Key Takeaways

- Expansion of the PUBG IP franchise and strategic game launches aim to boost engagement, diversify revenue streams, and solidify market presence.

- Leveraging AI innovation and international market focus could drive improved user experiences, increased monetization, and global influence.

- Expanding investments face risk if returns are insufficient, while reliance on PUBG and increased costs could strain margins and profitability.

Catalysts

About KRAFTON- Develops, distributes, and sells mobile game and application software in Asia, Korea, the United States, Europe, and internationally.

- Expansion of the PUBG IP franchise through new collaborations, content updates, and Unreal Engine 5 upgrades is expected to create new growth opportunities and sustain revenue momentum. The introduction of user-generated content could enhance engagement and monetization potential. (Revenue)

- KRAFTON's strategic investments in developing and launching new gaming titles, like inZOI, Dark and Darker Mobile, Subnautica 2, and the potential market expansion into India and other markets are aimed at diversifying revenue streams and capturing a larger market share. (Revenue)

- Increasing annual development budgets to around ₩300 billion for the next five years and securing big franchise IPs are expected to drive substantial revenue and corporate value growth, aiming for ₩7 trillion in revenue over five years. (Revenue)

- Leveraging AI technology and deep learning for innovations in gameplay and character interaction, particularly in titles like inZOI and PUBG, could enhance user experience and drive higher player retention and monetization. (Revenue/Net Margins)

- Continued focus on international market expansion, particularly strengthening presence in India through BGMI and esports, positions KRAFTON for increased global influence and helps solidify the company’s earnings potential. (Revenue)

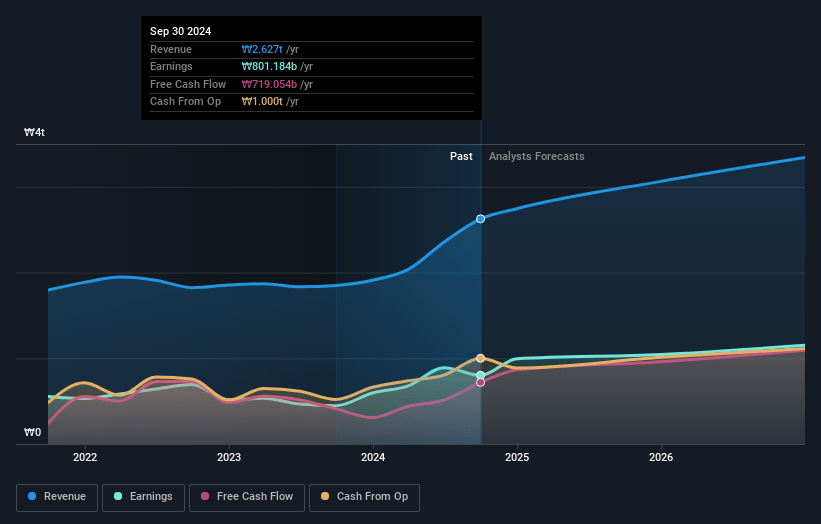

KRAFTON Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming KRAFTON's revenue will grow by 13.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 48.2% today to 32.3% in 3 years time.

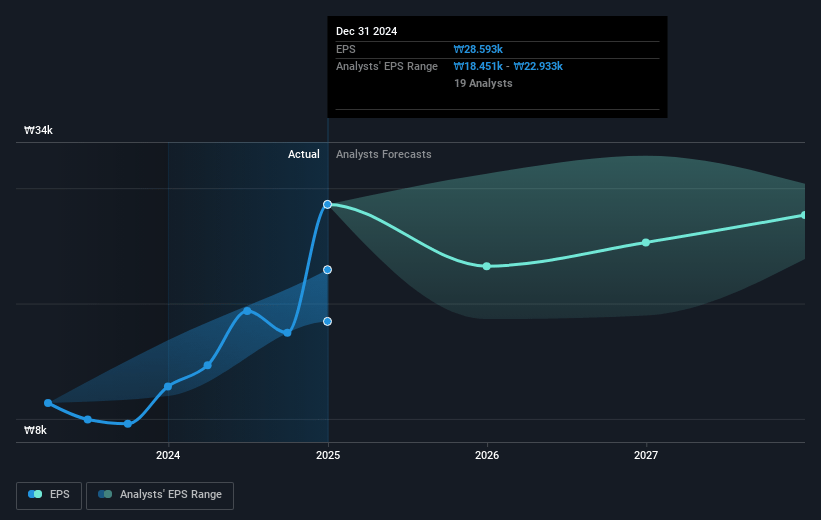

- Analysts expect earnings to reach ₩1271.0 billion (and earnings per share of ₩26308.71) by about March 2028, down from ₩1306.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.6x on those 2028 earnings, up from 12.1x today. This future PE is lower than the current PE for the KR Entertainment industry at 29.0x.

- Analysts expect the number of shares outstanding to decline by 1.58% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.61%, as per the Simply Wall St company report.

KRAFTON Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Expanding investment in new projects and IP development, while ambitious, poses a risk of insufficient returns if the success rate is low. This could negatively impact net margins if the projects do not yield the expected revenue increases.

- The planned substantial increase in annual development budgets to ₩300 billion may pressure operating costs. If revenue does not grow proportionately, it could affect KRAFTON's earnings negatively.

- Transitioning to Unreal Engine 5 is aimed at sustaining user interest but does not guarantee immediate revenue boosts. This investment in technology could strain financial resources if user retention and growth do not follow, impacting overall margins.

- The reliance on the continued growth of PUBG IP, which is targeted to contribute 60% of future revenue, poses a risk if the market interest wanes or if competition intensifies, potentially affecting the projected revenue trajectory.

- The labor cost and headcount expansion required to fuel KRAFTON's development strategy may become a financial strain if revenues from new IPs do not meet targets, potentially suppressing net profit growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₩451680.0 for KRAFTON based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₩550000.0, and the most bearish reporting a price target of just ₩360000.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₩3940.9 billion, earnings will come to ₩1271.0 billion, and it would be trading on a PE ratio of 19.6x, assuming you use a discount rate of 8.6%.

- Given the current share price of ₩348000.0, the analyst price target of ₩451680.0 is 23.0% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.