affecting future revenue streams.

- The decline in net profit by 44% year-on-year, primarily due to impairment losses and increased amortization of intangible assets, highlights financial vulnerabilities that could impact profitability if similar issues persist.

- The challenges faced by underperforming businesses and the need for bold restructuring indicate potential risks to revenue and net margins if these business units continue to underperform or if the restructuring initiatives do not yield expected results.

- The slow growth in the Mobile and Smart Home markets, with stagnating pay TV subscriber numbers and slower growth in 5G adoption, may restrict revenue increases and place pressure on future earnings.

- Despite plans for AI investments and digital transformation, execution risks, and the associated costs, particularly in maintaining a competitive edge and realizing a profit turnaround, pose potential threats to operating profit margins and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₩12629.167 for LG Uplus based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₩19000.0, and the most bearish reporting a price target of just ₩9000.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₩15413.3 billion, earnings will come to ₩698.0 billion, and it would be trading on a PE ratio of 9.4x, assuming you use a discount rate of 6.7%.

- Given the current share price of ₩12020.0, the analyst price target of ₩12629.17 is 4.8% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.